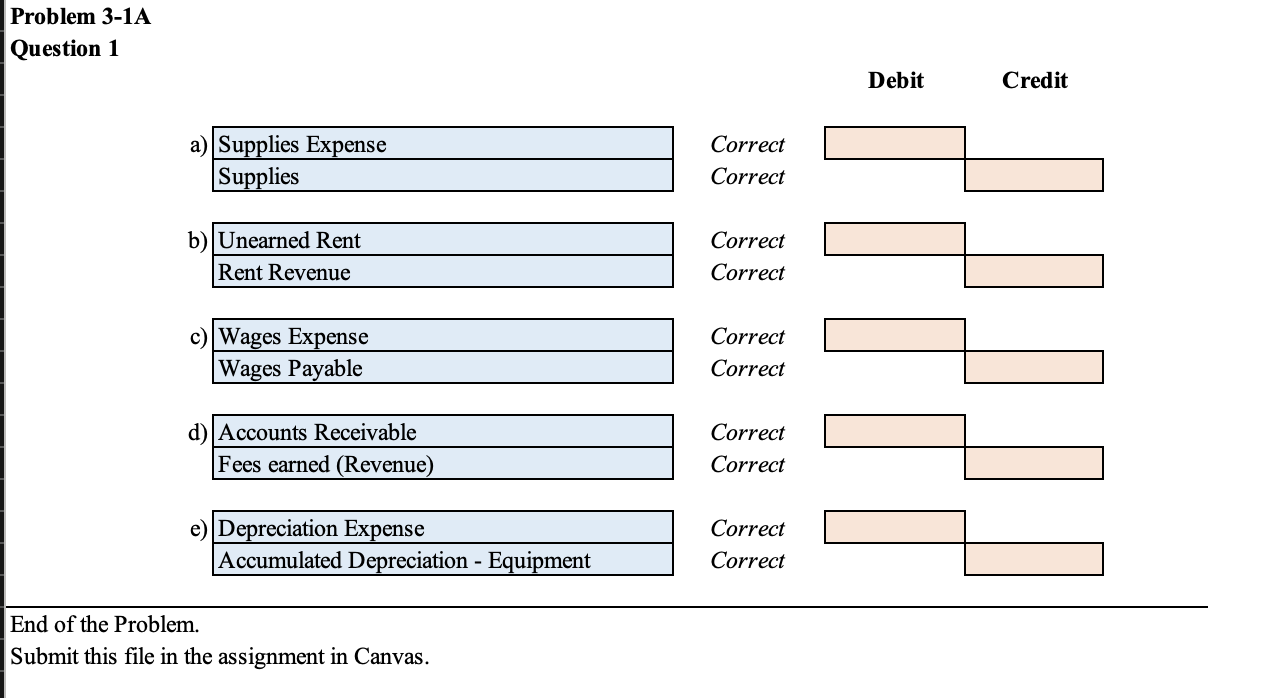

Question: Chapter 3 Problems PR 3-1A Adjusting entries m 2 On March 31, 2016, the following data were accumulated to assist the accountant in preparing the

![are $16,825. e. Depreciation of office equipment is $4,600. 0.1\"] Instructions 1.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/67402c238f55f_85167402c23752fa.jpg)

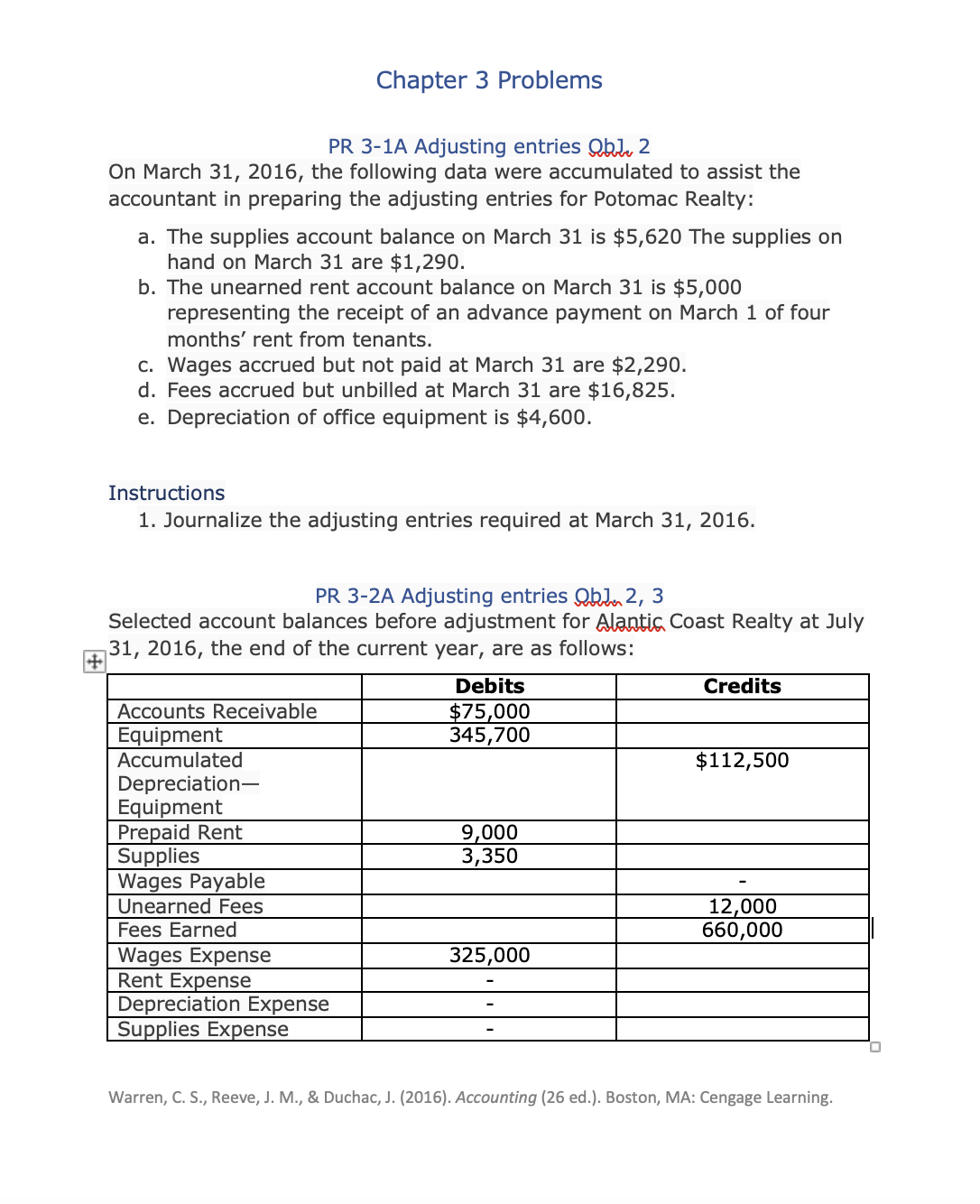

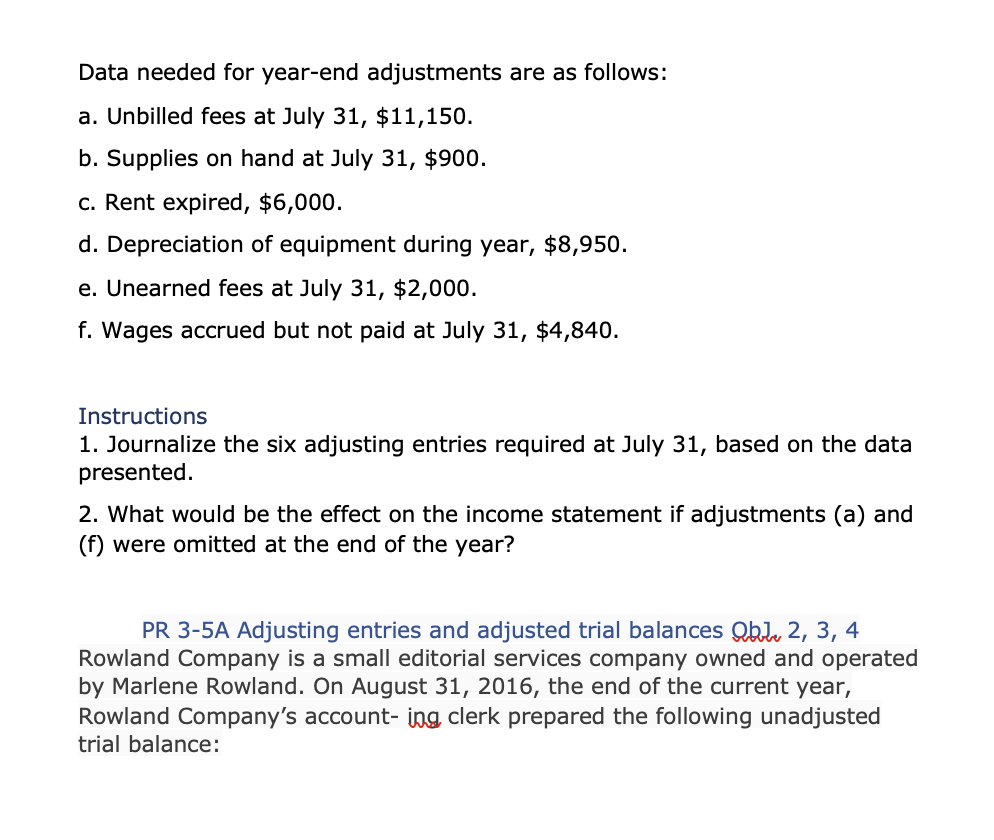

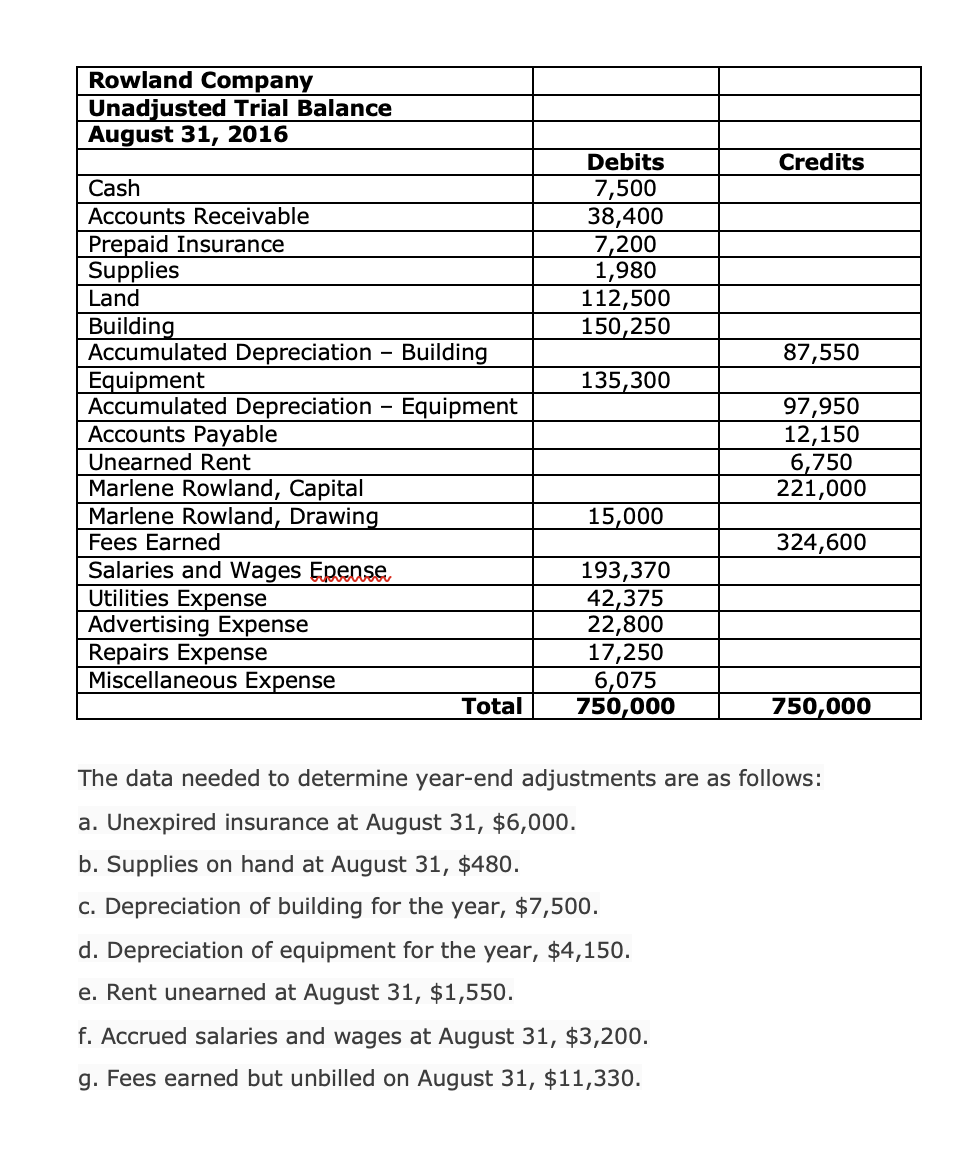

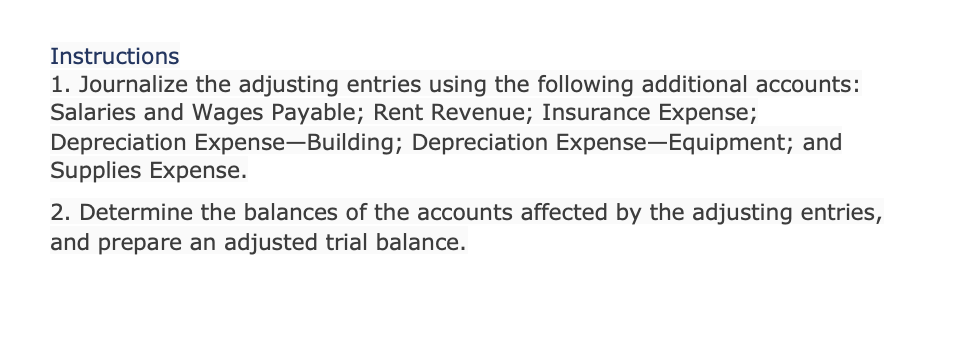

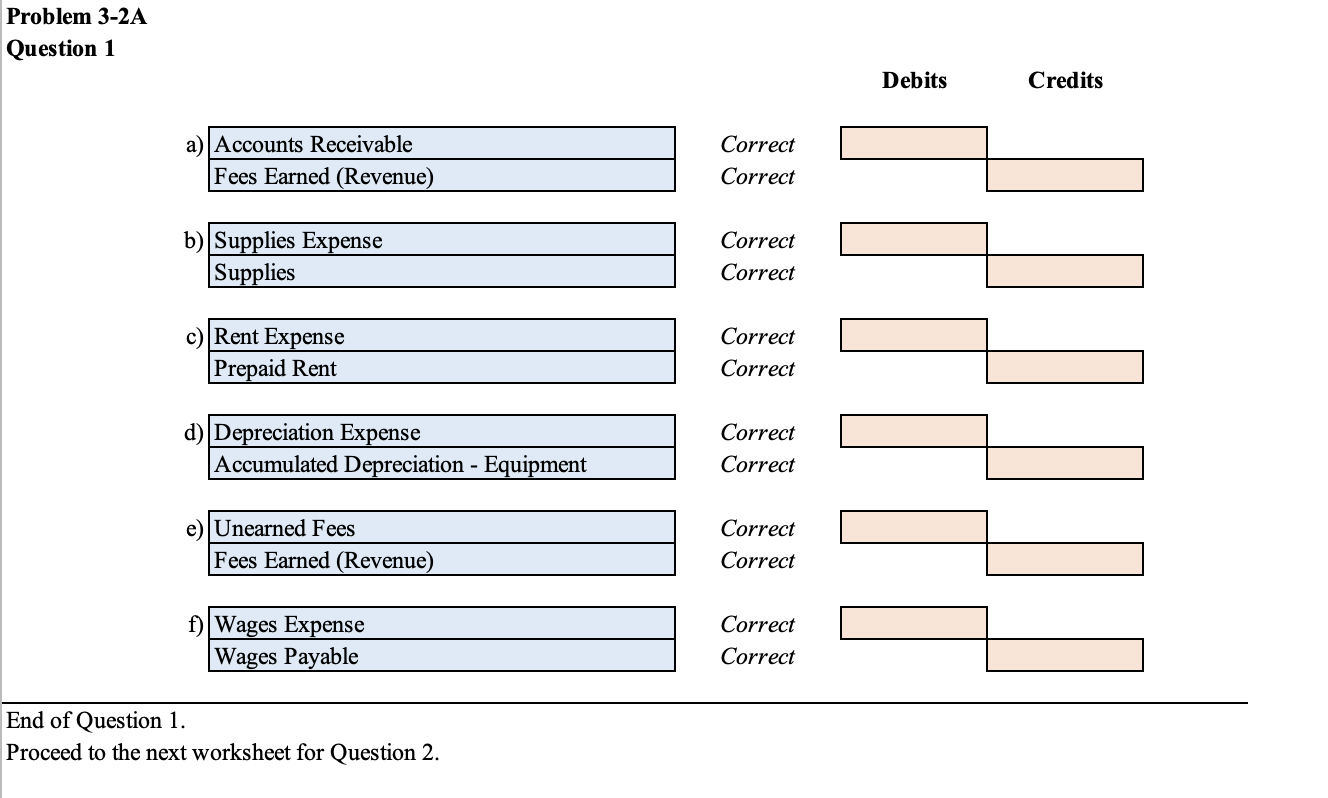

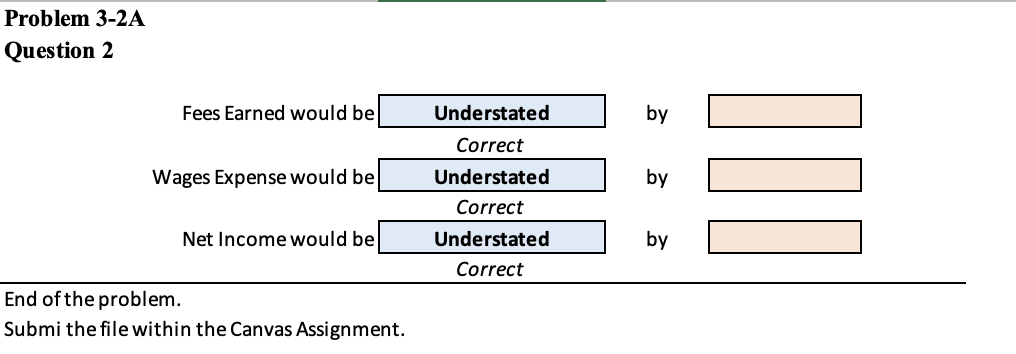

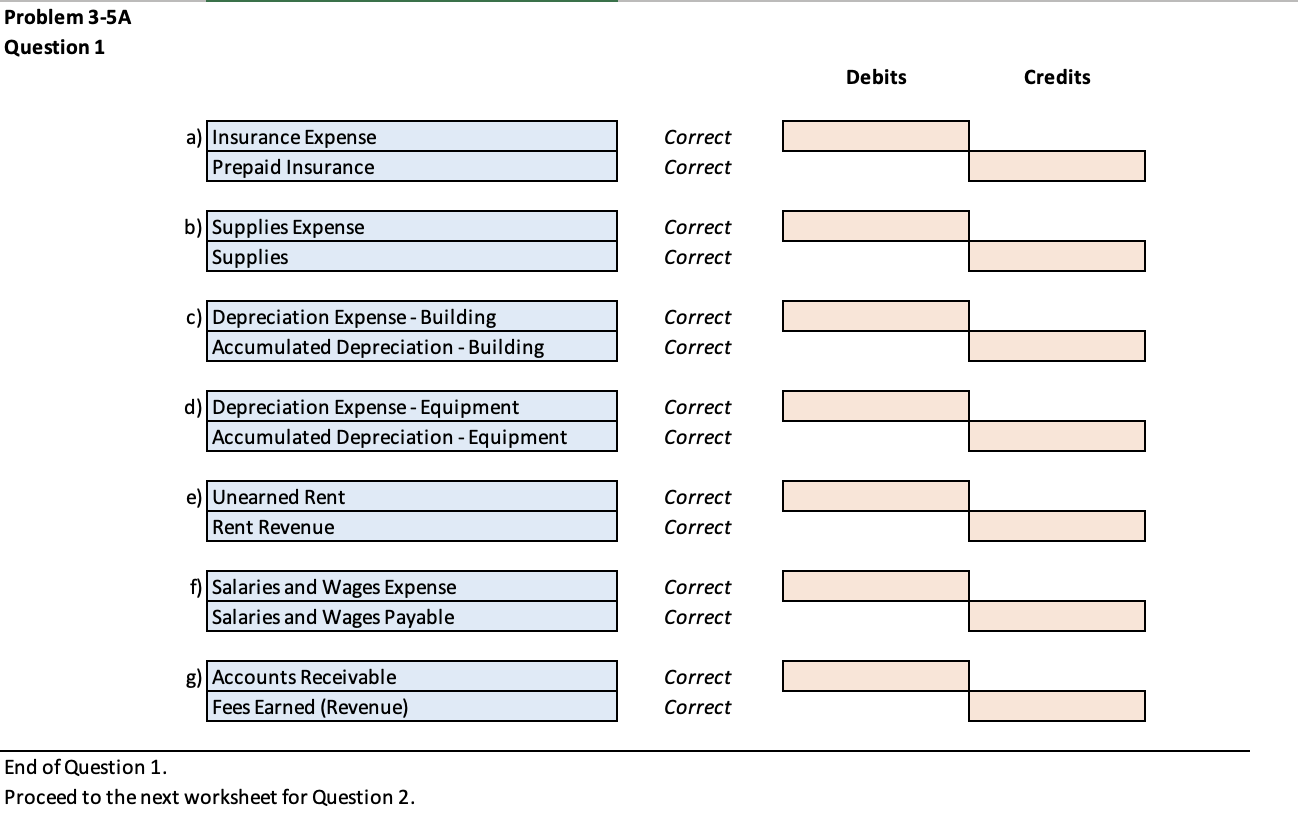

Chapter 3 Problems PR 3-1A Adjusting entries m 2 On March 31, 2016, the following data were accumulated to assist the accountant in preparing the adjusting entries for Potomac Realty: a. The supplies account balance on March 31 is $5,620 The supplies on hand on March 31 are $1,290. b. The unearned rent account balance on March 31 is $5,000 representing the receipt of an advance payment on March 1 of four months' rent from tenants. . Wages accrued but not paid at March 31 are $2,290. . Fees accrued but unbilled at March 31 are $16,825. e. Depreciation of office equipment is $4,600. 0.1\"] Instructions 1. Journalize the adjusting entries required at March 31, 2016. PR 32A Adjusting entries gm\"; 3 Selected account balances before adjustment forglanugCoast Realty at July 31, 2016, the end of the current year, are as follows: lil EEE_EEE_ Accounts Receivable 75 000 Equipment 345,700 Accumulated $112,500 Depreciation Equipment F're-aid Rent 9 000 Supplies 3350 | _ Depreciation Expense _ Warren, C. 5., Reeve, J. M, & Duchac, J. {2016}. Accounting {26 ed}. Boston, MA: Cengage Learning. Data needed for year-end adjustments are as follows: a. Unbilled fees at July 31, $11,150. b. Supplies on hand at July 31, $900. c. Rent expired, $6,000. d. Depreciation of equipment during year, $8,950. e. Unearned fees at July 31, $2,000. f. Wages accrued but not paid at July 31, $4,840. Instructions 1. Journalize the six adjusting entries required at July 31, based on the data presented. 2. What would be the effect on the income statement if adjustments (a) and (f) were omitted at the end of the year? PR 3-5A Adjusting entries and adjusted trial balances Qble 2, 3, 4 Rowland Company is a small editorial services company owned and operated by Marlene Rowland. On August 31, 2016, the end of the current year, Rowland Company's account- ing clerk prepared the following unadjusted trial balance:Rowland Company Unadjusted Trial Balance August 31, 2016 Debits Credits Cash 7,500 Accounts Receivable 38,400 Prepaid Insurance 7,200 Supplies 1,980 Land 112,500 Building 150,250 Accumulated Depreciation - Building 87,550 Equipment 135,300 Accumulated Depreciation - Equipment 97,950 Accounts Payable 12,150 Unearned Rent 6,750 Marlene Rowland, Capital 221,000 Marlene Rowland, Drawing 15,000 Fees Earned 324,600 Salaries and Wages Epense 193,370 Utilities Expense 42,375 Advertising Expense 22,800 Repairs Expense 17,250 Miscellaneous Expense 6,075 Total 750,000 750,000 The data needed to determine year-end adjustments are as follows: a. Unexpired insurance at August 31, $6,000. b. Supplies on hand at August 31, $480. c. Depreciation of building for the year, $7,500. d. Depreciation of equipment for the year, $4,150. e. Rent unearned at August 31, $1,550. f. Accrued salaries and wages at August 31, $3,200. g. Fees earned but unbilled on August 31, $11,330.Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation ExpenseBuilding; Depreciation ExpenseEquipment; and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries, and prepare an adjusted trial balance. Problem 3-1A Question 1 Debit Credit a) Supplies Expense Correct Supplies Correct b) Unearned Rent Correct Rent Revenue Correct c Wages Expense Correct Wages Payable Correct d) Accounts Receivable Correct Fees earned (Revenue) Correct e) Depreciation Expense Correct Accumulated Depreciation - Equipment Correct End of the Problem. Submit this file in the assignment in Canvas.Problem 3-2A Question 1 a) Accounts Receivable Fees Earned (Revenue) b) Supplies Expense Supplies c) Rent Expense Prepaid Rent (1) Depreciation Expense Accumulated Depreciation - Equipment e) Unearned Fees Fees Earned (Revenue) i) Wages Expense Wages Payable End of Question 1. Proceed to the next worksheet for Question 2. Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct D ebits Credits Problem 3-2A Question 2 Fees Earned would be Understated by Correct Wages Expense would be Understated by Correct Net Income would be Understated by Correct End of the problem. Submi the file within the Canvas Assignment.Problem 3-5A Question 1 Debits Credits a) Insurance Expense Correct Prepaid Insurance Correct b) Supplies Expense Correct Supplies Correct c) Depreciation Expense - Building Correct Accumulated Depreciation - Building Correct d) Depreciation Expense - Equipment Correct Accumulated Depreciation - Equipment Correct 2) Unearned Rent Correct Rent Revenue Correct F) | Salaries and Wages Expense Correct Salaries and Wages Payable Correct g) Accounts Receivable Correct Fees Earned (Revenue) Correct End of Question 1. Proceed to the next worksheet for Question 2.Problem 3-5A Question 2 ROWLAND COMPANY Adjusted Trial Balance August 31, 2016 Accounts Name Debits Credits Cash Correct Accounts Receivable Correct Prepaid Insurance Correct Supplies Correct Land Correct Building Correct Accumulated DepreciationBuilding Correct Equipment Correct Accumulated DepreciationEquipment Correct Accounts Payable Correct Unearned Rent Correct Salaries and Wages Payable Correct Marlene Rowland, Capital Correct Marlene Rowland, Drawing Correct Fees Earned Correct Rent Revenue Correct Salaries and Wages Expense Correct Utilities Expense Correct Advertising Expense Correct Repairs Expense Correct D ' reciation Ex o enseBuildin_ Correct D ' reciation Ex . enseE uiment Correct Insurance Expense Correct Supplies Expense Correct Miscellaneous Expense Correct TOTALS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts