Question: chapter 4 problem 4-1 please make sure that it is legible cursive I wont understand X Chapter 04 b - Problem 4-1 Forms 1 xlsx

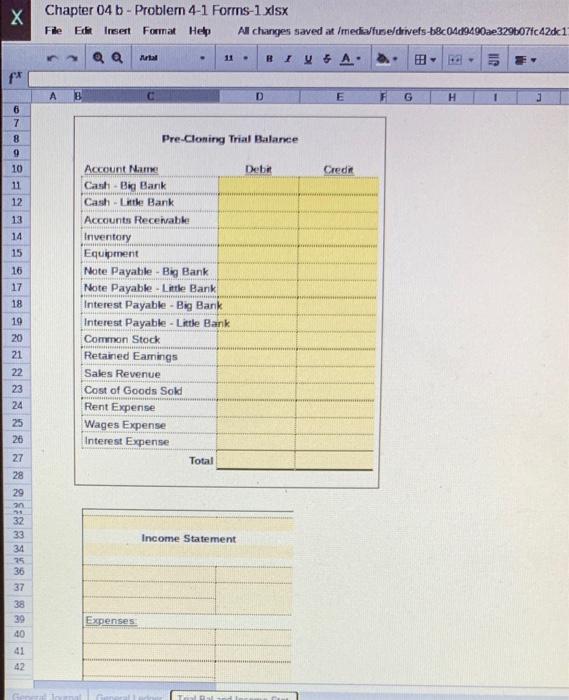

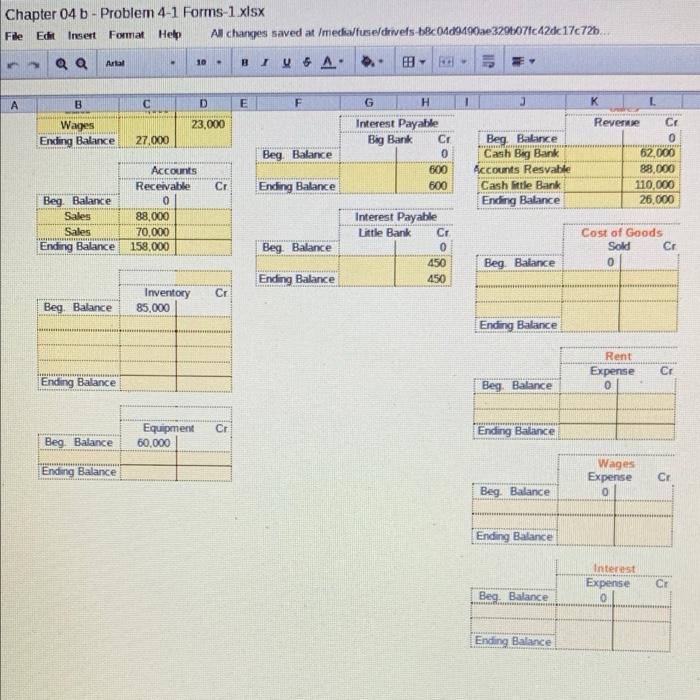

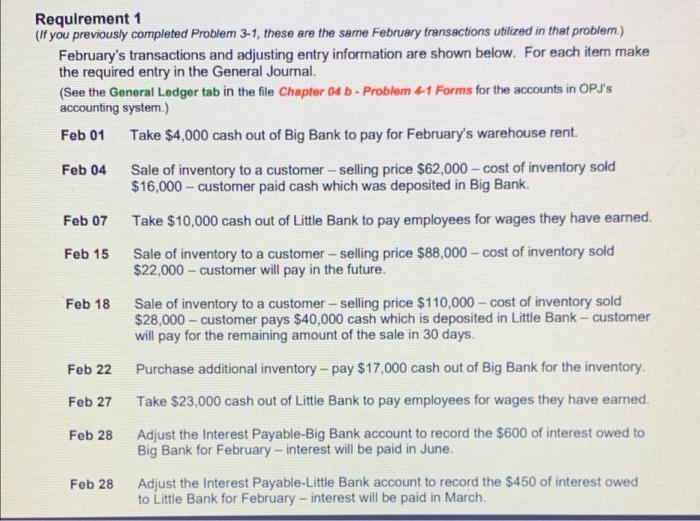

X Chapter 04 b - Problem 4-1 Forms 1 xlsx File Ei Insert Format Help All changes saved at /media/fuse/drivefs-b&c04d9490ae329b07fc42dc1 11 - BIVA. f* A D G H 6 7 8 9 10 Pre-Cloning Trial Balance Debat Cred 11 12 13 14 15 16 17 Account Name Cast - Big Bank Cash - Little Bank Accounts Receivable Inventory Equipment Note Payable - Big Bank Note Payable - Little Bank Interest Payable - Big Bank Interest Payable - Little Bank Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Rent Expense Wages Expense Interest Expense Total 20 21 22 23 24 25 26 27 28 SRENSNN & SENSES 29 33 34 income Statement 36 37 38 39 Expenses 42 Chapter 04 b - Problem 4-1 Forms-1.xlsx File Edit Insert Format Help Al changes saved at /media/fuse/drivels-bc04d9190ae3296071c42dc17c72b. QQ Artal 10 B 1 UGA. F A B C D E F 1 J K 23,000 Wages Ending Balance 27.000 G H Interest Payable Big Bank Cr 0 500 600 Beg. Balance Reverse CE 0 62.000 88,000 110,000 26.000 Beg Balance Cash Big Bank Accounts Resvable Cash little Bank Ending Balance Cr Ending Balance Accounts Receivable 0 88,000 70,000 159,000 Beg. Balance Sales Sales Ending Balance Interest Payable Little Bank Cr 0 Beg. Balance Cost of Goods Sold Cr 0 . 450 Beg Balance Ending Balance 450 Cr Inventory 85,000 Beg Balance Ending Balance Rent Expense 0 Cr Ending Balance Beg. Balance Cr Equipment 60.000 Ending Balance Beg Balance Ending Balance Wages Expense 0 Cr Beg. Balance Ending Balance Interest Expense 0 CY Beg. Balance Ending Balance Requirement 1 (If you previously completed Problem 3-1, these are the same February transactions utilized in that problem.) February's transactions and adjusting entry information are shown below. For each itern make the required entry in the General Journal. (See the General Ledger tab in the file Chapter 04 - Problem 4-1 Forms for the accounts in OPJ's accounting system.) Feb 01 Take $4,000 cash out of Big Bank to pay for February's warehouse rent. Feb 04 Sale of inventory to a customer-selling price $62,000 - cost of inventory sold $16,000 - customer paid cash which was deposited in Big Bank. Feb 07 Take $10,000 cash out of Little Bank to pay employees for wages they have earned. Feb 15 Sale of inventory to a customer - selling price $88,000 - cost of inventory sold $22,000 - customer will pay in the future. Feb 18 Sale of inventory to a customer-selling price $110,000 - cost of inventory sold $28,000 - customer pays $40,000 cash which is deposited in Little Bank - customer will pay for the remaining amount of the sale in 30 days. Feb 22 Purchase additional inventory - pay $17,000 cash out of Big Bank for the inventory. Feb 27 Take $23,000 cash out of Little Bank to pay employees for wages they have earned. Feb 28 Adjust the Interest Payable-Big Bank account to record the $600 of interest owed to Big Bank for February - interest will be paid in June. Feb 28 Adjust the Interest Payable-Little Bank account to record the $450 of interest owed to Little Bank for February - interest will be paid in March

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts