Question: Chapter 3 Problems eBook Show Me How Print Item Example 3-1 ? In 20--, the annual salaries paid each of the officers of Abrew, Inc.,

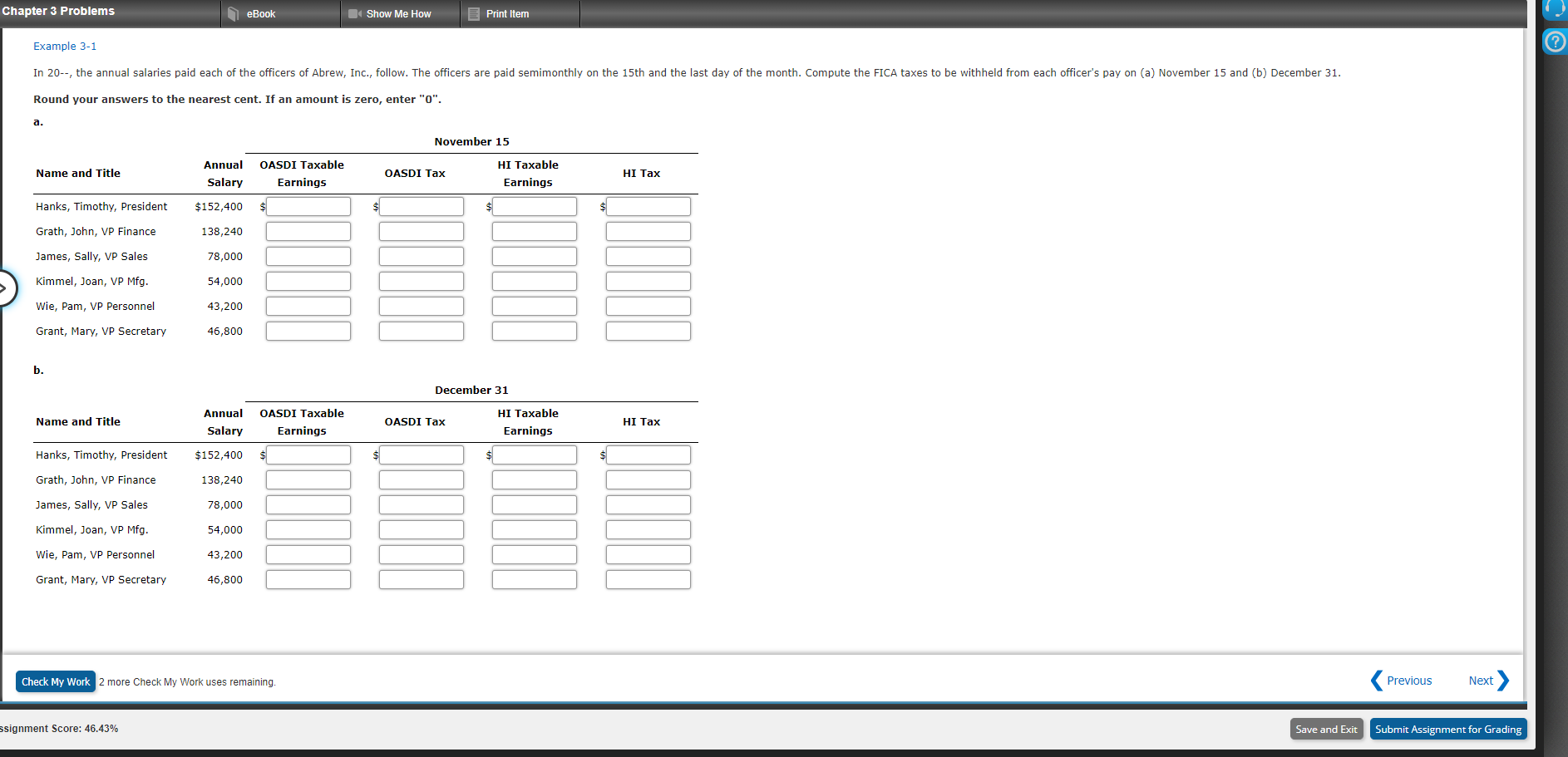

Chapter 3 Problems eBook Show Me How Print Item Example 3-1 ? In 20--, the annual salaries paid each of the officers of Abrew, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31. Round your answers to the nearest cent. If an amount is zero, enter "0". a. November 15 Name and Title Annual Salary OASDI Taxable Earnings OASDI Tax HI Taxable Earnings HI Tax Hanks, Timothy, President $152,400 $ $ Grath, John, VP Finance 138,240 James, Sally, VP Sales 78,000 Kimmel, Joan, VP Mfg. 54,000 Wie, Pam, VP Personnel 43,200 Grant, Mary, VP Secretary 46,800 b. December 31 Name and Title Annual Salary OASDI Taxable Earnings OASDI Tax HI Taxable Earnings HI Tax Hanks, Timothy, President $152,400 $ $ Grath, John, VP Finance 138,240 James, Sally, VP Sales 78,000 Kimmel, Joan, VP Mfg. 54,000 Wie, Pam, VP Personnel 43,200 Grant, Mary, VP Secretary 46,800 Check My Work 2 more Check My Work uses remaining. Previous Next ssignment Score: 46.43% Save and Exit Submit Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts