Question: CHAPTER 4 . Income Statement 187 statement? c. Which of the following would be classified as an extraordinary item on the income 1. Loss on

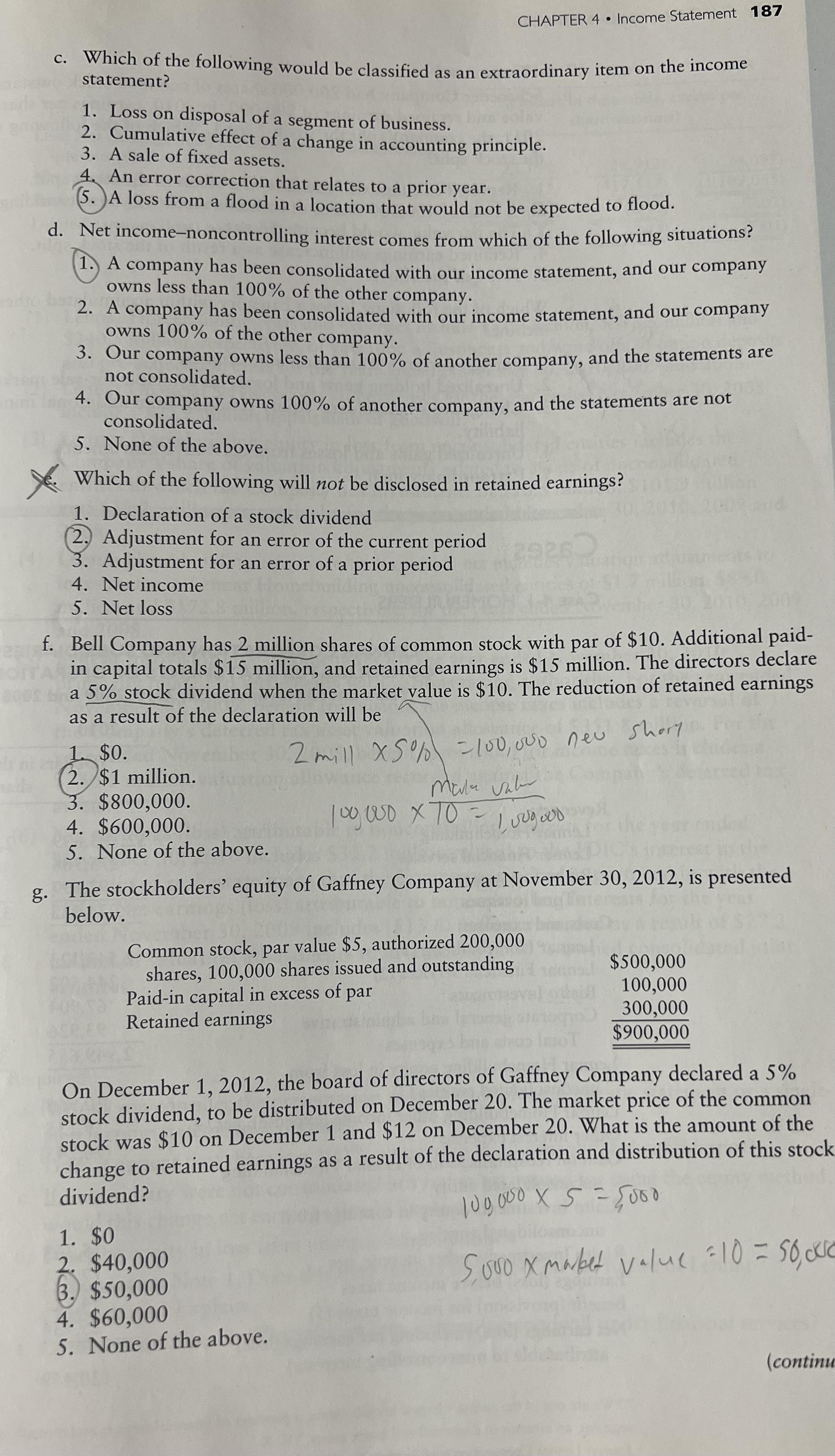

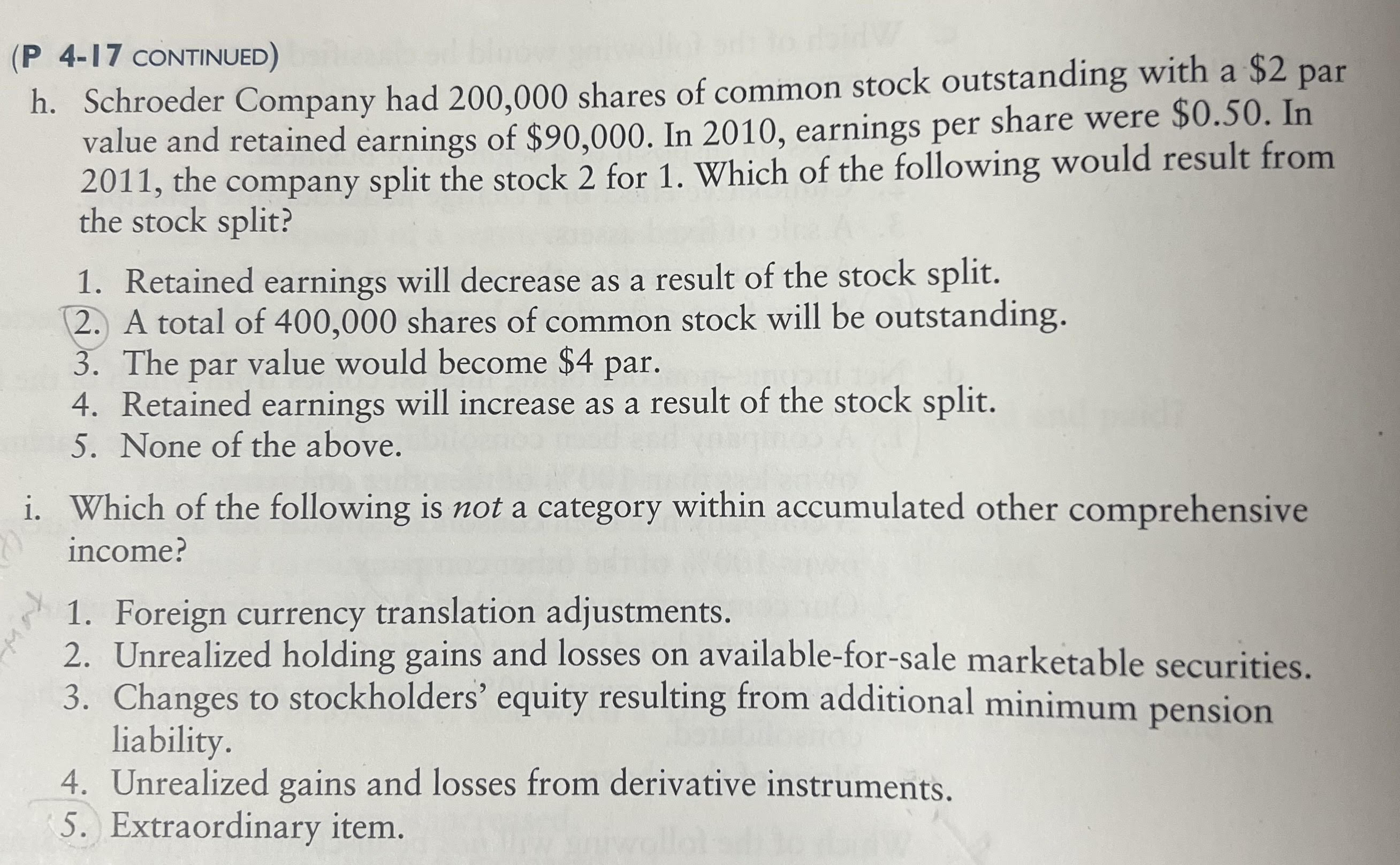

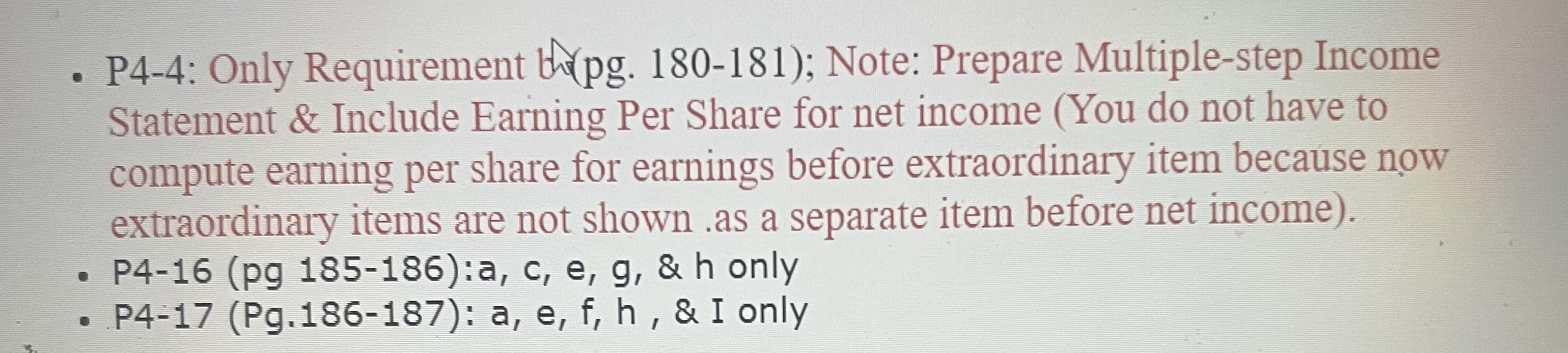

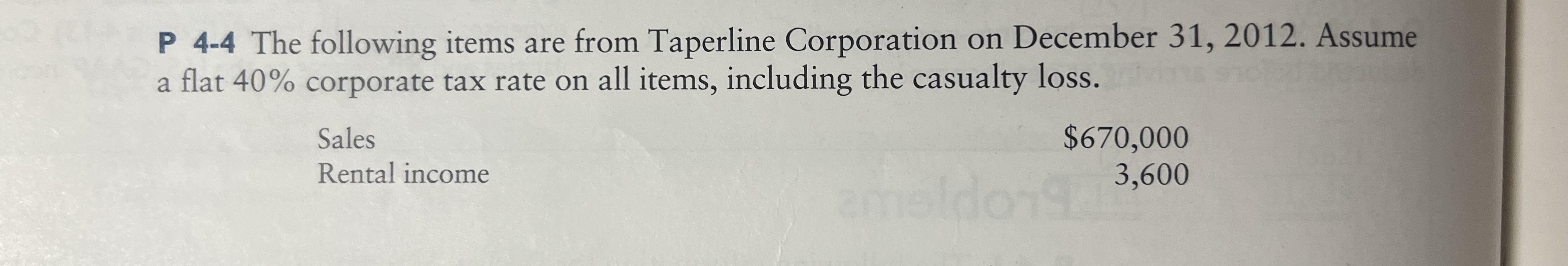

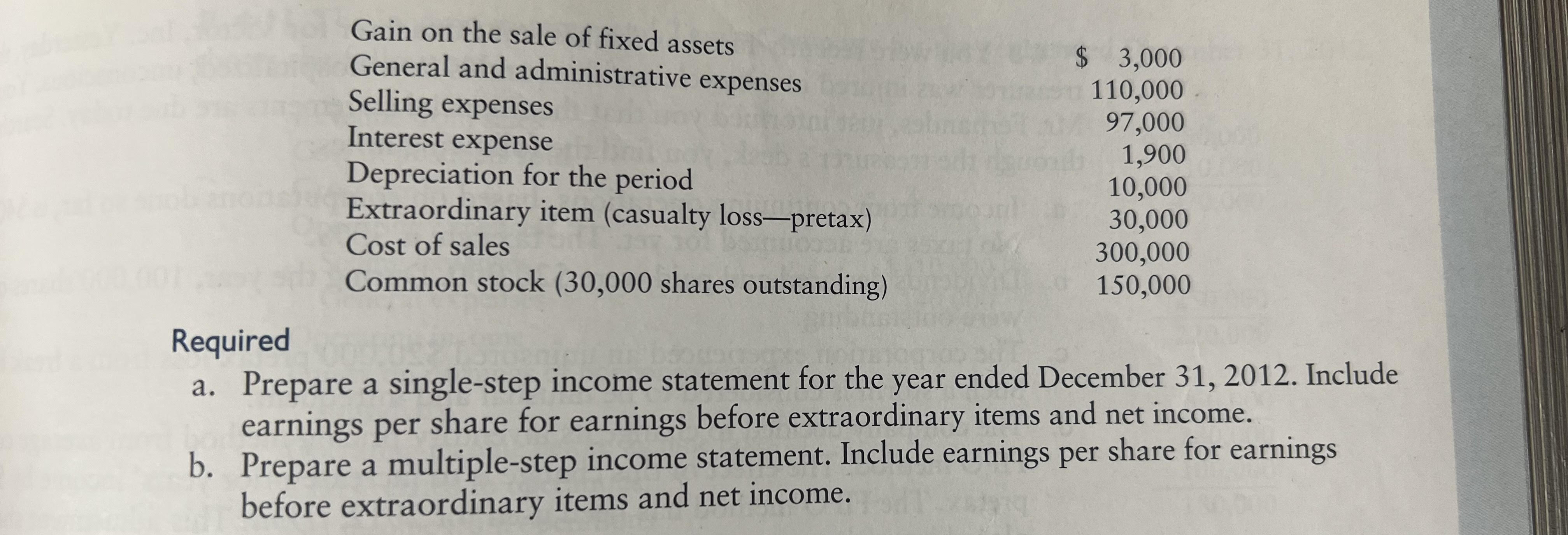

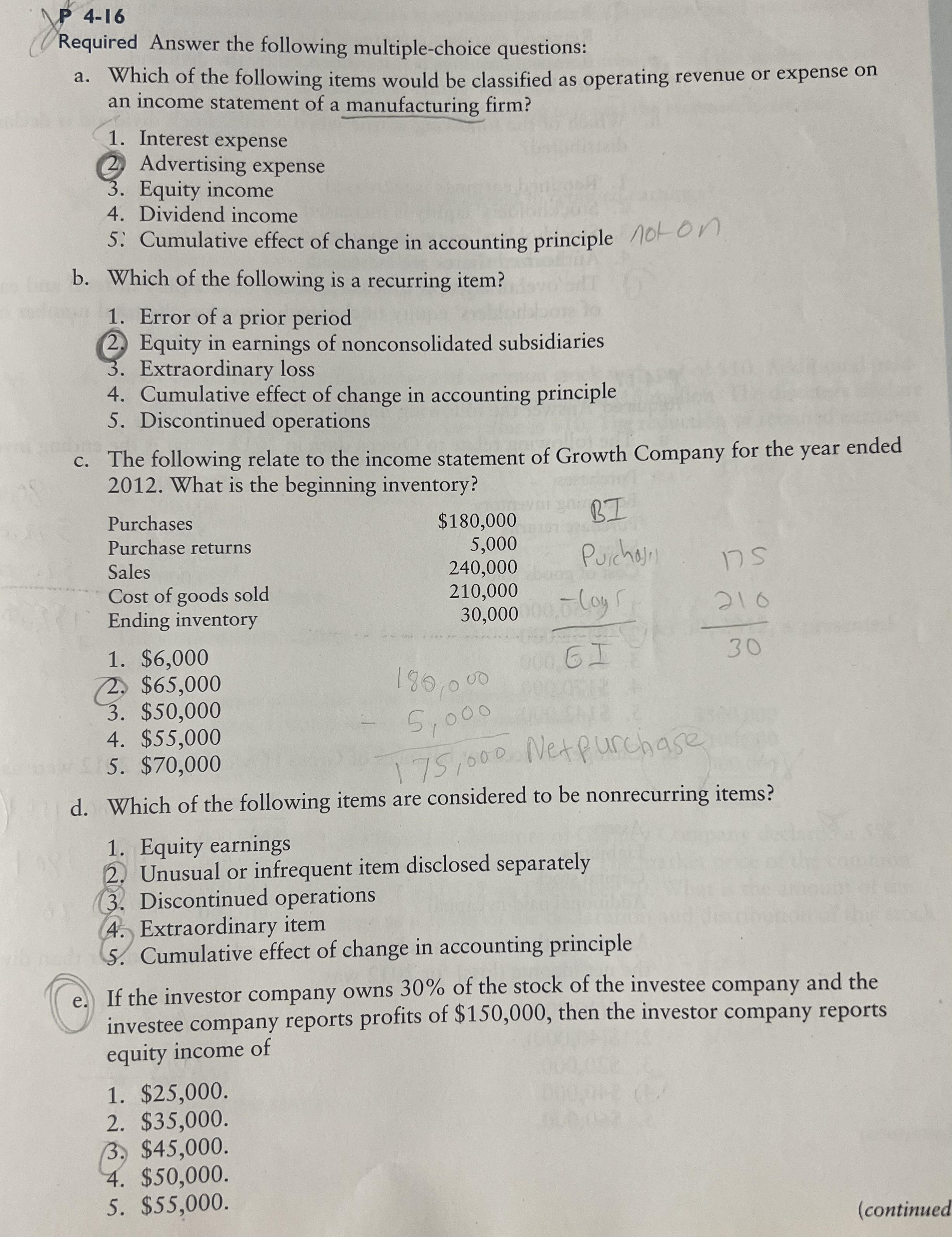

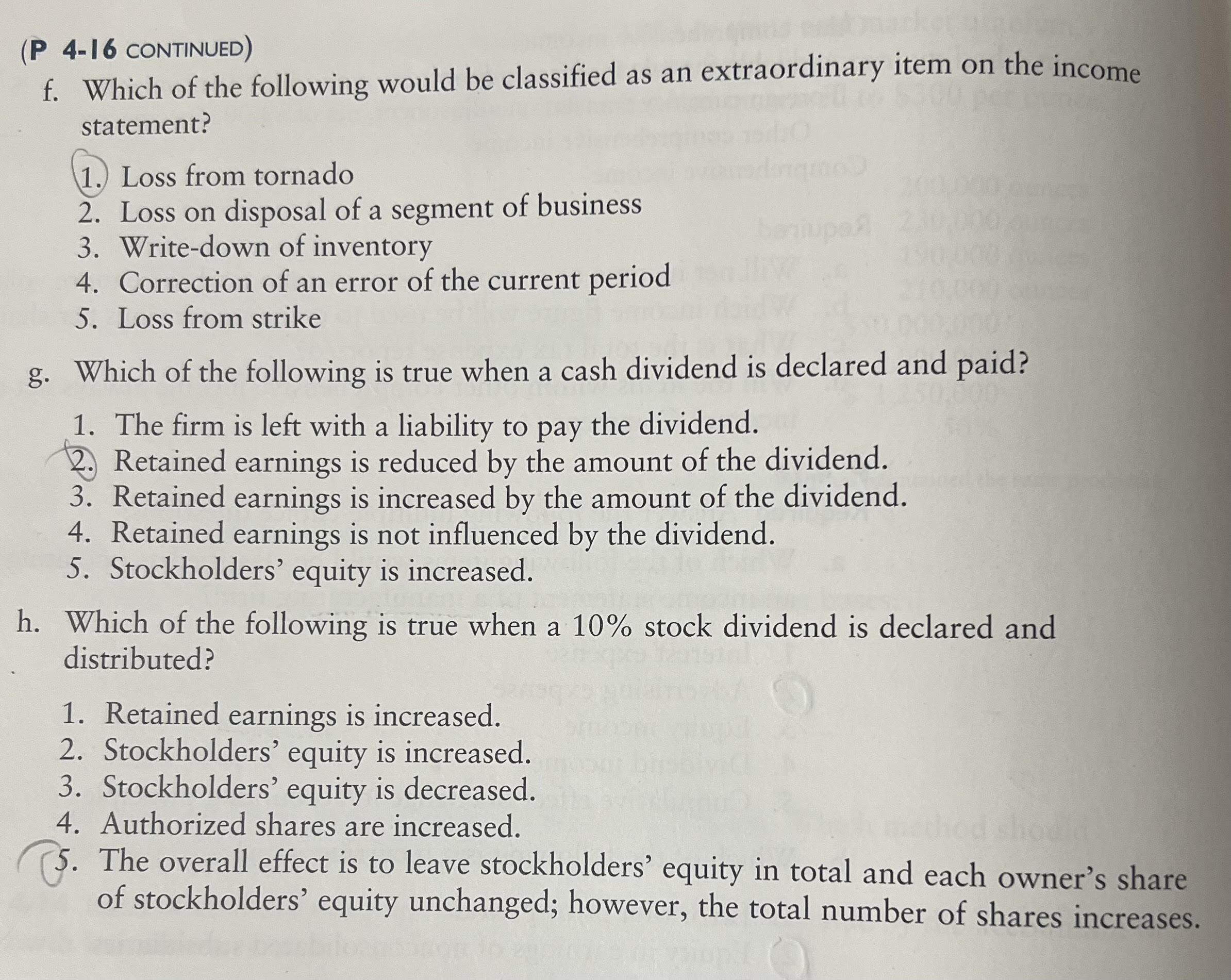

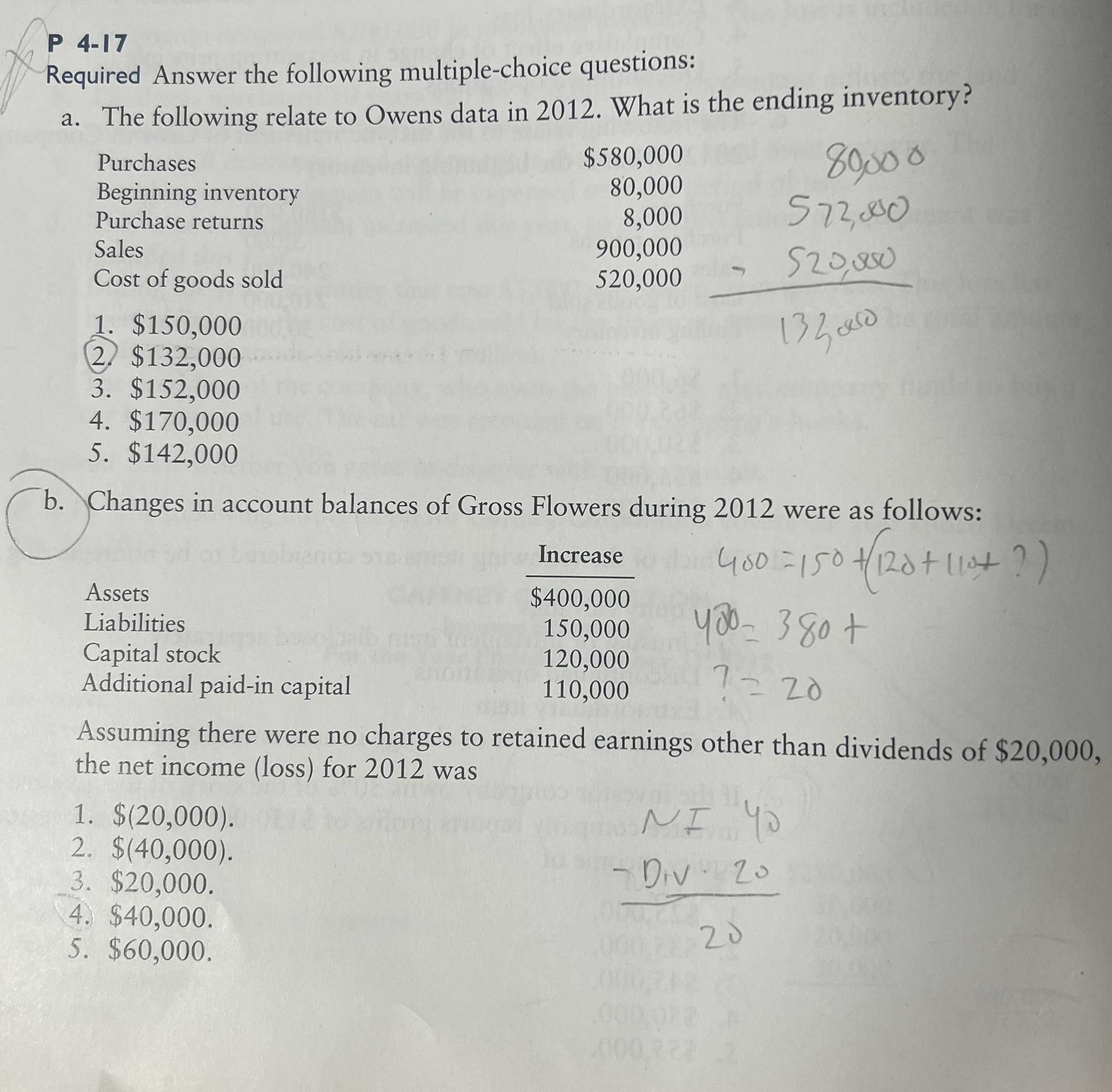

CHAPTER 4 . Income Statement 187 statement? c. Which of the following would be classified as an extraordinary item on the income 1. Loss on disposal of a segment of business. 2. Cumulative effect of a change in accounting principle. 3. A sale of fixed assets. 4. An error correction that relates to a prior year. (5. ) A loss from a flood in a location that would not be expected to flood. d. Net income-noncontrolling interest comes from which of the following situations? A company has been consolidated with our income statement, and our company owns less than 100% of the other company. 2. A company has been consolidated with our income statement, and our company owns 100% of the other company. 3. Our company owns less than 100% of another company, and the statements are not consolidated. 4. Our company owns 100% of another company, and the statements are not consolidated. 5. None of the above. . Which of the following will not be disclosed in retained earnings? 1. Declaration of a stock dividend 2. Adjustment for an error of the current period 3. Adjustment for an error of a prior period 29262 4. Net income 5. Net loss f. Bell Company has 2 million shares of common stock with par of $10. Additional paid- in capital totals $15 million, and retained earnings is $15 million. The directors declare a 5% stock dividend when the market value is $10. The reduction of retained earnings as a result of the declaration will be $0. 2 mill X50% = 100,500 new shory 2. $1 million. 3. $800,000. 4. $600,000. 10g WO X 10 - 1 50good 5. None of the above. g. The stockholders' equity of Gaffney Company at November 30, 2012, is presented below. Common stock, par value $5, authorized 200,000 shares, 100,000 shares issued and outstanding $500,000 Paid-in capital in excess of par 100,000 Retained earnings 300,000 $900,000 On December 1, 2012, the board of directors of Gaffney Company declared a 5% stock dividend, to be distributed on December 20. The market price of the common stock was $10 on December 1 and $12 on December 20. What is the amount of the change to retained earnings as a result of the declaration and distribution of this stock dividend? 109,050 x 5 = 5080 1. $0 2. $40,000 Sooo Xmarket value = 10 = 50, der B. $50,000 4. $60,000 5. None of the above. (continu(P 4-17 CONTINUED) h. Schroeder Company had 200,000 shares of common stock outstanding with a $2 par value and retained earnings of $90,000. In 2010, earnings per share were $0.50. In 2011, the company split the stock 2 for 1. Which of the following would result from the stock split? 1. Retained earnings will decrease as a result of the stock split. 2. A total of 400,000 shares of common stock will be outstanding. 3. The par value would become $4 par. 4. Retained earnings will increase as a result of the stock split. 5. None of the above. i. Which of the following is not a category within accumulated other comprehensive income? 1. Foreign currency translation adjustments. 2. Unrealized holding gains and losses on available-for-sale marketable securities. 3. Changes to stockholders' equity resulting from additional minimum pension liability. 4. Unrealized gains and losses from derivative instruments. 5. Extraordinary item.. P4-4: Only Requirement bo(pg. 180-181); Note: Prepare Multiple-step Income Statement & Include Earning Per Share for net income (You do not have to compute earning per share for earnings before extraordinary item because now extraordinary items are not shown .as a separate item before net income). P4-16 (pg 185-186):a, c, e, 9, & h only . P4-17 (Pg.186-187): a, e, f, h , & I onlyP 4-4 The following items are from Taperline Corporation on December 31, 2012. Assume a flat 40% corporate tax rate on all items, including the casualty loss. Sales $670,000 Rental income 3,600Gain on the sale of fixed assets General and administrative expenses $ 3,000 Selling expenses 110,000 Interest expense 97,000 Depreciation for the period 1,900 10,000 Extraordinary item (casualty loss-pretax) 30,000 Cost of sales 300,000 Common stock (30,000 shares outstanding) 150,000 Required a. Prepare a single-step income statement for the year ended December 31, 2012. Include earnings per share for earnings before extraordinary items and net income. b. Prepare a multiple-step income statement. Include earnings per share for earnings before extraordinary items and net income.P 4-16 Required Answer the following multiple-choice questions: a. Which of the following items would be classified as operating revenue or expense on an income statement of a manufacturing firm? 1. Interest expense Advertising expense 3 . Equity income 4. Dividend income 5: Cumulative effect of change in accounting principle not on) b. Which of the following is a recurring item? 1. Error of a prior period 2. Equity in earnings of nonconsolidated subsidiaries 3. Extraordinary loss 4. Cumulative effect of change in accounting principle 5. Discontinued operations c. The following relate to the income statement of Growth Company for the year ended 2012. What is the beginning inventory? Purchases $180,000 BI Purchase returns 5,000 Sales 240,000 Purchas il Cost of goods sold 210,000 Ending inventory 30,000 - logs 210 1. $6,000 30 2. $65,000 18010 00 3. $50,000 4. $55,000 5 , 00 0 5. $70,000 1751 000 Netpurchase d. Which of the following items are considered to be nonrecurring items? 1. Equity earnings 2. Unusual or infrequent item disclosed separately (3. Discontinued operations 4. Extraordinary item 5. Cumulative effect of change in accounting principle If the investor company owns 30% of the stock of the investee company and the investee company reports profits of $150,000, then the investor company reports equity income of 1. $25,000. 2. $35,000. 3. $45,000. 4. $50,000. 5. $55,000. (continued(P 4-16 CONTINUED) f. Which of the following would be classified as an extraordinary item on the income statement? 1. Loss from tornado 2. Loss on disposal of a segment of business beaupost 2 0 090 3. Write-down of inventory 4. Correction of an error of the current period 5. Loss from strike g. Which of the following is true when a cash dividend is declared and paid? 1. The firm is left with a liability to pay the dividend. 2. Retained earnings is reduced by the amount of the dividend. 3. Retained earnings is increased by the amount of the dividend. 4. Retained earnings is not influenced by the dividend. 5. Stockholders' equity is increased. h. Which of the following is true when a 10% stock dividend is declared and distributed? 1. Retained earnings is increased. 2. Stockholders' equity is increased. 3. Stockholders' equity is decreased. 4. Authorized shares are increased. (5. The overall effect is to leave stockholders' equity in total and each owner's share of stockholders' equity unchanged; however, the total number of shares increases.P 4-17 Required Answer the following multiple-choice questions: a. The following relate to Owens data in 2012. What is the ending inventory? Purchases $580,000 80308 Beginning inventory 80,000 Purchase returns 8,000 5 72,350 Sales 900,000 520,000 520, 800 Cost of goods sold . $150,000 2. $132,000 3. $152,000 4. $170,000 5. $142,000 b. Changes in account balances of Gross Flowers during 2012 were as follows: Increase 400 = 150 +/ 120 + ( lot ? ) Assets $400,000 Liabilities 150,000 400 - 380 + Capital stock 120,000 Additional paid-in capital 110,000 7 = 20 Assuming there were no charges to retained earnings other than dividends of $20,000, the net income (loss) for 2012 was 1. $(20,000). NI YO 2. $(40,000). 3. $20,000. - Div . 20 4. $40,000. 20 5. $60,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts