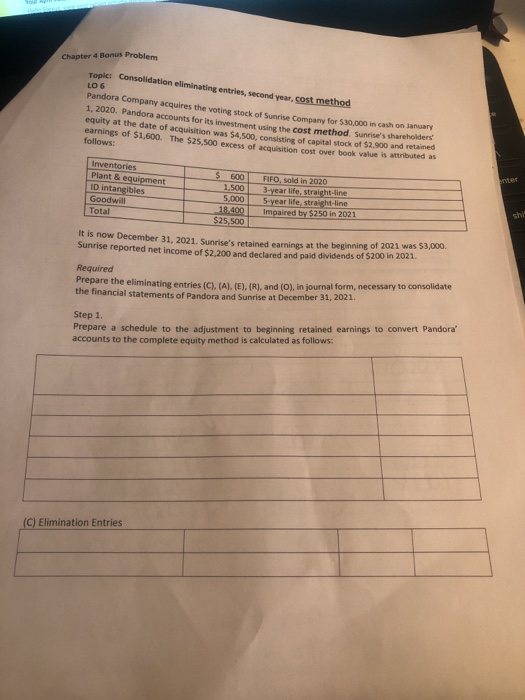

Question: Chapter 4 Bonus Problem Topic: Consolidation eliminating entries, second year, cost method LO 6 Pandora Company acquires the voting stock o f 30.000 in cash

Chapter 4 Bonus Problem Topic: Consolidation eliminating entries, second year, cost method LO 6 Pandora Company acquires the voting stock o f 30.000 in cash on any 1. 2020. Pandora accounts for its investment in the cost method. Sun 's shareholders equity at the date of acquisition was $4.500 consisting of capital stock of $2.500 and read earnings of $1,500. The $25.500 excess of caution cost over book value is attributed as follows: Inventories Plant & equipment ID intangibles Goodwill Total $ 500 1.500 5.000 18.400 $25,500 FIFO, sold in 2020 3-year life, straight line 5 year life, straight line impaired by $250 in 2021 is now December 31, 2021. Sunrise's retained earnings at the beginning of 2021 was $3.000 Sunrise reported net income of $2200 and declared and paid dividends of $200 in 2021 Required Prepare the eliminating entries (C), (ALLE) (R) and (0) in journal form, necessary to consolidate the financial statements of Pandora and Sunrise at December 31, 2021 Step 1. Prepare a schedule to the adjustment to beginning retained earnings to convert Pandora accounts to the complete equity method is calculated as follows: (C) Elimination Entries AJ Elimination Entries (This is an entry used under the Cost Method El Elimination Entries (R) Elimination Entries (O) Elimination Entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts