Question: Chapter 3 Assignment 0 Saved Help Check my work mode : This shows what is correct or incorrect for the work you have completed so

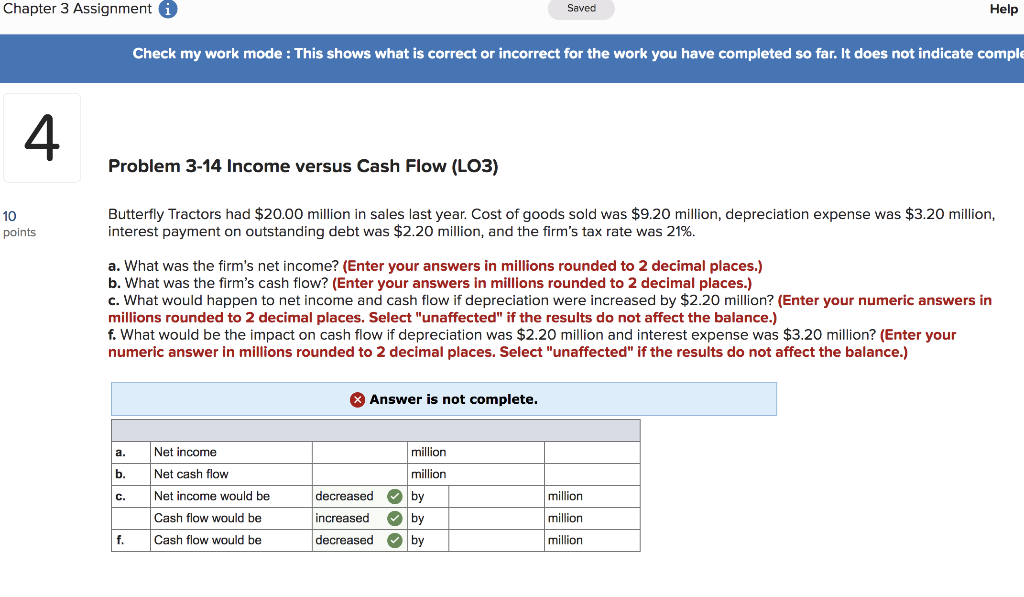

Chapter 3 Assignment 0 Saved Help Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate comple 4 Problem 3-14 Income versus Cash Flow (LO3) 10 points Butterfly Tractors had $20.00 million in sales last year. Cost of goods sold was $9.20 million, depreciation expense was $3.20 million, interest payment on outstanding debt was $2.20 million, and the firm's tax rate was 21%. a. What was the firm's net income? (Enter your answers in millions rounded to 2 decimal places.) b. What was the firm's cash flow? (Enter your answers in millions rounded to 2 decimal places.) c. What would happen to net income and cash flow if depreciation were increased by $2.20 million? (Enter your numeric answers in millions rounded to 2 decimal places. Select "unaffected" if the results do not affect the balance.) f. What would be the impact on cash flow if depreciation was $2.20 million and interest expense was $3.20 million? (Enter your numeric answer in millions rounded to 2 decimal places. Select "unaffected" if the results do not affect the balance.) Answer is not complete. a. Net income million b. Net cash flow million c. Net income would be by million Cash flow would be decreased increased decreased by million f. Cash flow would be by million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts