Question: chapter 4 microsoft excel spreadsheet: time value of money please answer this question parts a,b,c if you can do it on microsoft excel that will

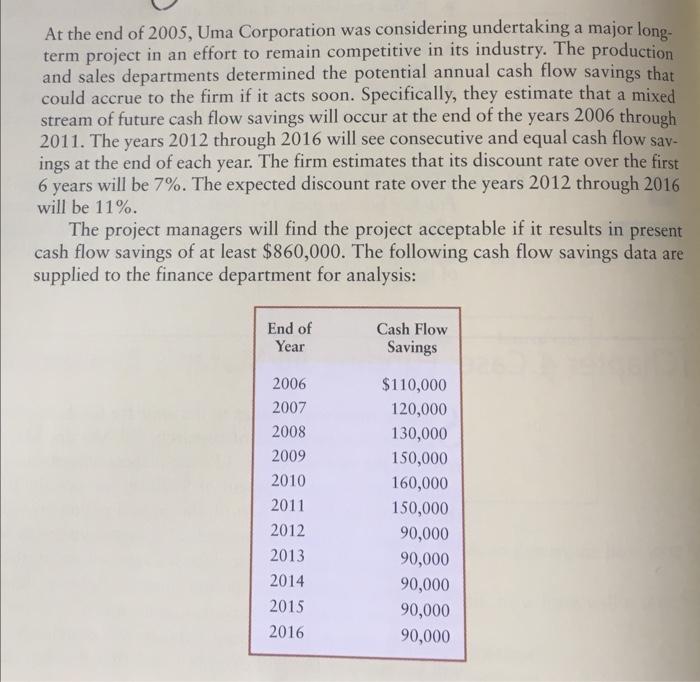

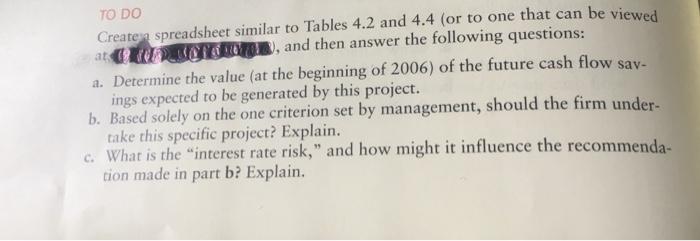

At the end of 2005 , Uma Corporation was considering undertaking a major longterm project in an effort to remain competitive in its industry. The production and sales departments determined the potential annual cash flow savings that could accrue to the firm if it acts soon. Specifically, they estimate that a mixed stream of future cash flow savings will occur at the end of the years 2006 through 2011. The years 2012 through 2016 will see consecutive and equal cash flow savings at the end of each year. The firm estimates that its discount rate over the first 6 years will be 7%. The expected discount rate over the years 2012 through 2016 will be 11%. The project managers will find the project acceptable if it results in present cash flow savings of at least $860,000. The following cash flow savings data are supplied to the finance department for analysis: Createn spreadsheet similar to Tables 4.2 and 4.4 (or to one that can be viewed TO DO a. Determine the value (at the beginning of 2006) of the future cash flow savings expected to be generated by this project. b. Based solely on the one criterion set by management, should the firm undertake this specific project? Explain. c. What is the "interest rate risk," and how might it influence the recommendation made in part b? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts