Question: Chapter 3 Homework Navigation DODDIDDIW Finish attempt Support Question 7 Not complete Marked out of 14.00 P Flag question Reporting on Discontinued Operations-Disposal in Current

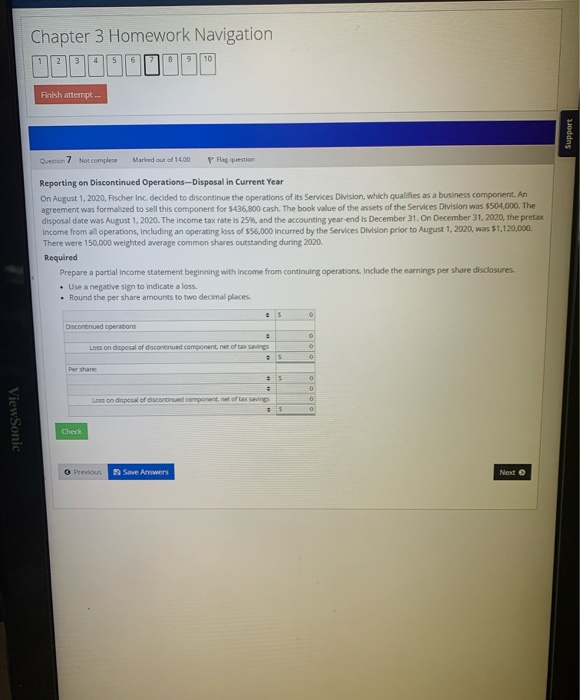

Chapter 3 Homework Navigation DODDIDDIW Finish attempt Support Question 7 Not complete Marked out of 14.00 P Flag question Reporting on Discontinued Operations-Disposal in Current Year On August 1, 2020, Fischer Inc. decided to discontinue the operations of its Services Division, which qualifies as a business component. An agreement was formalized to sell this component for 5436,800 cash. The book value of the assets of the Services Division was $504,000. The disposal date was August 1, 2020. The income tax rate is 25%, and the accounting year-end is December 31. On December 31, 2020, the pretax Income from all operations, including an operating loss of $56,000 incurred by the Services Division prior to August 1, 2020, was 51,120,000 There were 150.000 weighted average common shares outstanding during 2020. Required Prepare a partial Income statement beginning with income from continuing operations, include the earnings per share disclosures. . Use a negative sign to indicate a loss. Round the per share amounts to two decimal places. o Discontinued operations 0 0 Loss on disposal of discontinued component net of tax saving 0 Per share + 5 o 0 0 Loss on disposal of continued component.net of tax savings 5 0 ViewSonic Check Previous Save Answers Next Chapter 3 Homework Navigation DODDIDDIW Finish attempt Support Question 7 Not complete Marked out of 14.00 P Flag question Reporting on Discontinued Operations-Disposal in Current Year On August 1, 2020, Fischer Inc. decided to discontinue the operations of its Services Division, which qualifies as a business component. An agreement was formalized to sell this component for 5436,800 cash. The book value of the assets of the Services Division was $504,000. The disposal date was August 1, 2020. The income tax rate is 25%, and the accounting year-end is December 31. On December 31, 2020, the pretax Income from all operations, including an operating loss of $56,000 incurred by the Services Division prior to August 1, 2020, was 51,120,000 There were 150.000 weighted average common shares outstanding during 2020. Required Prepare a partial Income statement beginning with income from continuing operations, include the earnings per share disclosures. . Use a negative sign to indicate a loss. Round the per share amounts to two decimal places. o Discontinued operations 0 0 Loss on disposal of discontinued component net of tax saving 0 Per share + 5 o 0 0 Loss on disposal of continued component.net of tax savings 5 0 ViewSonic Check Previous Save Answers Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts