Question: Chapter 3 - Exercise 25 Suppose that you sell short 500 shares of Xtel, currently selling for $40 per dshare, given your broker $15,000 to

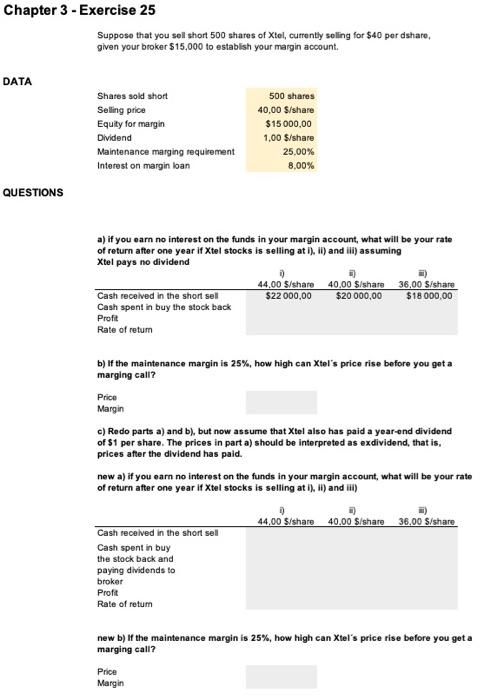

Chapter 3 - Exercise 25 Suppose that you sell short 500 shares of Xtel, currently selling for $40 per dshare, given your broker $15,000 to establish your margin account. DATA Shares sold short Seling price Equity for margin Dividend Maintenance marging requirement Interest on margin loan 500 shares 40,00 S/share $15 000,00 1.00 $/share 25.00% 8.00% QUESTIONS a) if you earn no interest on the funds in your margin account, what will be your rate of return after one year if Xtel stocks is selling at i), ii) and ili) assuming Xtel pays no dividend 44.00 S/share 40.00 $/share 36,00 S/share Cash received in the short sel $22 000,00 $20 000,00 $18000,00 Cash spent in buy the stock back Profit Rate of retum b) If the maintenance margin is 25%, how high can Xtel's price rise before you get a marging call? Price Margin c) Redo parts a) and b), but now assume that Xtel also has paid a year-end dividend of 51 per share. The prices in part a) should be interpreted as exdividend, that is, prices after the dividend has paid. new a) if you earn no interest on the funds in your margin account, what will be your rate of return after one year if Xtel stocks is selling at i), m) and I) 44,00 $/share 40.00 $/share 36,00 S/share Cash received in the short sel Cash spent in buy the stock back and paying dividends to broker Profit Rate of retum new b) If the maintenance margin is 25%, how high can Xtel's price rise before you get a marging call? Price Margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts