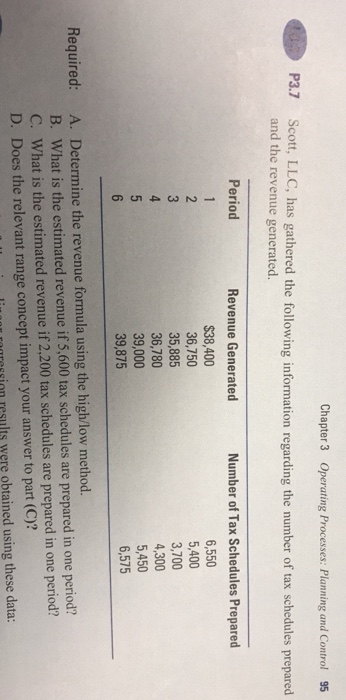

Question: Chapter 3 Operating Processes: Planning and Control 95 P3.7 Scott, LLC, has gathered the following information regarding the number of tax schedules prepared and the

Chapter 3 Operating Processes: Planning and Control 95 P3.7 Scott, LLC, has gathered the following information regarding the number of tax schedules prepared and the revenue generated. Period Revenue Generated $38,400 36,750 35,885 36,780 39,000 39,875 Number of Tax Schedules Prepared 6,550 5,400 3,700 4,300 5,450 6,575 Required: A. Determine the revenue formula using the high/low method. B. What is the estimated revenue if 5,600 tax schedules are prepared in one period? C. What is the estimated revenue if 2,200 tax schedules are prepared in one period? D. Does the relevant range concept impact your answer to part (C)? uression results were obtained using these data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts