Question: Chapter 4 - Fixed Interest Rate Mortgage Loans 2 11 points eBook References Saved C At the end of five years, calculatings A partially

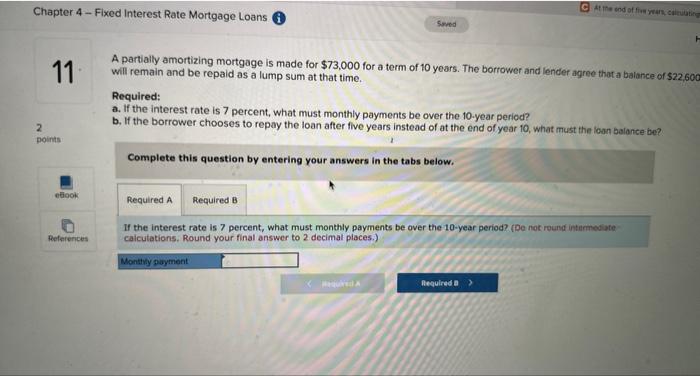

Chapter 4 - Fixed Interest Rate Mortgage Loans 2 11 points eBook References Saved C At the end of five years, calculatings A partially amortizing mortgage is made for $73,000 for a term of 10 years. The borrower and lender agree that a balance of $22,600m will remain and be repaid as a lump sum at that time. Required: a. If the interest rate is 7 percent, what must monthly payments be over the 10-year period? b. If the borrower chooses to repay the loan after five years instead of at the end of year 10, what must the loan balance be? Complete this question by entering your answers in the tabs below. Required A Required B If the interest rate is 7 percent, what must monthly payments be over the 10-year period? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Monthly payment Required B >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts