Question: Chapter 5 - Assignments SHOW ALL WORK If you wish to accumulate $ 1 4 0 , 0 0 0 in 1 3 years, how

Chapter Assignments SHOW ALL WORK

If you wish to accumulate $ in years, how much must you deposit today in an account that pays an annual interest rate of

What will $ grow to be in years if it is invested today in an account with an annual interest rate of

How many years will it take for $ to grow to be $ if it is invested in an account with an anual interest rate of

At what annual interest rate must $ be invested so that it will grow to be $ in years?

If you wish to accumulate $ in years, how much must you deposit today in an account that pays a quoted annual interest rate of with semiannual compounding of interest?

What will $ grow to be in years if it is invested today in an account with a quoted annual interest rate of with monthly compounding of interest?

How many years will it take for $ to grow to be $ if it is invested in an account with a quoted annual interest rate of with monthly compounding of interest?

At what quoted annual interest rate must $ be invested so that it will grow to be $ in years if interest is compounded weekly?

You are offered an annuity that will pay $ per year for years the first payment will occur one year from today If you feel that the appropriate discount rate is what is the annuity worth to you today?

If you deposit $ per year for years each deposit is made at the end of each year in an account that pays an annual interest rate of what will your account be worth at the end of years?

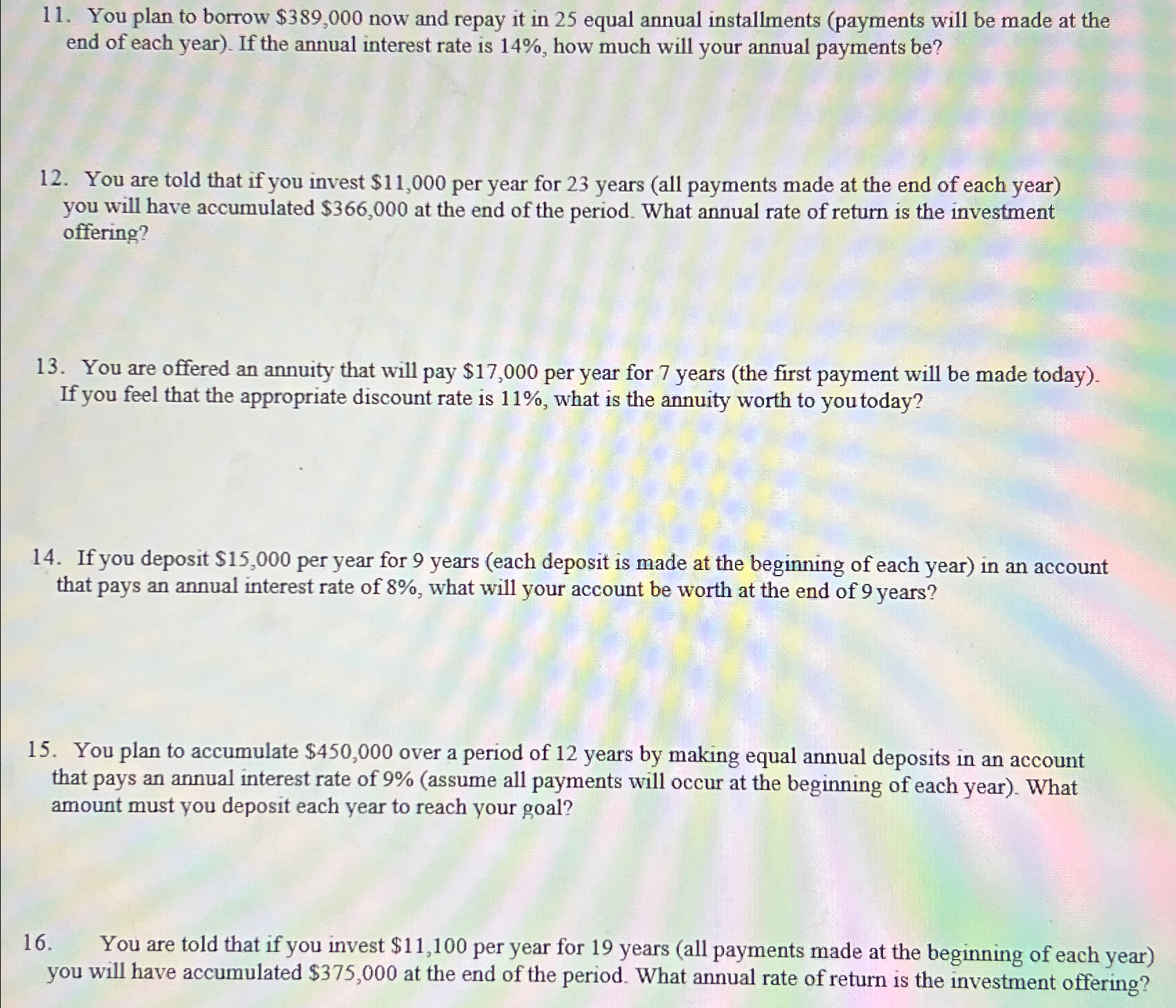

You plan to borrow $ now and repay it in equal annual installments payments will be made at the end of each year If the annual interest rate is how much will your annual payments be

You are told that if you invest $ per year for years all payments made at the end of each year you will have accumulated $ at the end of the period. What annual rate of return is the investment offering?

You are offered an annuity that will pay $ per year for years the first payment will be made today If you feel that the appropriate discount rate is what is the annuity worth to you today?

If you deposit $ per year for years each deposit is made at the beginning of each year in an account that pays an annual interest rate of what will your account be worth at the end of years?

You plan to accumulate $ over a period of years by making equal annual deposits in an account that pays an annual interest rate of assume all payments will occur at the beginning of each year What amount must you deposit each year to reach your goal?

You are told that if you invest $ per year for years all payments made at the beginning of each year you will have accumulated $ at the end of the period. What annual rate of return is the investment offering?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock