Question: CHAPTER 4 CAPITAL BUDGETING QUESTION - 01 Bashar & Co. is evaluating 2 (TWO) independent investment projects. Initial capital outlay for both projects are as

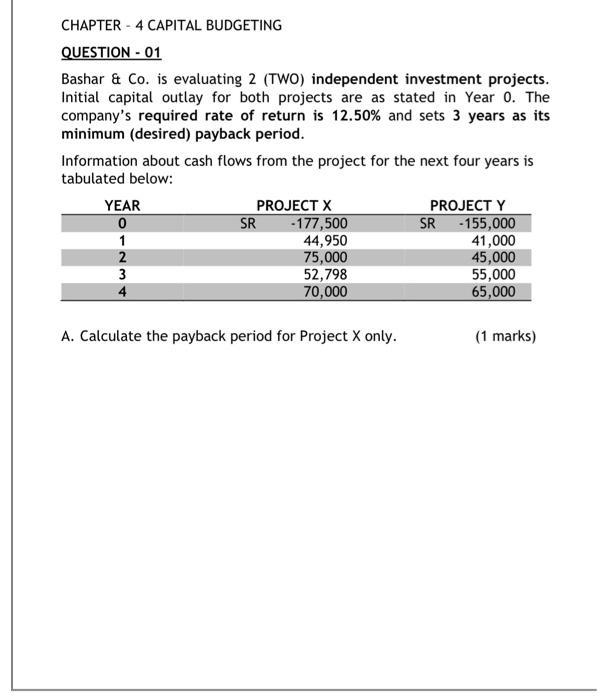

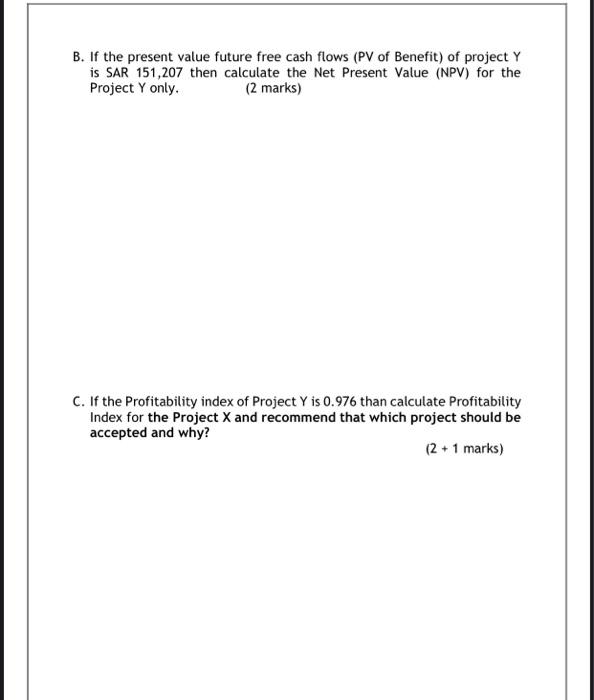

CHAPTER 4 CAPITAL BUDGETING QUESTION - 01 Bashar & Co. is evaluating 2 (TWO) independent investment projects. Initial capital outlay for both projects are as stated in Year 0. The company's required rate of return is 12.50% and sets 3 years as its minimum (desired) payback period. Information about cash flows from the project for the next four years is tabulated below: YEAR PROJECT X PROJECT Y SR -155,000 0 SR -177,500 1 44,950 41,000 2 75,000 45,000 3 52,798 55,000 70,000 65,000 A. Calculate the payback period for Project X only. (1 marks) B. If the present value future free cash flows (PV of Benefit) of project Y is SAR 151,207 then calculate the Net Present Value (NPV) for the Project Y only. (2 marks) C. If the Profitability index of Project Y is 0.976 than calculate Profitability Index for the Project X and recommend that which project should be accepted and why? (2 + 1 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts