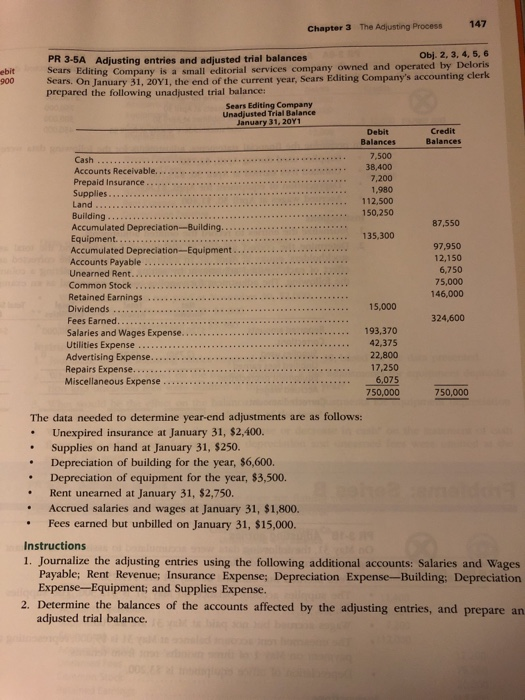

Question: Chapter 3 The Adjusting Process147 Obj. 2, 3, 4, 5,6 and operated by Deloris PR 3-5A Adjusting entries and adjusted trial balances ebitSears Editing Company

Chapter 3 The Adjusting Process147 Obj. 2, 3, 4, 5,6 and operated by Deloris PR 3-5A Adjusting entries and adjusted trial balances ebitSears Editing Company is a small editorial services company ow 900 sears. On January 31, 20Y1, the end of the current year, Sears Editing Company's accounting clerk prepared the following unadjusted trial balance: Sears Editing Company Unadjusted Trial Balance January 31, 20Y1 Credit Balances Debit Balances 7,500 ...38,400 7,200 1,980 112,500 150,250 Cash Prepaid Insurance Supplies.. Land Building Accumulated Depreciation-Building Equipment. 87,550 .. 135,300 97,950 12,150 6,750 75,000 146,000 Accounts Payable Common Stock Retained Earnings . .. Dividends Fees Earned Salaries and Wages Expense... Utilities Expense Advertising Expense... 324,600 193,370 42,375 17,250 6,075 750,000 Miscellaneous Expense 750,000 The data needed to determine year-end adjustments are as follows: .Unexpired insurance at January 31, $2,400. Supplies on hand at January 31, $250. Depreciation of building for the year, $6,600. .Depreciation of equipment for the year, $3,500. Rent unearned at January 31, $2,750. Accrued salaries and wages at January 31, $1,800. Fees earned but unbilled on January 31, $15,000 . Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense-Building; Depreciation Expense-Equipment; and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries, and prepare an adjusted trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts