Question: Chapter 4 5:00 Time Left:0:59:33 Brooklyn Stanley: Attempt 1 Question 12 (13 points) Will Martin are looking at company's health care options and trying to

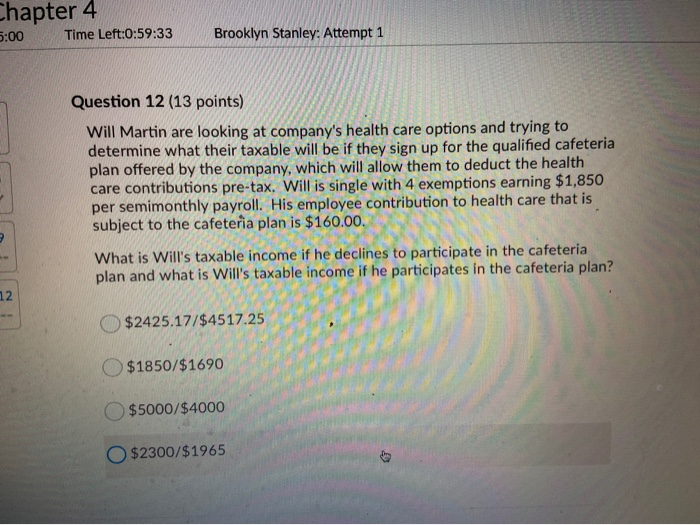

Chapter 4 5:00 Time Left:0:59:33 Brooklyn Stanley: Attempt 1 Question 12 (13 points) Will Martin are looking at company's health care options and trying to determine what their taxable will be if they sign up for the qualified cafeteria plan offered by the company, which will allow them to deduct the health care contributions pre-tax. Will is single with 4 exemptions earning $1,850 per semimonthly payroll. His employee contribution to health care that is subject to the cafeteria plan is $160.00. What is Will's taxable income if he declines to participate in the cafeteria plan and what is Will's taxable income if he participates in the cafeteria plan? $2425.17/$4517.25 $1850/$1690 $5000/$4000 $2300/$1965

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts