Question: Chapter 4, Question 17 The following information is available for Skysong Inc. for the year ended December 31, 2017: Loss on discontinued operations $70,000 Retained

Chapter 4, Question 17

The following information is available for Skysong Inc. for the year ended December 31, 2017:

| Loss on discontinued operations | $70,000 | Retained earnings January 1, 2017 | $1,500,000 | |||

|---|---|---|---|---|---|---|

| Rent revenue | 91,000 | Selling expenses | 878,000 | |||

| Income tax applicable to continuing operations | 292,000 | Income tax applicable to loss on discontinued operations | 32,000 | |||

| Administrative expenses | 504,000 | Cost of goods sold | 1,674,000 | |||

| Loss on write-down of inventory | 45,000 | Sales revenue | 3,725,000 | |||

| Gain on sale of equipment | 30,000 | Cash dividends declared | 218,000 | |||

| Unrealized gain on available-for-sale securities | 35,000 | Interest expense | 52,000 |

200,000 shares were outstanding during all of 2017.

Part a)

Part b)

Part c)

Please show work!! And help me correct my mistakes

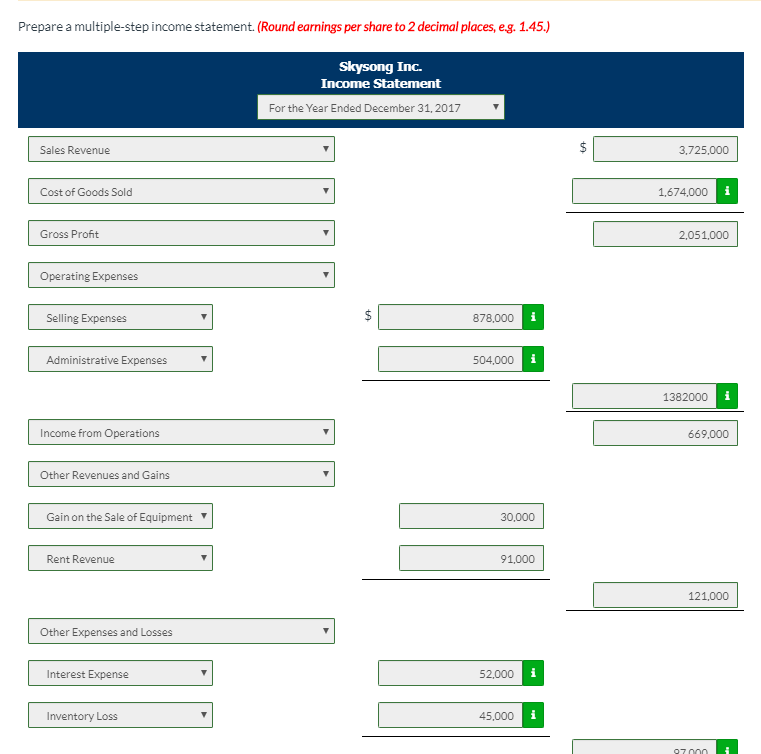

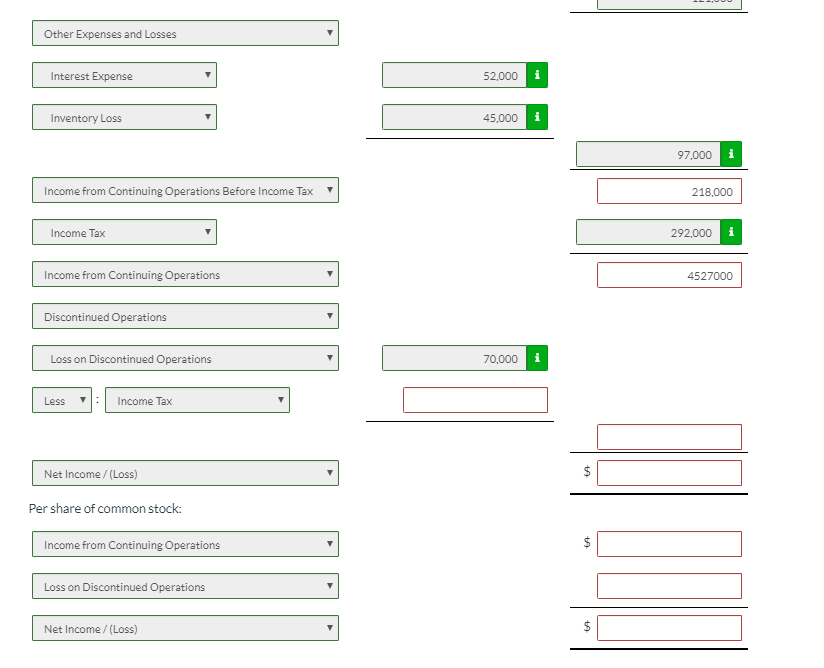

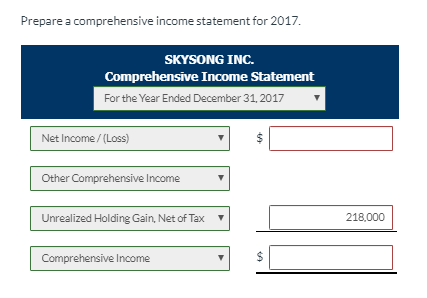

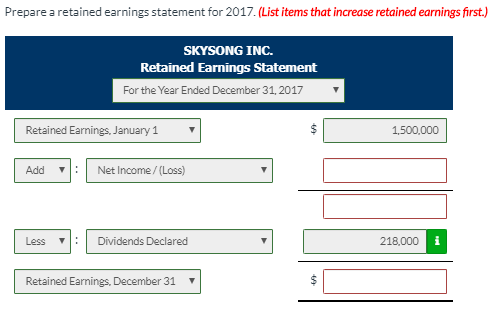

Prepare a multiple-step income statement. (Round earnings per share to 2 decimal places, eg. 1.45.) Skysong Inc. Income Statement For the Year Ended December 31, 2017 Sales Revenue $ 3,725,000 Cost of Goods Sold 1,674,000 i Gross Profit 2,051,000 Operating Expenses Selling Expenses UA 878,000 i Administrative Expenses 504.000 i 1382000 Income from Operations 669,000 Other Revenues and Gains Gain on the sale of Equipment 30.000 Rent Revenue 91,000 121,000 Other Expenses and Losses Interest Expense 52.000 i Inventory Loss 45.000 i 070 Other Expenses and Losses Interest Expense 52,000 i Inventory Loss 45,000 i 97.000 i Income from Continuing Operations Before Income Tax 218.000 Income Tax 292.000 i Income from Continuing Operations 4527000 Discontinued Operations Loss on Discontinued Operations 70,000 i Less Income Tax Net Income /(Loss) $ Per share of common stock: Income from Continuing Operations $ Loss on Discontinued Operations Net Income /(Loss) $ Prepare a comprehensive income statement for 2017 SKYSONG INC. Comprehensive Income Statement For the Year Ended December 31, 2017 Net Income / (Loss) $ Other Comprehensive Income Unrealized Holding Gain, Net of Tax 218,000 Comprehensive Income $ Prepare a retained earnings statement for 2017. (List items that increase retained earnings first.) SKYSONG INC. Retained Earnings Statement For the Year Ended December 31, 2017 Retained Earnings, January 1 1,500,000 Add Net Income / (Loss) Less Dividends Declared 218,000 Retained Earnings. December 31 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts