Question: Chapter 4 The Accounting Cycle: Journals and Ledgers Case Study CS-1 LO 1 2 3 4 5 6 7 Renu Mawani has been operating her

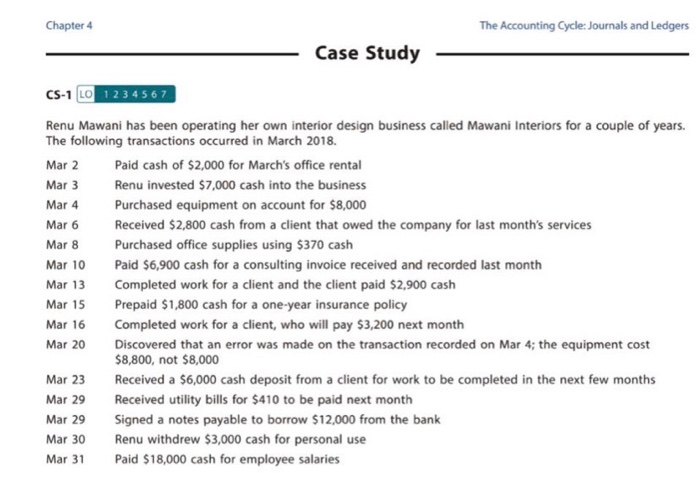

Chapter 4 The Accounting Cycle: Journals and Ledgers Case Study CS-1 LO 1 2 3 4 5 6 7 Renu Mawani has been operating her own interior design business called Mawani Interiors for a couple of years. The following transactions occurred in March 2018. Mar 2 Paid cash of $2,000 for March's office rental Mar 3 Renu invested $7,000 cash into the business Mar 4 Purchased equipment on account for $8,000 Mar 6 Received $2,800 cash from a client that owed the company for last month's services Mar 8 Purchased office supplies using $370 cash Mar 10 Paid $6,900 cash for a consulting invoice received and recorded last month Mar 13 Completed work for a client and the client paid $2,900 cash Mar 15 Prepaid $1,800 cash for a one-year insurance policy Mar 16 Completed work for a client, who will pay $3,200 next month Mar 20 Discovered that an error was made on the transaction recorded on Mar 4; the equipment cost $8,800, not $8,000 Mar 23 Received a $6,000 cash deposit from a client for work to be completed in the next few months Mar 29 Received utility bills for $410 to be paid next month Mar 29 Signed a notes payable to borrow $12,000 from the bank Mar 30 Renu withdrew $3,000 cash for personal use Mar 31 Paid $18,000 cash for employee salaries 8:16 4 AA ameengage.com Date 1 D 8 Description A Deserto E a 8 B O 8:16 4 AA ameengage.com Date Dane De D a A Date E 8 A Date Description 3 Dale TH A De Destion LLL 165 O 8:16 4 AA ameengage.com Description I De 11 3 B A Date Deser a 8 a A Da 8 c a GR Date 8 a energeting entering A De D Date 2 8 6 Description 1 B O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts