Question: Chapter 4 short answer question Explain at least one attribute or characteristic about each of the following security types: 1. Money-market instruments. 2. Fixed-income securities

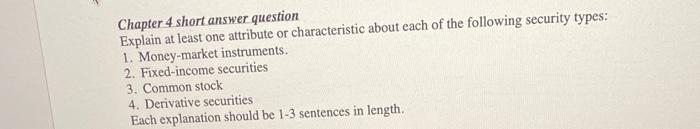

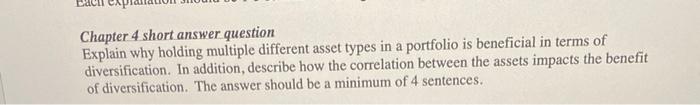

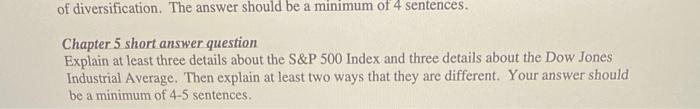

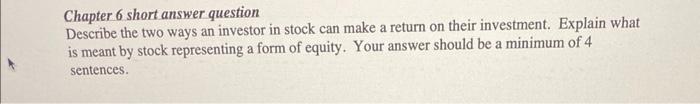

Chapter 4 short answer question Explain at least one attribute or characteristic about each of the following security types: 1. Money-market instruments. 2. Fixed-income securities 3. Common stock 4. Derivative securities Each explanation should be 1-3 sentences in length. Chapter 4 short answer question Explain why holding multiple different asset types in a portfolio is beneficial in terms of diversification. In addition, describe how the correlation between the assets impacts the benefit of diversification. The answer should be a minimum of 4 sentences. Chapter 5 short answer question Explain at least three details about the S\&P 500 Index and three details about the Dow Jones Industrial Average. Then explain at least two ways that they are different. Your answer should be a minimum of 45 sentences. Chapter 6 short answer question Describe the two ways an investor in stock can make a return on their investment. Explain what is meant by stock representing a form of equity. Your answer should be a minimum of 4 sentences. Module takeaway short answer question Describe two key takeaways from this module that you hope to remember in the future. Why did you select each point takeaway? Your answer should be a minimum of 4 sentences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts