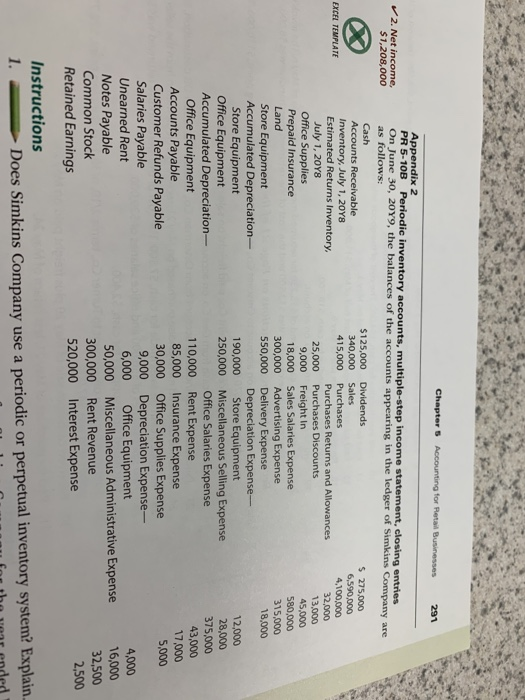

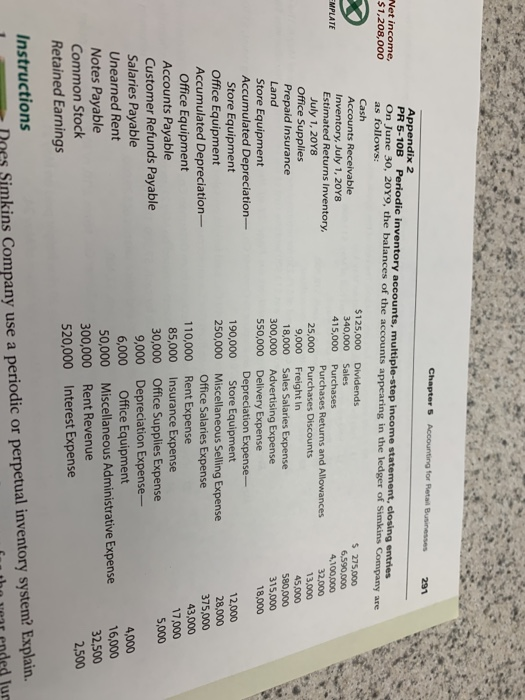

Question: Chapter 5 Accounting for Retail Businesses 291 Appendix 2 PR 5-10B Periodic inventory accounts, multiple-step income statement, closing entries 2. Net income, On June 30,

Chapter 5 Accounting for Retail Businesses 291 Appendix 2 PR 5-10B Periodic inventory accounts, multiple-step income statement, closing entries 2. Net income, On June 30, 2049, the balances of the accounts appearing in the ledger of Simkins Company are $1,208,000 as follows: Cash $125,000 Dividends $ 275.000 Accounts Receivable 340,000 Sales 6,590,000 EXCEL TEMPLATE Inventory, July 1, 2048 415,000 Purchases 4,100,000 Estimated Returns Inventory Purchases Returns and Allowances 32,000 July 1, 20Y8 25,000 Purchases Discounts 13,000 Office Supplies 9,000 Freight in 45,000 Prepaid Insurance 18,000 Sales Salaries Expense 580,000 Land 300,000 Advertising Expense 315,000 Store Equipment 550,000 Delivery Expense 18,000 Accumulated Depreciation- Depreciation Expense- Store Equipment 190,000 Store Equipment 12,000 Office Equipment 250,000 Miscellaneous Selling Expense 28,000 Accumulated Depreciation- Office Salaries Expense 375,000 Office Equipment 110,000 Rent Expense 43,000 Accounts Payable 85,000 Insurance Expense 17,000 Customer Refunds Payable 30,000 Office Supplies Expense 5,000 Salaries Payable 9,000 Depreciation Expense- Unearned Rent 6,000 Office Equipment 4,000 Notes Payable 50,000 Miscellaneous Administrative Expense 16,000 Common Stock 32,500 300,000 Rent Revenue 2,500 Retained Earnings 520,000 Interest Expense Instructions 1. Does Simkins Company use a periodic or perpetual inventory system? Explain Chapter 5 Accounting for Retail Businesses 291 Appendix 2 PR 5-10B Periodic inventory accounts, multiple-step income statement, closing entries Wet income, On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are $1,208,000 as follows: Cash $125,000 Dividends Accounts Receivable $ 275.000 340,000 Sales 6,590,000 Inventory, July 1, 2048 EMPLATE 415,000 Purchases 4,100,000 Estimated Returns Inventory Purchases Returns and Allowances 32.000 July 1, 2018 25,000 Purchases Discounts 13,000 Office Supplies 9,000 Freight in 45,000 Prepaid Insurance 18,000 Sales Salaries Expense 580,000 Land 300,000 Advertising Expense 315,000 Store Equipment 550,000 Delivery Expense 18,000 Accumulated Depreciation- Depreciation Expense- Store Equipment 190,000 Store Equipment 12.000 Office Equipment 250,000 Miscellaneous Selling Expense 28,000 375,000 Office Salaries Expense Accumulated Depreciation- 110,000 Office Equipment 43,000 Rent Expense 85,000 Accounts Payable 17,000 Insurance Expense 5,000 Customer Refunds Payable 30,000 Office Supplies Expense Salaries Payable 9,000 Depreciation Expense- 6,000 Unearned Rent Office Equipment 16,000 Notes Payable 50,000 Miscellaneous Administrative Expense 32,500 Common Stock 300,000 Rent Revenue 2,500 Retained Earnings 520,000 Interest Expense 4,000 Instructions Simkins Company use a periodic or perpetual inventory system? Explain. Jur Chapter 5 Accounting for Retail Businesses 291 Appendix 2 PR 5-10B Periodic inventory accounts, multiple-step income statement, closing entries 2. Net income, On June 30, 2049, the balances of the accounts appearing in the ledger of Simkins Company are $1,208,000 as follows: Cash $125,000 Dividends $ 275.000 Accounts Receivable 340,000 Sales 6,590,000 EXCEL TEMPLATE Inventory, July 1, 2048 415,000 Purchases 4,100,000 Estimated Returns Inventory Purchases Returns and Allowances 32,000 July 1, 20Y8 25,000 Purchases Discounts 13,000 Office Supplies 9,000 Freight in 45,000 Prepaid Insurance 18,000 Sales Salaries Expense 580,000 Land 300,000 Advertising Expense 315,000 Store Equipment 550,000 Delivery Expense 18,000 Accumulated Depreciation- Depreciation Expense- Store Equipment 190,000 Store Equipment 12,000 Office Equipment 250,000 Miscellaneous Selling Expense 28,000 Accumulated Depreciation- Office Salaries Expense 375,000 Office Equipment 110,000 Rent Expense 43,000 Accounts Payable 85,000 Insurance Expense 17,000 Customer Refunds Payable 30,000 Office Supplies Expense 5,000 Salaries Payable 9,000 Depreciation Expense- Unearned Rent 6,000 Office Equipment 4,000 Notes Payable 50,000 Miscellaneous Administrative Expense 16,000 Common Stock 32,500 300,000 Rent Revenue 2,500 Retained Earnings 520,000 Interest Expense Instructions 1. Does Simkins Company use a periodic or perpetual inventory system? Explain Chapter 5 Accounting for Retail Businesses 291 Appendix 2 PR 5-10B Periodic inventory accounts, multiple-step income statement, closing entries Wet income, On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are $1,208,000 as follows: Cash $125,000 Dividends Accounts Receivable $ 275.000 340,000 Sales 6,590,000 Inventory, July 1, 2048 EMPLATE 415,000 Purchases 4,100,000 Estimated Returns Inventory Purchases Returns and Allowances 32.000 July 1, 2018 25,000 Purchases Discounts 13,000 Office Supplies 9,000 Freight in 45,000 Prepaid Insurance 18,000 Sales Salaries Expense 580,000 Land 300,000 Advertising Expense 315,000 Store Equipment 550,000 Delivery Expense 18,000 Accumulated Depreciation- Depreciation Expense- Store Equipment 190,000 Store Equipment 12.000 Office Equipment 250,000 Miscellaneous Selling Expense 28,000 375,000 Office Salaries Expense Accumulated Depreciation- 110,000 Office Equipment 43,000 Rent Expense 85,000 Accounts Payable 17,000 Insurance Expense 5,000 Customer Refunds Payable 30,000 Office Supplies Expense Salaries Payable 9,000 Depreciation Expense- 6,000 Unearned Rent Office Equipment 16,000 Notes Payable 50,000 Miscellaneous Administrative Expense 32,500 Common Stock 300,000 Rent Revenue 2,500 Retained Earnings 520,000 Interest Expense 4,000 Instructions Simkins Company use a periodic or perpetual inventory system? Explain. Jur

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts