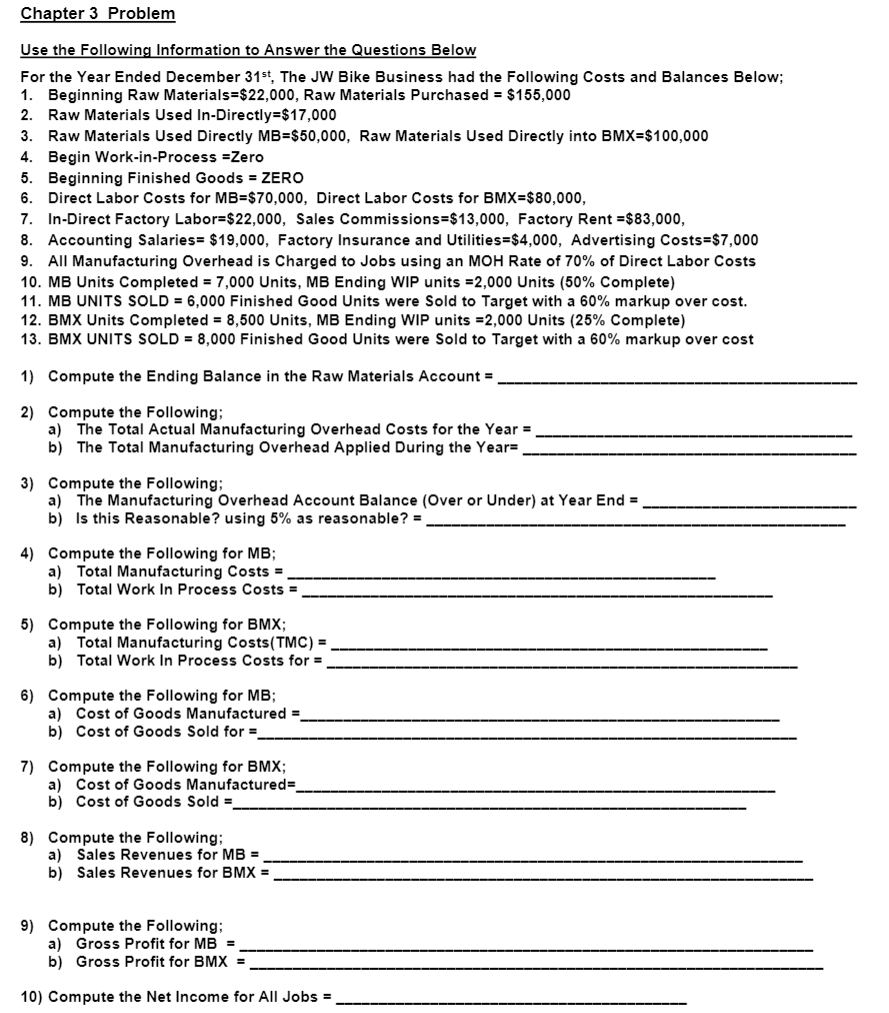

Question: Chapter 3 Problem Use the following Information to Answer the questions Below For the Year Ended December 31st, The JW Bike Business had the Following

Chapter 3 Problem Use the following Information to Answer the questions Below For the Year Ended December 31st, The JW Bike Business had the Following costs and Balances Below; 1. Beginning Raw Materials=$22,000, Raw Materials Purchased = $155,000 2. Raw Materials Used In-Directly=$17,000 3. Raw Materials Used Directly MB=$50,000, Raw Materials Used Directly into BMX=$100,000 4. Begin Work-in-Process =Zero 5. Beginning Finished Goods = ZERO 6. Direct Labor Costs for MB=$70,000, Direct Labor Costs for BMX=$80,000, 7. In-Direct Factory Labor=$22,000, Sales Commissions=$13,000, Factory Rent =$83,000, 8. Accounting Salaries= $19,000, Factory Insurance and Utilities $4,000, Advertising Costs=$7,000 9. All Manufacturing Overhead is Charged to Jobs using an MOH Rate of 70% of Direct Labor Costs 10. MB Units Completed = 7,000 Units, MB Ending WIP units =2,000 Units (50% Complete) 11. MB UNITS SOLD = 6,000 Finished Good Units were sold to Target with a 60% markup over cost. 12. BMX Units Completed = 8,500 Units, MB Ending WIP units =2,000 Units (25% Complete) 13. BMX UNITS SOLD = 8,000 Finished Good Units were sold to Target with a 60% markup over cost 1) Compute the Ending Balance in the Raw Materials Account = 2) Compute the Following; a) The Total Actual Manufacturing Overhead Costs for the Year = b) The Total Manufacturing Overhead Applied During the Year= 3) Compute the following; a) The Manufacturing Overhead Account Balance (Over or Under) at Year End = b) Is this Reasonable? using 5% as reasonable? = 4) Compute the following for MB; a) Total Manufacturing Costs = b) Total Work In Process Costs = 5) Compute the following for BMX; a) Total Manufacturing Costs(TMC) = b) Total Work In Process Costs for = 6) Compute the Following for MB; a) Cost of Goods Manufactured = b) Cost of Goods Sold for = 7) Compute the Following for BMX; a) Cost of Goods Manufactured= b) Cost of Goods Sold = 8) Compute the Following; a) Sales Revenues for MB = b) Sales Revenues for BMX = 9) Compute the Following; a) Gross Profit for MB = b) Gross Profit for BMX = 10) Compute the Net Income for All Jobs = Chapter 3 Problem Use the following Information to Answer the questions Below For the Year Ended December 31st, The JW Bike Business had the Following costs and Balances Below; 1. Beginning Raw Materials=$22,000, Raw Materials Purchased = $155,000 2. Raw Materials Used In-Directly=$17,000 3. Raw Materials Used Directly MB=$50,000, Raw Materials Used Directly into BMX=$100,000 4. Begin Work-in-Process =Zero 5. Beginning Finished Goods = ZERO 6. Direct Labor Costs for MB=$70,000, Direct Labor Costs for BMX=$80,000, 7. In-Direct Factory Labor=$22,000, Sales Commissions=$13,000, Factory Rent =$83,000, 8. Accounting Salaries= $19,000, Factory Insurance and Utilities $4,000, Advertising Costs=$7,000 9. All Manufacturing Overhead is Charged to Jobs using an MOH Rate of 70% of Direct Labor Costs 10. MB Units Completed = 7,000 Units, MB Ending WIP units =2,000 Units (50% Complete) 11. MB UNITS SOLD = 6,000 Finished Good Units were sold to Target with a 60% markup over cost. 12. BMX Units Completed = 8,500 Units, MB Ending WIP units =2,000 Units (25% Complete) 13. BMX UNITS SOLD = 8,000 Finished Good Units were sold to Target with a 60% markup over cost 1) Compute the Ending Balance in the Raw Materials Account = 2) Compute the Following; a) The Total Actual Manufacturing Overhead Costs for the Year = b) The Total Manufacturing Overhead Applied During the Year= 3) Compute the following; a) The Manufacturing Overhead Account Balance (Over or Under) at Year End = b) Is this Reasonable? using 5% as reasonable? = 4) Compute the following for MB; a) Total Manufacturing Costs = b) Total Work In Process Costs = 5) Compute the following for BMX; a) Total Manufacturing Costs(TMC) = b) Total Work In Process Costs for = 6) Compute the Following for MB; a) Cost of Goods Manufactured = b) Cost of Goods Sold for = 7) Compute the Following for BMX; a) Cost of Goods Manufactured= b) Cost of Goods Sold = 8) Compute the Following; a) Sales Revenues for MB = b) Sales Revenues for BMX = 9) Compute the Following; a) Gross Profit for MB = b) Gross Profit for BMX = 10) Compute the Net Income for All Jobs =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts