Question: CHAPTER 3 Adjusting Accounts for Financial Statements 214 2. Post the adjusting entries prepared in Problem 3-9A to the accounts. 3. Prepare an adjusted trial

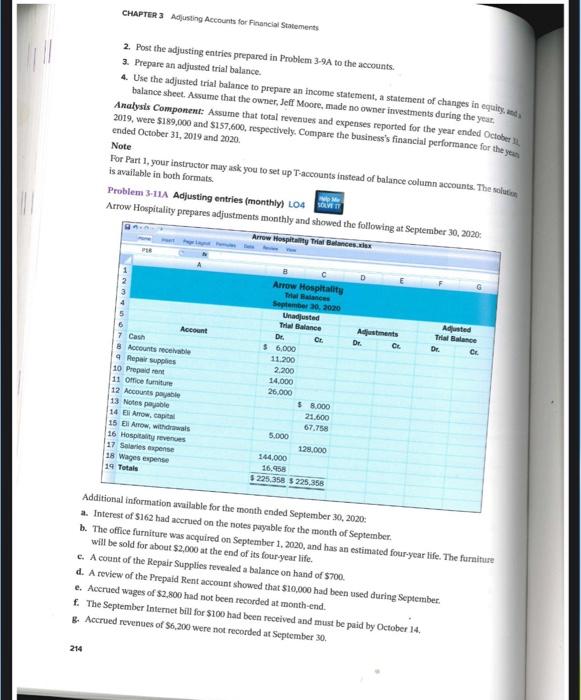

CHAPTER 3 Adjusting Accounts for Financial Statements 214 2. Post the adjusting entries prepared in Problem 3-9A to the accounts. 3. Prepare an adjusted trial balance. 4. Use the adjusted trial balance to prepare an income statement, a statement of changes in equity, and a balance sheet. Assume that the owner, Jeff Moore, made no owner investments during the year. Analysis Component: Assume that total revenues and expenses reported for the year ended October 31 2019, were $189,000 and $157,600, respectively. Compare the business's financial performance for the years ended October 31, 2019 and 2020. Note For Part 1, your instructor may ask you to set up T-accounts instead of balance column accounts. The solution is available in both formats. Problem 3-11A Adjusting entries (monthly) LO4 Arrow Hospitality prepares adjustments monthly and showed the following at September 30, 2020: 83.3. 1 Home Insert P18 4 5 6 7 Cash 8 Accounts receivable 9 Repair supplies 10 Prepaid rent 11 Office furniture Page Layout Formulas 18 Wages expense 19 Totals 12 Accounts payable 13 Notes payable 14 Eli Arrow, capital 15 Eli Arrow, withdrawals 16 Hospitality revenues 17 Salaries expense A Account Help Me SOLVE IT Arrow Hospitality Trial Balances.xlsx Data Review View B C Arrow Hospitality Trial Balances September 30, 2020 Unadjusted Trial Balance Dr. $ 6,000 11,200 2,200 14,000 26,000 5,000 Cr. $ 8,000 21,600 67,758 128,000 144,000 16,958 $ 225,358 $ 225,358 D Adjustments Dr. E Cr. F Adjusted Trial Balance Cr. Dr. Additional information available for the month ended September 30, 2020: a. Interest of $162 had accrued on the notes payable for the month of September. b. The office furniture was acquired on September 1, 2020, and has an estimated four-year life. The furniture will be sold for about $2,000 at the end of its four-year life. c. A count of the Repair Supplies revealed a balance on hand of $700. d. A review of the Prepaid Rent account showed that $10,000 had been used during September. e. Accrued wages of $2,800 had not been recorded at month-end. f. The September Internet bill for $100 had been received and must be paid by October 14. g. Accrued revenues of $6,200 were not recorded at September 30.

CHAPTER 3 Adjusting Accounts for Flowialal Stalements. 2. Post the adjusting entries prepared in Problem 3-9A to the accounts. 3. Prepare an adjusted trial balance. 4. Use the adjusted trial balance to prepare an income statement, a statement of changes in equitg, asd, Analyals Component: Assume that total revenues and expenses reported for the year ended October th 2019, wetc $169,000 and $157,600 Note Note Arrow Hospitality prepares adjustrent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock