Question: CHAPTER 3 Income Flows versus Cash Flows: Understanding the Statement of Cash Flows INTEGRATIVE CASE 3 . 1 Starbucks Exhibit 3 . 3 4 presents

CHAPTER Income Flows versus Cash Flows: Understanding the Statement of Cash Flows

INTEGRATIVE CASE

Starbucks

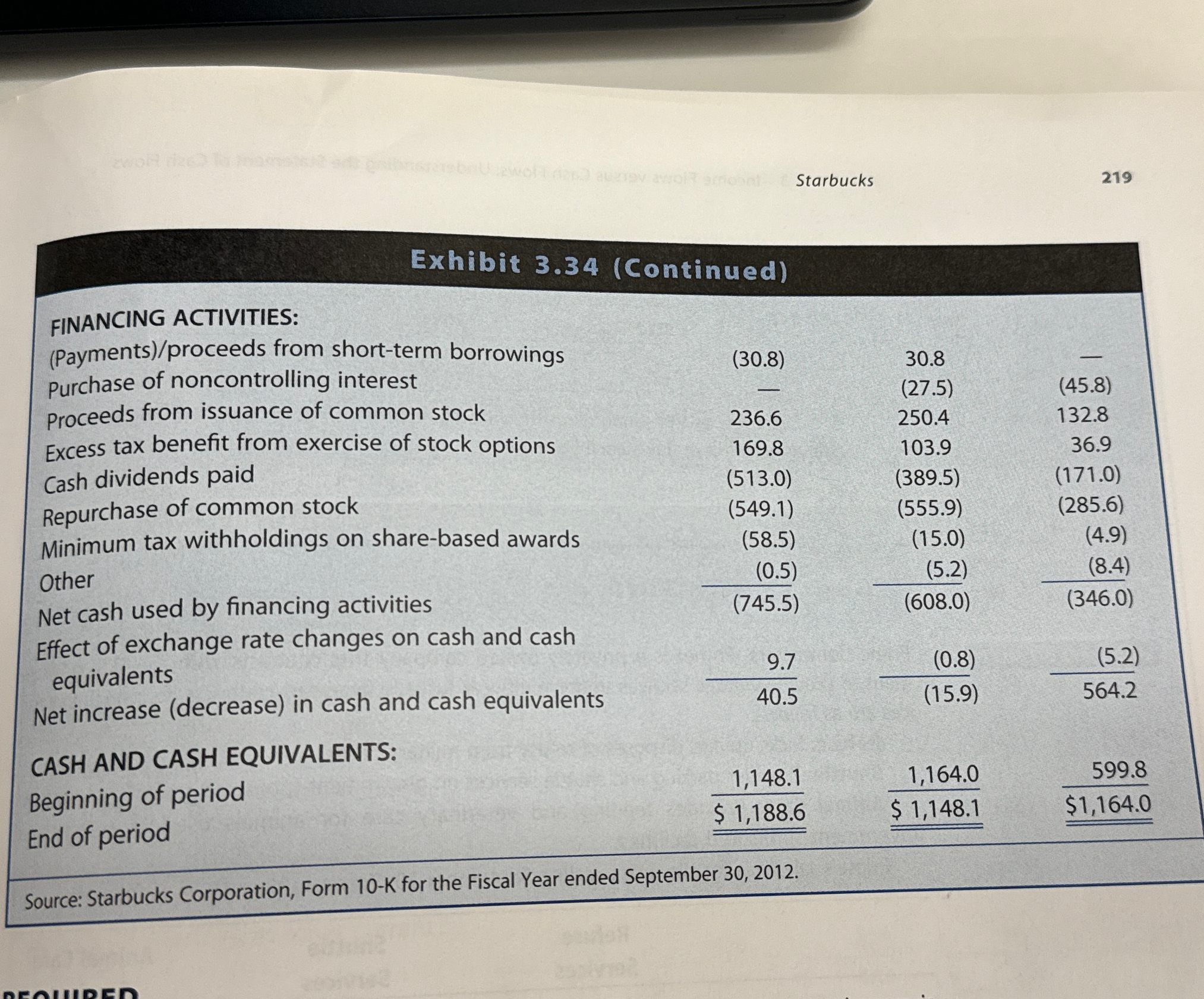

Exhibit presents a statement of cash flows for Starbucks for and This state ment is an expanded version of the statement of cash flows for Starbucks shown in Exhibit

Continued

Starbucks

Exhibit Continued

FINANCING ACTIVITIES:

Paymentsproceeds from shortterm borrowings Purchase of noncontrolling interest

Proceeds from issuance of common stock

Excess tax benefit from exercise of stock options

Cash dividends paid

Repurchase of common stock

Minimum tax withholdings on sharebased awards

Other

Net cash used by financing activities

Effect of exchange rate changes on cash and cash equivalents

Net increase decrease in cash and cash equivalents

table

g Discuss the relations among net income, nonworking capital adjustments, working capital adjustments, operating cash flows, and EBITDA for the three years. Are the patterns similar or different? What are the primary determinants of the differences between the summary measures net income, operating cash flows, and EBITDA?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock