Question: Chapter 4 Question 5 Chapter 4 Question 5 BETTER PIC Backshell Corporasion has a singlo class of common stock outstanding Don owns 200 shares, which

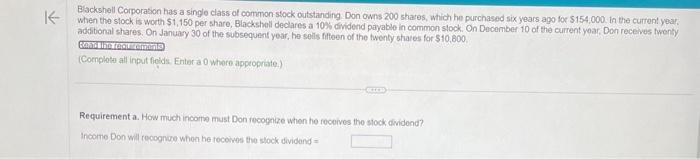

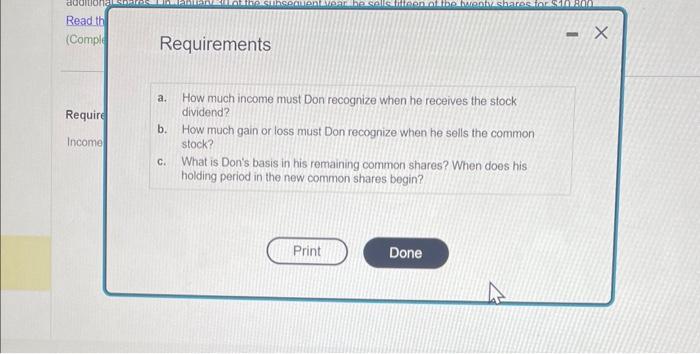

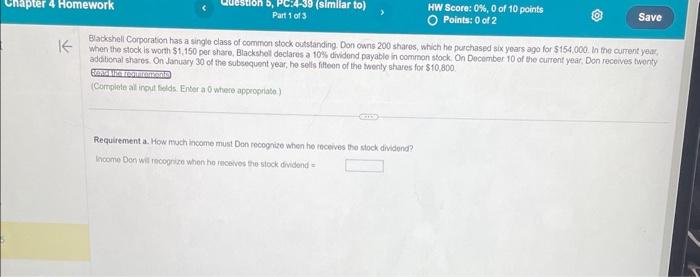

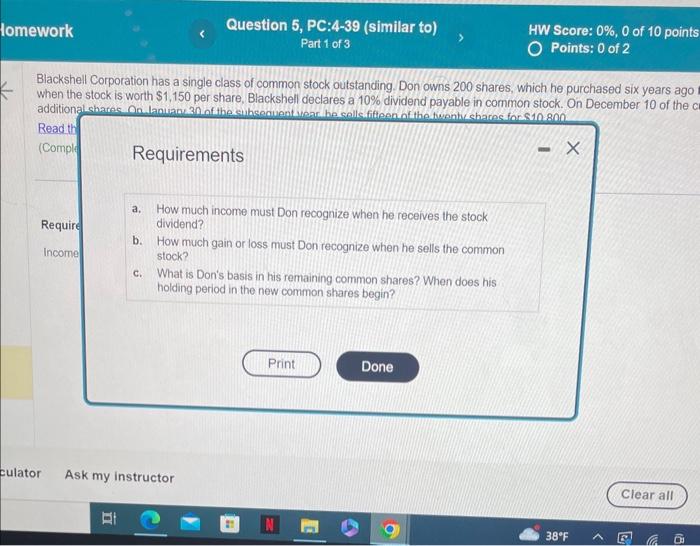

Backshell Corporasion has a singlo class of common stock outstanding Don owns 200 shares, which he purchased six years ago for $154,000. in the current year. When the slock is worth 51,150 per share, Blackshell declares a 10 es cividend payablo in common slock. On December 10 of the current yoar, Den receves fuenty additional shares. On January 30 of the subsequent year, he selis fifteen of the twenly shates for $10,600. (Cornplotis all input fiodis. Enter a 0 Whore appeopriate.) Requirement a. How much incorve must Don rocognize when he rocoives the slock dividend? Income Don wil reoognue when he rocoives the slock dividang = Requirements a. How much income must Don recognize when he receives the stock dividend? b. How much gain or loss must Don recognize when he sells the common stock? c. What is Don's basis in his remaining common shares? When does his holding period in the new common shares begin? Bladeshell Comporaticn has a single class of common stock oustanding. Don owns 200 shares, which he purchased six yoars ago for $154,000 in the current year, When the slock is worth $1,150 per share, Blackshot declares a 10N dividend payatlo in common thock. On Decomber 10 of the current year. Don recoives twenty additional shares. On January 30 of the subsequont year, he sels fittoen of the twently shares for $10,800. (Corpiche al irout wids. Enter a 0 where appropriato ) Requirement a. How much income must Don rocognize when ho roceves tho stock dividond? Goome Dorv wit recogriso when ho moeves the-slock dividond = Blackshell Corporation has a single class of common stock outstanding Don owns 200 shares, which he purchased six years ago when the stock is worth $1,150 per share, Blackshell declares a 10% dividend payable in common stock. On December 10 of the Requirements a. How much income must Don recognize when he receives the stock dividend? b. How much gain or loss must Don recognize when he sells the common slock? c. What is Dor's basis in his remaining common shares? When does his holding period in the new common shares begin? Backshell Corporasion has a singlo class of common stock outstanding Don owns 200 shares, which he purchased six years ago for $154,000. in the current year. When the slock is worth 51,150 per share, Blackshell declares a 10 es cividend payablo in common slock. On December 10 of the current yoar, Den receves fuenty additional shares. On January 30 of the subsequent year, he selis fifteen of the twenly shates for $10,600. (Cornplotis all input fiodis. Enter a 0 Whore appeopriate.) Requirement a. How much incorve must Don rocognize when he rocoives the slock dividend? Income Don wil reoognue when he rocoives the slock dividang = Requirements a. How much income must Don recognize when he receives the stock dividend? b. How much gain or loss must Don recognize when he sells the common stock? c. What is Don's basis in his remaining common shares? When does his holding period in the new common shares begin? Bladeshell Comporaticn has a single class of common stock oustanding. Don owns 200 shares, which he purchased six yoars ago for $154,000 in the current year, When the slock is worth $1,150 per share, Blackshot declares a 10N dividend payatlo in common thock. On Decomber 10 of the current year. Don recoives twenty additional shares. On January 30 of the subsequont year, he sels fittoen of the twently shares for $10,800. (Corpiche al irout wids. Enter a 0 where appropriato ) Requirement a. How much income must Don rocognize when ho roceves tho stock dividond? Goome Dorv wit recogriso when ho moeves the-slock dividond = Blackshell Corporation has a single class of common stock outstanding Don owns 200 shares, which he purchased six years ago when the stock is worth $1,150 per share, Blackshell declares a 10% dividend payable in common stock. On December 10 of the Requirements a. How much income must Don recognize when he receives the stock dividend? b. How much gain or loss must Don recognize when he sells the common slock? c. What is Dor's basis in his remaining common shares? When does his holding period in the new common shares begin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts