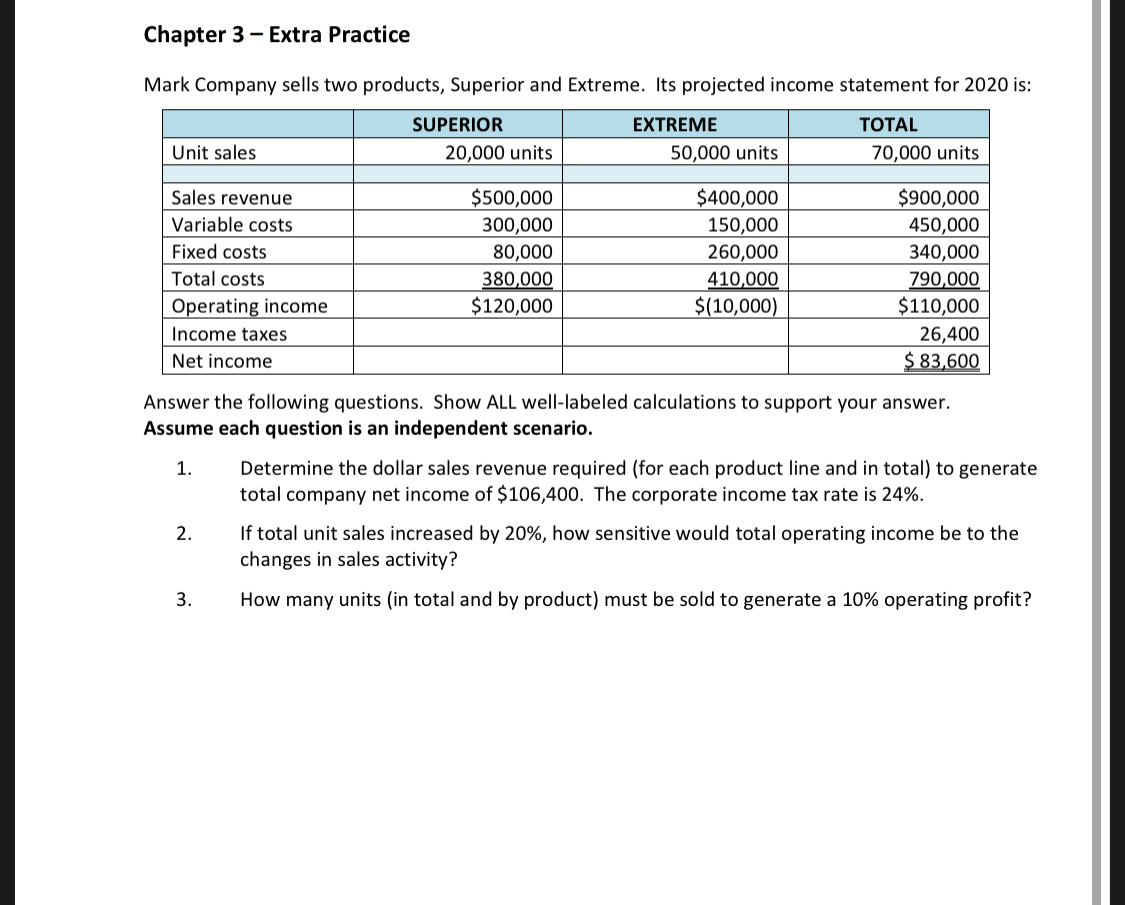

Question: Chapter 3 - Extra Practice Mark Company sells two products, Superior and extreme. Its projected income statement for 2020 is: SUPERIOR 20,000 units EXTREME 50,000

Chapter 3 - Extra Practice Mark Company sells two products, Superior and extreme. Its projected income statement for 2020 is: SUPERIOR 20,000 units EXTREME 50,000 units TOTAL 70,000 units Unit sales Sales revenue Variable costs Fixed costs Total costs Operating income Income taxes Net income $500,000 300,000 80,000 380,000 $120,000 $400,000 150,000 260,000 410,000 $(10,000) $900,000 450,000 340,000 790,000 $110,000 26,400 $ 83,600 Answer the following questions. Show ALL well-labeled calculations to support your answer. Assume each question is an independent scenario. 1. 2. Determine the dollar sales revenue required (for each product line and in total) to generate total company net income of $106,400. The corporate income tax rate is 24%. If total unit sales increased by 20%, how sensitive would total operating income be to the changes in sales activity? How many units (in total and by product) must be sold to generate a 10% operating profit? 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts