Question: Chapter 4 Willowbrook School is a small private school that has retained your services as a systems analyst to assist in the development of a

Chapter 4

Willowbrook School is a small private school that has retained your services as a systems analyst to assist in the development of a new information system for the school's administrative needs.

Background

Willowbrook School has decided to proceed to the systems analysis phase, based on the findings and proposal you presented after the preliminary investigation. A summary of your fact-finding is as follows:

Fact-Finding Summary

Registration for Willowbrook School has two components, regular daily students and children in after-care. Regular daily students are divided into groups, dependent on whether the child is in pre-school, kindergarten, or primary school. Children in after-care are divided into two groups, those students who are pre-registered and those who use the service on a "drop-in" basis. Most of the students who are pre-registered for after-care attend the school during the day but some are bussed in from other schools. For a student to be registered, tuition payments must be in good standing.

There are two payment options for tuition and the pre-registered component of after-care, monthly or weekly. Regular daily tuition is based on the academic program in which the student is enrolled. A discount of 5 percent is applied to fees for parents choosing the monthly payment option. Parents who have more than one child enrolled at Willowbrook are eligible for an additional 5 percent multi-child discount on tuition for all enrolled children. Discounts are lost for any payment that is overdue by more than seven days.

Charges for after-care used on a "drop-in" basis are based on an hourly rate, billed in fifteen minute increments. Parents are billed monthly for regular students, and charges are added to the monthly and weekly bills. New bills are generated weekly for "drop-in" care for children who are not pre-registered for after-care or regular daily students. For parents who pay monthly, tuition bills and after-care fees are due on the first of the month, and are distributed to parents one week prior to their being due. For parents who pay weekly, payments are due on Mondays with bills generated on Fridays. Parents who have more than one child enrolled in Willowbrook receive a separate bill for each child. The student's account must be in good standing for a student to be registered. For the account to be considered to be in good standing, the tuition payment must not be over seven days late. Tuition payments that are over seven days late may be overridden by the director; these cases are handled on a case-by-case basis.

The current registration system is done using Microsoft Excel. Michelle Madrid, the administrative assistant, sets up a new workbook for each academic year. Each month Michelle creates a new worksheet in the workbook. The worksheet contains one line per student, and each line contains the following registration and billing information for the student:

Student Name

Parent Name

Address

Academic program (pre-school, kindergarten, primary school grade 1-6)

After-Care (Yes/No)

Weekly tuition fee

Billing cycle (Monthly or Weekly)

Tuition discount

Multi-child discount

Amount of discount (calculated field)

Additional care, after-care "drop-in" fees

Total monthly fee (calculated field)

Payment received

Amount paid to date (calculated field)

Amount outstanding (calculated field)

The entry for each student is updated monthly when bills are prepared, each time a payment is made, and when Michelle enters the data from the after-care reports detailing all "drop-in" hours for each student. Michelle manually calculates the time and the spreadsheet calculates the charges. Monthly statements are generated from the spreadsheets using the mail merge tool in Microsoft Word.

A summary monthly report is generated for the Board of Directors from this spreadsheet summarizing fee collections for tuition and after care. The financial committee, who provides regular oversight for the Board, also receives separate monthly reports detailing payroll expenses for all employees. Reports need to be ready for distribution at the financial committee meeting that is scheduled for the second Tuesday of every month.

Michelle has indicated that the most useful new feature that could be added to the system would be the ability to generate one bill per family, listing each student's charges separately, and an overall total. Also useful would be the ability to generate a receipt at the time payments are recorded. This receipt should contain information required for reimbursement requests from different types of dependent care and tuition accounts, including name, location, and federal tax ID number of the school. In addition, parents have asked for a separate statement accompanying their bill itemizing all drop-in after-care hours for that statement.

Tasks

List the system requirements with examples for each category. Review the information that you gathered, and assume that you will add your own ideas to achieve more effective outputs, inputs, processes, performance, and controls.

Are there scalability issues that you should consider? If so, what are they?

If you want to conduct a survey of parents of current, former, and prospective students to obtain their input, what type of sampling should you use? Why?

Draw an FDD that shows the main operations described in the fact-finding summary.

Section D

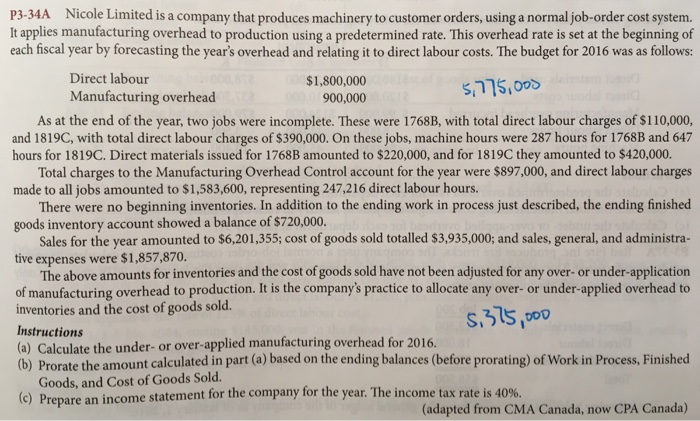

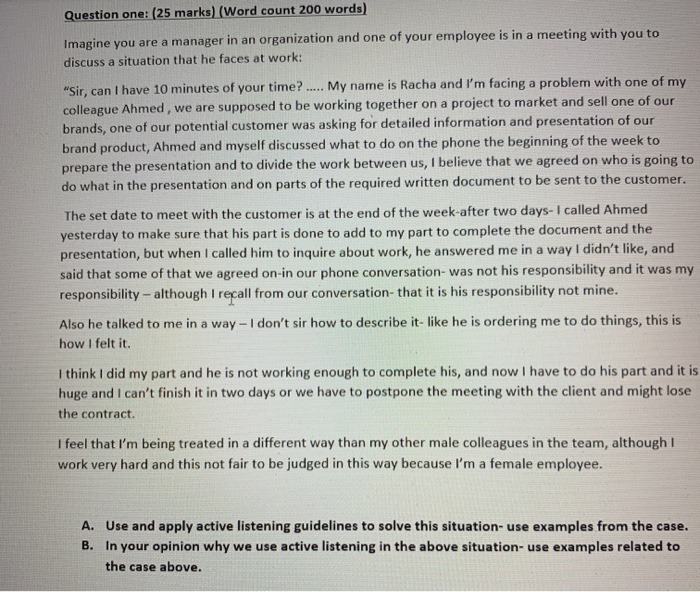

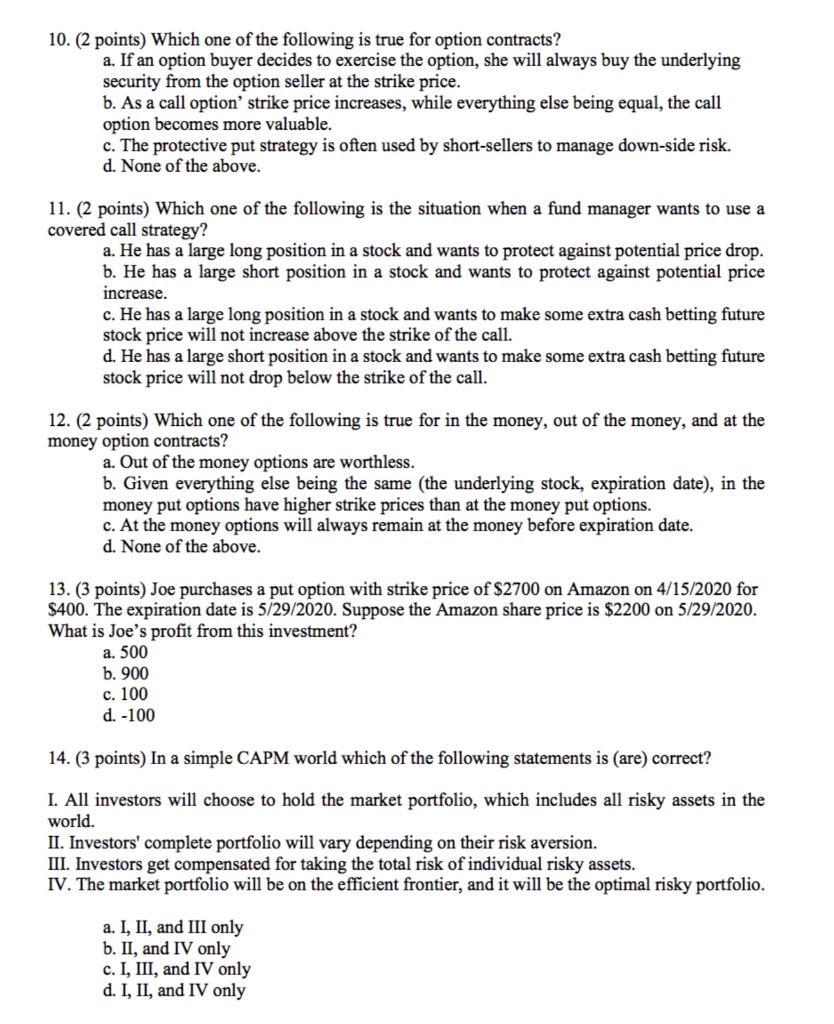

P3-34A Nicole Limited is a company that produces machinery to customer orders, using a normal job-order cost system. It applies manufacturing overhead to production using a predetermined rate. This overhead rate is set at the beginning of each fiscal year by forecasting the year's overhead and relating it to direct labour costs. The budget for 2016 was as follows: Direct labour $1,800,000 Manufacturing overhead 5, 775,00 900,000 As at the end of the year, two jobs were incomplete. These were 1768B, with total direct labour charges of $1 10,000, and 1819C, with total direct labour charges of $390,000. On these jobs, machine hours were 287 hours for 1768B and 647 hours for 1819C. Direct materials issued for 1768B amounted to $220,000, and for 1819C they amounted to $420,000. Total charges to the Manufacturing Overhead Control account for the year were $897,000, and direct labour charges made to all jobs amounted to $1,583,600, representing 247,216 direct labour hours. There were no beginning inventories. In addition to the ending work in process just described, the ending finished goods inventory account showed a balance of $720,000. Sales for the year amounted to $6,201,355; cost of goods sold totalled $3,935,000; and sales, general, and administra- tive expenses were $1,857,870. The above amounts for inventories and the cost of goods sold have not been adjusted for any over- or under-application of manufacturing overhead to production. It is the company's practice to allocate any over- or under-applied overhead to inventories and the cost of goods sold. 5, 375,DOD Instructions (a) Calculate the under- or over-applied manufacturing overhead for 2016. (b) Prorate the amount calculated in part (a) based on the ending balances (before prorating) of Work in Process, Finished Goods, and Cost of Goods Sold. (c) Prepare an income statement for the company for the year. The income tax rate is 40%. (adapted from CMA Canada, now CPA Canada)Question one: (25 marks) (Word count 200 words) Imagine you are a manager in an organization and one of your employee is in a meeting with you to discuss a situation that he faces at work: "Sir, can I have 10 minutes of your time? .... My name is Racha and I'm facing a problem with one of my colleague Ahmed , we are supposed to be working together on a project to market and sell one of our brands, one of our potential customer was asking for detailed information and presentation of our brand product, Ahmed and myself discussed what to do on the phone the beginning of the week to prepare the presentation and to divide the work between us, I believe that we agreed on who is going to do what in the presentation and on parts of the required written document to be sent to the customer. The set date to meet with the customer is at the end of the week-after two days- I called Ahmed yesterday to make sure that his part is done to add to my part to complete the document and the presentation, but when I called him to inquire about work, he answered me in a way I didn't like, and said that some of that we agreed on-in our phone conversation- was not his responsibility and it was my responsibility - although I recall from our conversation- that it is his responsibility not mine. Also he talked to me in a way - I don't sir how to describe it- like he is ordering me to do things, this is how I felt it. I think I did my part and he is not working enough to complete his, and now I have to do his part and it is huge and I can't finish it in two days or we have to postpone the meeting with the client and might lose the contract. I feel that I'm being treated in a different way than my other male colleagues in the team, although I work very hard and this not fair to be judged in this way because I'm a female employee. A. Use and apply active listening guidelines to solve this situation- use examples from the case. B. In your opinion why we use active listening in the above situation- use examples related to the case above.10. (2 points) Which one of the following is true for option contracts? a. If an option buyer decides to exercise the option, she will always buy the underlying security from the option seller at the strike price. b. As a call option' strike price increases, while everything else being equal, the call option becomes more valuable. c. The protective put strategy is often used by short-sellers to manage down-side risk. d. None of the above. 11. (2 points) Which one of the following is the situation when a fund manager wants to use a covered call strategy? a. He has a large long position in a stock and wants to protect against potential price drop. b. He has a large short position in a stock and wants to protect against potential price increase. c. He has a large long position in a stock and wants to make some extra cash betting future stock price will not increase above the strike of the call. d. He has a large short position in a stock and wants to make some extra cash betting future stock price will not drop below the strike of the call. 12. (2 points) Which one of the following is true for in the money, out of the money, and at the money option contracts? a. Out of the money options are worthless. b. Given everything else being the same (the underlying stock, expiration date), in the money put options have higher strike prices than at the money put options. c. At the money options will always remain at the money before expiration date. d. None of the above. 13. (3 points) Joe purchases a put option with strike price of $2700 on Amazon on 4/15/2020 for $400. The expiration date is 5/29/2020. Suppose the Amazon share price is $2200 on 5/29/2020. What is Joe's profit from this investment? a. 500 b. 900 c. 100 d. -100 14. (3 points) In a simple CAPM world which of the following statements is (are) correct? I. All investors will choose to hold the market portfolio, which includes all risky assets in the world. II. Investors' complete portfolio will vary depending on their risk aversion. III. Investors get compensated for taking the total risk of individual risky assets. IV. The market portfolio will be on the efficient frontier, and it will be the optimal risky portfolio. a. I, II, and III only b. II, and IV only c. I, III, and IV only d. I, II, and IV only