Question: CHAPTER 3 EXERCISES: SET B Explain the time period Assumption (LO 1) E3-1B Maria Diaz has prepared the following list of statements about the time

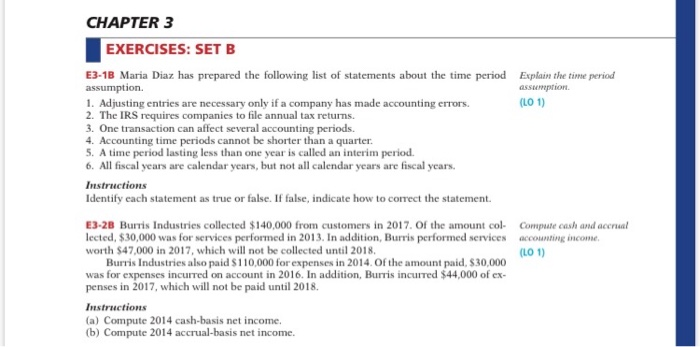

CHAPTER 3 EXERCISES: SET B Explain the time period Assumption (LO 1) E3-1B Maria Diaz has prepared the following list of statements about the time period assumption. 1. Adjusting entries are necessary only if a company has made accounting errors. 2. The IRS requires companies to file annual tax returns. 3. One transaction can affect several accounting periods. 4. Accounting time periods cannot be shorter than a quarter. 5. A time period lasting less than one year is called an interim period. 6. All fiscal years are calendar years, but not all calendar years are fiscal years. Instructions Identify each statement as true or false. If false, indicate how to correct the statement. E3-2B Burris Industries collected $140,000 from customers in 2017. Of the amount col lected, $30,000 was for services performed in 2013. In addition, Burris performed services worth $47.000 in 2017, which will not be collected until 2018 Burris Industries also paid $110,000 for expenses in 2014. Of the amount paid $30,000 was for expenses incurred on account in 2016. In addition, Burris incurred $44,000 of ex- penses in 2017, which will not be paid until 2018. Compute cash and accrual accounting income (LO 1) Instructions (a) Compute 2014 cash-basis net income. (b) Compute 2014 accrual basis net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts