Question: Chapter 4 Critical Thinking Case 2 Reconciling the Wells' Checking Account vivian and Rowen Wells are college students who opened their first joint checking account

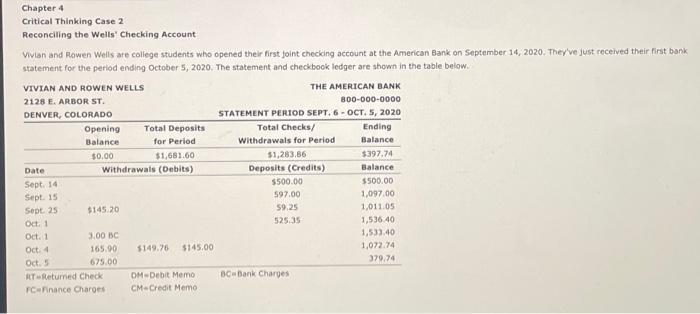

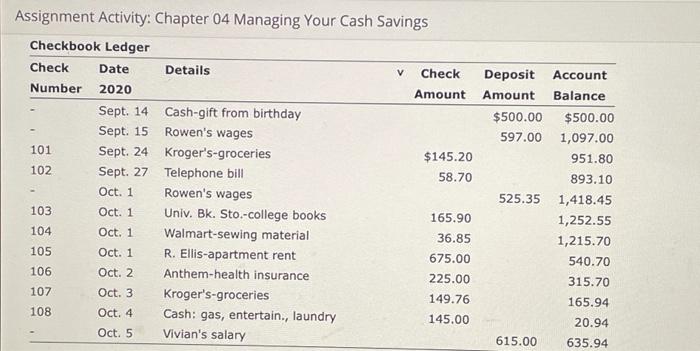

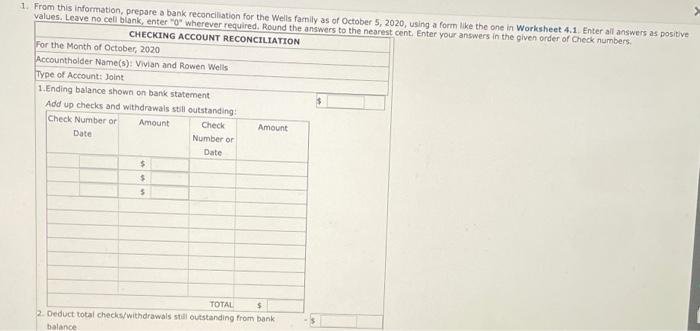

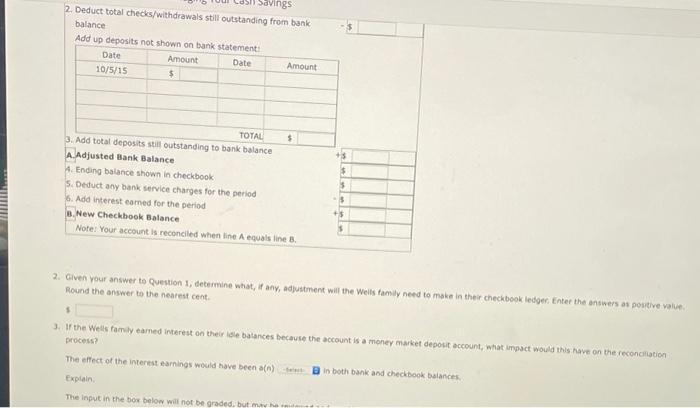

Chapter 4 Critical Thinking Case 2 Reconciling the Wells' Checking Account vivian and Rowen Wells are college students who opened their first joint checking account at the American Bank on September 14, 2020. They've just received their first bank statement for the period ending October 5, 2020. The statement and checkbook ledger are shown in the table below. VIVIAN AND ROWEN WELLS THE AMERICAN BANK 2128 E. ARBOR ST. B00-000-0000 DENVER, COLORADO STATEMENT PERIOD SEPT. 6 - OCT. 5, 2020 Opening Total Deposits Total Checks/ Ending Balance for Period Withdrawals for Period Balance $0.00 $1,681.60 $1,283.86 $397.74 Date Withdrawals (Debits) Deposits (Credits) Balance Sept. 14 $500.00 5500.00 Sept. 15 597.00 1,097.00 Sept. 25 $145.20 59.25 1,011.05 525.35 1,536.40 Oct. 1 3.00 BC 1,533.40 Oct 4 165.90 $149.96 $145.00 1,072.74 Oct. 5 675.00 379.74 AT Retured Check DMDebit Memo BC Bank Charges FCFinance Charges CMCredit Memo Oct Account Balance Deposit Amount $500.00 597.00 Assignment Activity: Chapter 04 Managing Your Cash Savings Checkbook Ledger Check Date Details v Check Number 2020 Amount Sept. 14 Cash-gift from birthday Sept. 15 Rowen's wages 101 Sept. 24 Kroger's-groceries $145.20 102 Sept. 27 Telephone bill 58.70 Oct. 1 Rowen's wages 103 Oct. 1 Univ. Bk. Sto.-college books 165.90 104 Oct. 1 Walmart-sewing material 36.85 105 Oct. 1 R. Ellis-apartment rent 675.00 106 Oct. 2 Anthem-health insurance 225.00 107 Oct. 3 Kroger's-groceries 149.76 108 Oct. 4 Cash: gas, entertain., laundry 145.00 Oct. 5 Vivian's salary 525.35 $500.00 1,097.00 951.80 893.10 1,418.45 1,252.55 1,215.70 540.70 315.70 165.94 20.94 635.94 615.00 1. From this information, prepare a bank reconciliation for the Wells family as of October 5, 2020, using a form like the one in Worksheet 4.1. Enter all answers as positive values. Leave no cell blank, enter" wherever required. Round the answers to the nearest cent. Enter your answers in the given order of Check numbers. CHECKING ACCOUNT RECONCILIATION For the Month of October, 2020 Accountholder Name(s): Vivian and Rowen Wells Type of Account: Joint 1.Ending balance shown on bank statement Add up checks and withdrawals still outstanding: Check Number or Amount Check Amount Date Number or Date $ $ $ TOTAL $ 2. Deduct total checks/withdrawals still outstanding from bank balance Savings 2. Deduct total checks/withdrawals still outstanding from bank balance Add up deposits not shown on bank statement Date Amount Date Amount 10/5/15 $ $ TOTAL $ 3. Add total deposits still outstanding to bank balance Adjusted Bank Balance 4. Ending balance shown in checkbook 5. Deduct any bank service charges for the period 6. Add interest cared for the period New Checkbook Balance Note: Your account is reconciled when Iine. A equals line 8. 5 $ + 2. Give your answer to Question 1, determine what any, adjustment will the Wells family need to make in the checkbook ledger Enter the answers as positive value Round the answer to the nearest cent. 3. If the Wells family earned interest on their die balances because the account is a money market deposit account, what impact would this have on the reconciliation process The effect of the interest earnings would have been an Bin both bank and checkbook balances Explain The input in the box below will not be graded but

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts