Question: Chapter 3 Critical Thinking Case 2 Kendra Thayer: Waitress or Tax Expert? Kendra Thayer, who is single, goes to graduate school part-time and works as

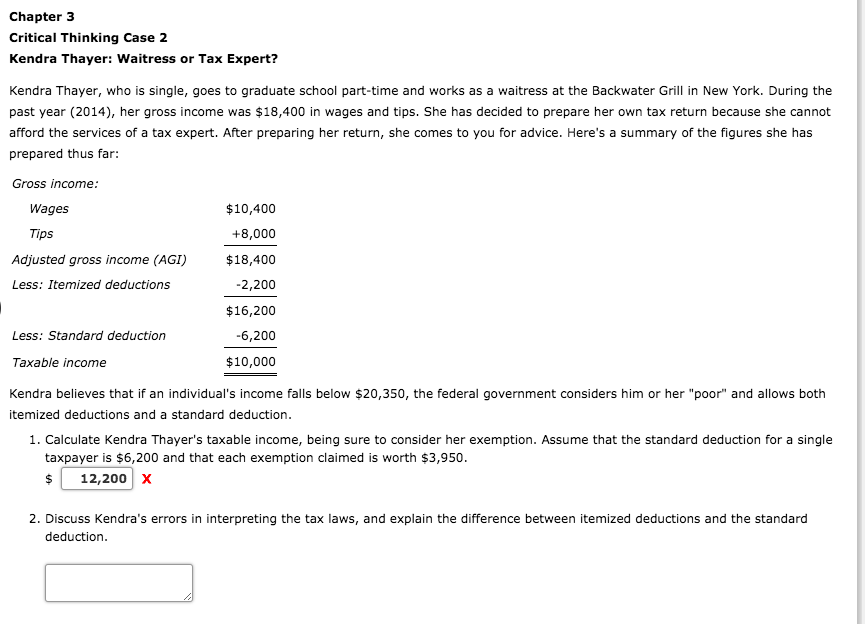

Chapter 3 Critical Thinking Case 2 Kendra Thayer: Waitress or Tax Expert? Kendra Thayer, who is single, goes to graduate school part-time and works as a waitress at the Backwater Grill in New York. During the past year (2014), her gross income was $18,400 in wages and tips. She has decided to prepare her own tax return because she cannot afford the services of a tax expert. After preparing her return, she comes to you for advice. Here's a summary of the figures she has prepared thus far: Gross income: Wages $10,400 +8,000 Tips Adjusted gross income (AGI) Less: Itemized deductions $18,400 -2,200 $16,200 -6,200 Less: Standard deduction Taxable income $10,000 Kendra believes that if an individual's income falls below $20,350, the federal government considers him or her "poor" and allows both itemized deductions and a standard deduction. 1. Calculate Kendra Thayer's taxable income, being sure to consider her exemption. Assume that the standard deduction for a single taxpayer is $6,200 and that each exemption claimed is worth $3,950. $ 12,200 x 2. Discuss Kendra's errors in interpreting the tax laws, and explain the difference between itemized deductions and the standard deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts