Question: Chapter 5 Assignment - Disbursement Red Flags Forensic Accounting Forensic Accounting and Fraud Examination textbook BRIEF CASES 1. Assume that your data analytics examination related

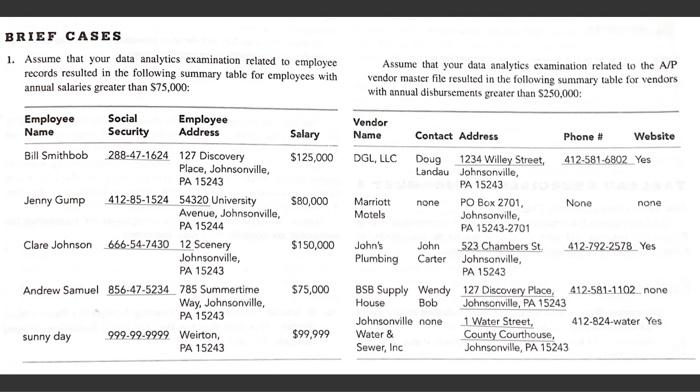

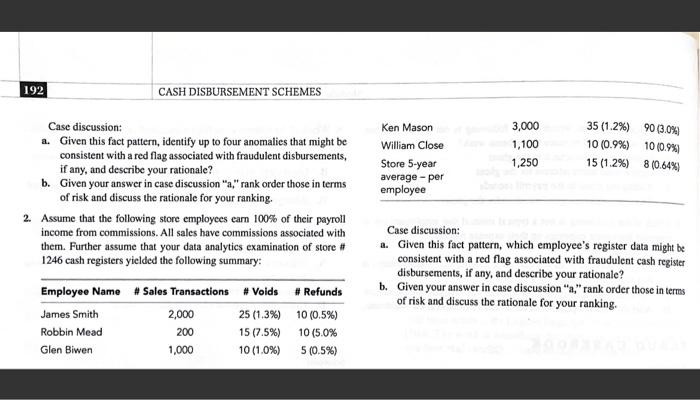

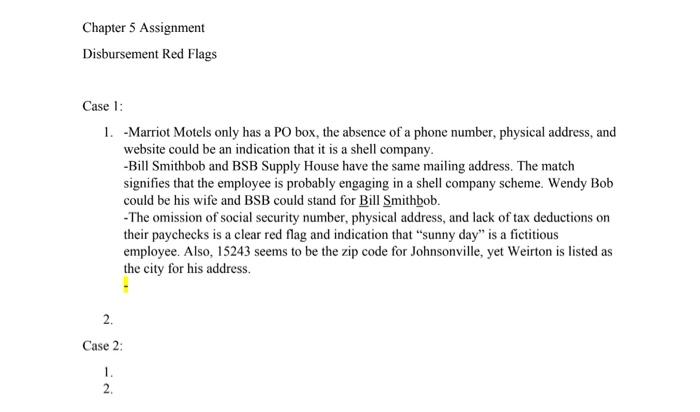

BRIEF CASES 1. Assume that your data analytics examination related to employee records resulted in the following summary table for employees with annual salaries greater than $75,000: Assume that your data analytics examination related to the A/P vendor master file resulted in the following summary table for vendors with annual disbursements greater than $250,000: Salary $125,000 $80,000 none Employee Social Employee Name Security Address Bill Smithbob 288.47-1624 127 Discovery Place, Johnsonville, PA 15243 Jenny Gump 412-85-1524 54320 University Avenue, Johnsonville, PA 15244 Clare Johnson 666-54-7430 12 Scenery Johnsonville, PA 15243 Andrew Samuel 856-47-5234_785 Summertime Way, Johnsonville, PA 15243 sunny day 999-99-9999 Weirton, PA 15243 Vendor Name Contact Address Phone # Website DGL, LLC Doug 1234 Willey Street 412-581-6802 Yes Landau Johnsonville, PA 15243 Marriott PO Box 2701, None none Motels Johnsonville, PA 15243-2701 John's John 523 Chambers St 412-792-2578 Yes Plumbing Johnsonville, PA 15243 BSB Supply Wendy 127 Discovery Place, 412-581-1102_none House Bob Johnsonville, PA 15243 Johnsonville none 1 Water Street, 412-824-water Yes Water & County Courthouse, Sewer, Inc Johnsonville, PA 15243 $150,000 Carter $75,000 $99,999 192 CASH DISBURSEMENT SCHEMES 90 (3.0% Ken Mason William Close Store 5-year average- per employee 3,000 1,100 1,250 35 (1.2%) 10 (0.9%) 10(0.9% 15 (1.2%) Case discussion: a. Given this fact pattern, identify up to four anomalies that might be consistent with a red flag associated with fraudulent disbursements, if any, and describe your rationale? b. Given your answer in case discussion "," rank order those in terms of risk and discuss the rationale for your ranking. 2. Assume that the following store employees earn 100% of their payroll income from commissions. All sales have commissions associated with them. Further assume that your data analytics examination of store # 1246 cash registers yielded the following summary: 8 (0.64% Case discussion: 1. Given this fact pattern, which employee's register data might be consistent with a red flag associated with fraudulent cash register disbursements, if any, and describe your rationale? b. Given your answer in case discussion "," rank order those in terms of risk and discuss the rationale for your ranking. Employee Name # Sales Transactions # Volds James Smith 2,000 25 (1.3%) Robbin Mead 200 15 (7.5%) Glen Biwen 1,000 10 (1.0%) # Refunds 10 (0.5%) 10 (5.0% 5 (0.5%) Chapter 5 Assignment Disbursement Red Flags Case 1: 1. Marriot Motels only has a PO box, the absence of a phone number, physical address, and website could be an indication that it is a shell company. -Bill Smithbob and BSB Supply House have the same mailing address. The match signifies that the employee is probably engaging in a shell company scheme. Wendy Bob could be his wife and BSB could stand for Bill Smithbob. -The omission of social security number, physical address, and lack of tax deductions on their paychecks is a clear red flag and indication that "sunny day" is a fictitious employee. Also, 15243 seems to be the zip code for Johnsonville, yet Weirton is listed as the city for his address 2. Case 2: 1. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts