Question: CHAPTER #3 During the year, Kim sold the following assets: business auto for a $1,000 loss, stock investment for a $1,000 loss, and pleasure yacht

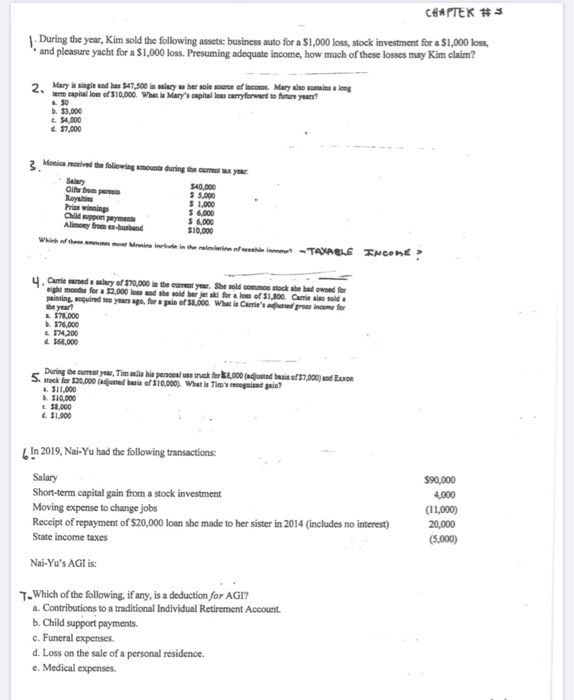

CHAPTER #3 During the year, Kim sold the following assets: business auto for a $1,000 loss, stock investment for a $1,000 loss, and pleasure yacht for a $1,000 loss. Presuming adequate income, how much of these losses may Kim claim? 2. Mary is single and has 547,500 in salary her sole source of income. Mary also in a long em capital low of $10,000. What is Mary's capital los taryforward to funere years? c. 54,000 4. 57,000 3. Monica merived the following amount during the new year 540,000 Gite for 35.000 Royal $ 1.000 Prize winning $ 6,000 ad por payment $ 6,000 Alimey from husband $10,000 While we mnies in het in the maintenis wat is - TAMNELE Incont? 4. Come and say of 570,000 hecy. Se old come to add eight month for a $2.000 low and the old herjer for a low of $1,100 Camisola painting, quired to years ago for a pain of 1,000. What is Carrie's a great income for the year 1.575,000 . 576,000 6.574200 568,000 During the cumst yeur, Tim seile his personal use truck for 4,000 (adjusted basis ef57.000) and Euro 5. rock for 20,000 adjusted basis of $10,000). What is in cognised pain? 511,000 310,000 c. 38.000 d. 51.000 6 In 2019, Nai-Yu had the following transactions: Salary Short-term capital gain from a stock investment Moving expense to change jobs Receipt of repayment of $20,000 loan she made to her sister in 2014 (includes no interest) State income taxes Nai-Yu's AGT is: $90,000 4,000 (11,000) 20,000 (5,000) 7-Which of the following, if any, is a deduction for AGI? a. Contributions to a traditional Individual Retirement Account b. Child support payments c. Funeral expenses d. Loss on the sale of a personal residence. e. Medical expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts