Question: Chapter 4 Critical Thinking Case 1 une Xu's Savings and Banking Plans June Xu is a registered nurse who earns $3,250 per month after taxes.

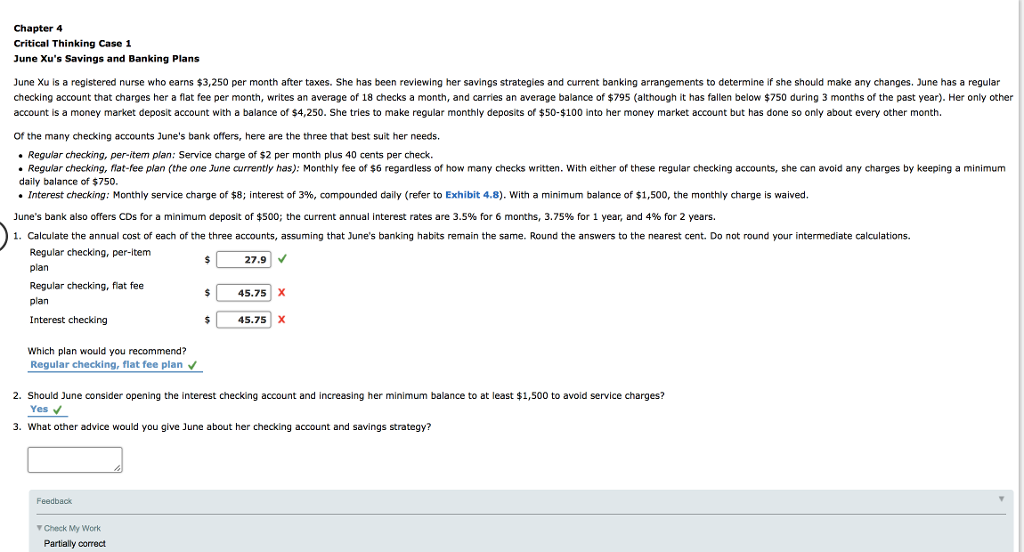

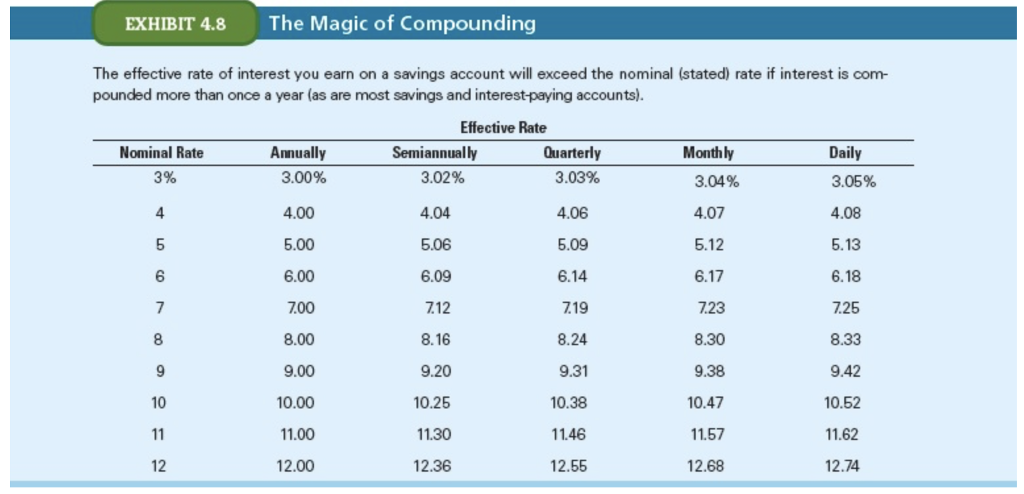

Chapter 4 Critical Thinking Case 1 une Xu's Savings and Banking Plans June Xu is a registered nurse who earns $3,250 per month after taxes. She has been reviewing her savings strategies and current banking arrangements to determine if she should make any changes. June has a regular checking account that charges her a flat ee per month, writes an average of 18 checks a month, and carries an average balance of $795 although t has a en be oS750 du n 3 months of he st year , er nother account is a money market deposit account with a balance of $4,250. She tries to make regular monthly deposits of $50-$100 into her money market account but has done so only about every other month. Of the many checking accounts June's bank offers, here are the three that best suit her needs. Regular checking, per-item plan: Service charge of $2 per month plus 40 cents per check. Regular checking, flat-fee plan (the one June currently has): Monthly fee of $6 regardless of how many checks written. With either of these regular checking accounts, she can avoid any charges by keeping a minimum daily balance of $750. * Interest checking: Monthly service charge of $8; interest of 3%, compounded daily refer to Exhibit 4.8). With a minimum balance of $1,500, the monthly charge is waived June's bank also offers CDs for a minimum deposit of $500; the current annual interest rates are 3.5% for 6 months, 3.75% for 1 year, and 496 for 2 years. Calculate the annual cost of each of the three accounts, assuming that June's banking habits remain the same. Round the answers to the nearest cent. Do not round your intermediate calculations. Regular checking, per-tem plan Regular checking, flat fee plan Interest checking 27.9 45.75 X 45.75 X Which plan would you recommend? Regular checking, flat fee plan 2. Should June consider opening the interest checking account and increasing her minimum balance to at least $1,500 to avoid service charges? Yes 3. What other advice would you give June about her checking account and savings strategy? Feedback Check My work Partially correct Chapter 4 Critical Thinking Case 1 une Xu's Savings and Banking Plans June Xu is a registered nurse who earns $3,250 per month after taxes. She has been reviewing her savings strategies and current banking arrangements to determine if she should make any changes. June has a regular checking account that charges her a flat ee per month, writes an average of 18 checks a month, and carries an average balance of $795 although t has a en be oS750 du n 3 months of he st year , er nother account is a money market deposit account with a balance of $4,250. She tries to make regular monthly deposits of $50-$100 into her money market account but has done so only about every other month. Of the many checking accounts June's bank offers, here are the three that best suit her needs. Regular checking, per-item plan: Service charge of $2 per month plus 40 cents per check. Regular checking, flat-fee plan (the one June currently has): Monthly fee of $6 regardless of how many checks written. With either of these regular checking accounts, she can avoid any charges by keeping a minimum daily balance of $750. * Interest checking: Monthly service charge of $8; interest of 3%, compounded daily refer to Exhibit 4.8). With a minimum balance of $1,500, the monthly charge is waived June's bank also offers CDs for a minimum deposit of $500; the current annual interest rates are 3.5% for 6 months, 3.75% for 1 year, and 496 for 2 years. Calculate the annual cost of each of the three accounts, assuming that June's banking habits remain the same. Round the answers to the nearest cent. Do not round your intermediate calculations. Regular checking, per-tem plan Regular checking, flat fee plan Interest checking 27.9 45.75 X 45.75 X Which plan would you recommend? Regular checking, flat fee plan 2. Should June consider opening the interest checking account and increasing her minimum balance to at least $1,500 to avoid service charges? Yes 3. What other advice would you give June about her checking account and savings strategy? Feedback Check My work Partially correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts