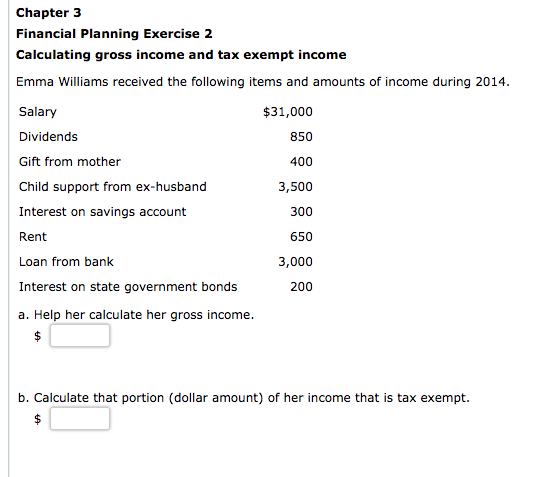

Question: Chapter 3 Financial Planning Exercise 2 Calculating gross income and tax exempt income Emma Williams received the following items and amounts of income during 2014.

Chapter 3 Financial Planning Exercise 2 Calculating gross income and tax exempt income Emma Williams received the following items and amounts of income during 2014. $31,000 850 Salary Dividends Gift from mother Child support from ex-husband 400 3,500 Interest on savings account 300 Rent Loan from bank Interest on state government bonds a. Help her calculate her gross income. 650 3,000 200 b. Calculate that portion (dollar amount) of her income that is tax exempt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock