Question: Chapter 3 Financial Planning Exercise 3 Calculating taxes on security transactions If Olivia Garcia is single and in the 28% tax bracket, calculate the tax

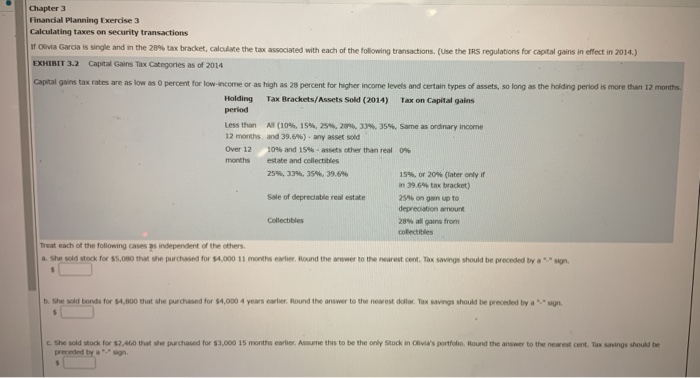

Chapter 3 Financial Planning Exercise 3 Calculating taxes on security transactions If Olivia Garcia is single and in the 28% tax bracket, calculate the tax associated with each of the following transactions. (Use the IRS regulations for capital gains in effect in 2014.) EXHIBIT 3.2 Capital Gains Tax Categories as of 2014 Capital gains tax rates are as low as O percent for low-ncome or as high as 28 percent for higher income levels and certain types of assets, so long as the holding period is more than 12 months Holding Tax Brackets/Assets Sold (2014) Tax on Capital gains period Less than Al (10%, 15%, 25, 26, 334, 35%. Same as ordinary income 12 months and 39.6%) - any asset sold Over 12 10% and 15-assets other than real 0% months estate and collectibles 25%, 33%, 359, 39.6% 15% or 20% (later only if in 39.6% tax bracket) Sale of depreciable real estate 2576 on Onn up to depreciation amount Collectibles 28% all gains from collecties Treat each of the following cases as independent of the others. a. She sold stock for $5,000 that she purchased for $4,000 11 months earlier Round the wwwer to the nearest cent. Thx savings should be preceded by a sign b. She told bonds for $4,000 that she purchased for $4,000 4 years earlier. Round the answer to the nearest dolor. Tox savings should be preceded by aug. c. She sold stock for $2.460 that she purchased for $3,000 15 months earlier. Assume this to be the only stock in Olivia's portfolio Round the answer to the nearest cent. Tax savings should be preceded by an

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts