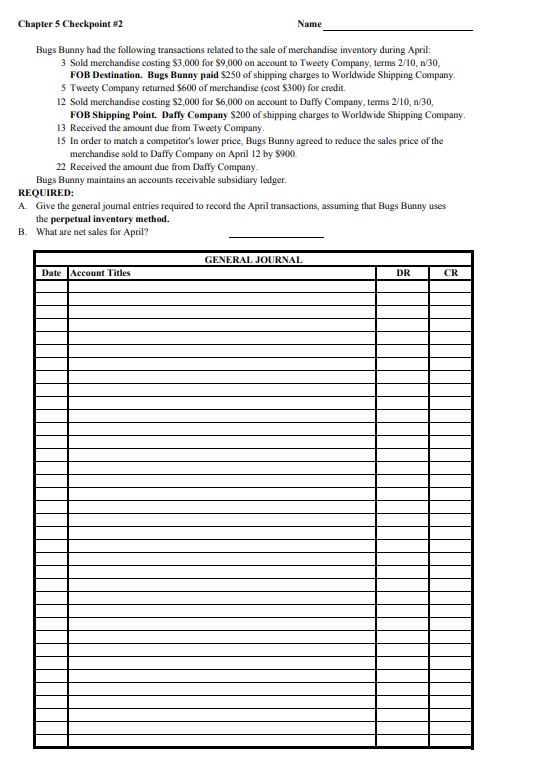

Question: Chapter 5 Checkpoint #2 Name Bugs Bunny had the following transactions related to the sale of merchandise inventory during April: 3 Sold merchandise costing $3,000

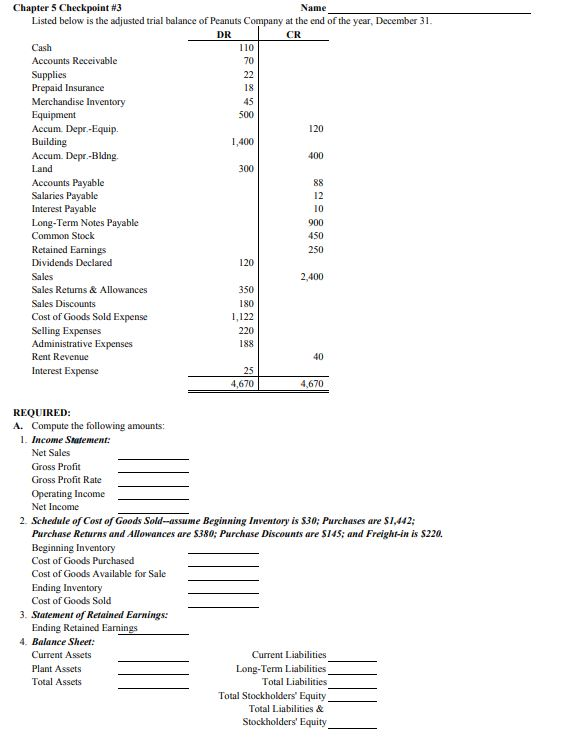

Chapter 5 Checkpoint #2 Name Bugs Bunny had the following transactions related to the sale of merchandise inventory during April: 3 Sold merchandise costing $3,000 for $9,000 on account to Tweety Company, terms 2/10, 130, FOB Destination. Bugs Bunny paid $250 of shipping charges to Worldwide Shipping Company 5 Tweety Company returned $600 of merchandise (cost $300) for credit 12 Sold merchandise costing $2.000 for $6,000 on account to Daffy Company, terms 2/10, n/30, FOB Shipping Point. Daffy Company $200 of shipping charges to Worldwide Shipping Company 13 Received the amount due from Tweety Company 15 In order to match a competitor's lower price, Bugs Bunny agreed to reduce the sales price of the merchandise sold to Daffy Company on April 12 by 9900 22 Received the amount due from Daffy Company Bugs Bunny maintains an accounts receivable subsidiary ledger REQUIRED: A Give the general joumal entries required to record the April transactions, assuming that Bugs Bunny uses the perpetual inventory method. B What are net sales for April? GENERAL JOURNAL Date Account Ticles T 1 Chapter 5 Checkpoint #3 Name Listed below is the adjusted trial balance of Peanuts Company at the end of the year, December 31 DR CR Cash Accounts Receivable Supplies Prepaid Insurance Merchandise Inventory Equipment Accum. Depr.-Equip. Building Accum. Depr.-Bldng. Land Accounts Payable Salaries Payable Interest Payable Long-Term Notes Payable 900 Common Stock Retained Earnings 250 Dividends Declared Sales Sales Retums & Allowances 350 Sales Discounts 180 Cost of Goods Sold Expense 1,122 Selling Expenses 220 Administrative Expenses Rent Revenue Interest Expense 4,670 4,670 450 2,400 188 40 REQUIRED: A. Compute the following amounts: 1. Income Statement: Net Sales Gross Profit Gross Profit Rate Operating Income Net Income 2. Schedule of Cost of Goods Sold--assume Beginning Inventory is $30; Purchases are $1,442, Purchase Returns and Allowances are $380; Purchase Discounts are S145; and Freight-in is $220. Beginning Inventory Cost of Goods Purchased Cost of Goods Available for Sale Ending Inventory Cost of Goods Sold 3. Statement of Retained Earnings: Ending Retained Earnings 4. Balance Sheet: Current Assets Current Liabilities Plant Assets Long-Term Liabilities Total Assets Total Liabilities Total Stockholders' Equity Total Liabilities & Stockholders' Equity Chapter 5 Checkpoint #2 Name Bugs Bunny had the following transactions related to the sale of merchandise inventory during April: 3 Sold merchandise costing $3,000 for $9,000 on account to Tweety Company, terms 2/10, 130, FOB Destination. Bugs Bunny paid $250 of shipping charges to Worldwide Shipping Company 5 Tweety Company returned $600 of merchandise (cost $300) for credit 12 Sold merchandise costing $2.000 for $6,000 on account to Daffy Company, terms 2/10, n/30, FOB Shipping Point. Daffy Company $200 of shipping charges to Worldwide Shipping Company 13 Received the amount due from Tweety Company 15 In order to match a competitor's lower price, Bugs Bunny agreed to reduce the sales price of the merchandise sold to Daffy Company on April 12 by 9900 22 Received the amount due from Daffy Company Bugs Bunny maintains an accounts receivable subsidiary ledger REQUIRED: A Give the general joumal entries required to record the April transactions, assuming that Bugs Bunny uses the perpetual inventory method. B What are net sales for April? GENERAL JOURNAL Date Account Ticles T 1 Chapter 5 Checkpoint #3 Name Listed below is the adjusted trial balance of Peanuts Company at the end of the year, December 31 DR CR Cash Accounts Receivable Supplies Prepaid Insurance Merchandise Inventory Equipment Accum. Depr.-Equip. Building Accum. Depr.-Bldng. Land Accounts Payable Salaries Payable Interest Payable Long-Term Notes Payable 900 Common Stock Retained Earnings 250 Dividends Declared Sales Sales Retums & Allowances 350 Sales Discounts 180 Cost of Goods Sold Expense 1,122 Selling Expenses 220 Administrative Expenses Rent Revenue Interest Expense 4,670 4,670 450 2,400 188 40 REQUIRED: A. Compute the following amounts: 1. Income Statement: Net Sales Gross Profit Gross Profit Rate Operating Income Net Income 2. Schedule of Cost of Goods Sold--assume Beginning Inventory is $30; Purchases are $1,442, Purchase Returns and Allowances are $380; Purchase Discounts are S145; and Freight-in is $220. Beginning Inventory Cost of Goods Purchased Cost of Goods Available for Sale Ending Inventory Cost of Goods Sold 3. Statement of Retained Earnings: Ending Retained Earnings 4. Balance Sheet: Current Assets Current Liabilities Plant Assets Long-Term Liabilities Total Assets Total Liabilities Total Stockholders' Equity Total Liabilities & Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts