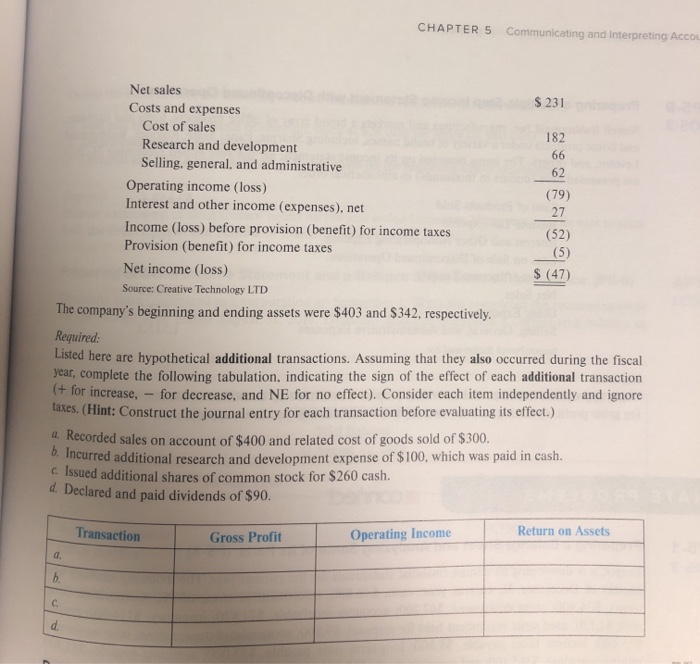

Question: CHAPTER 5 Communicating and interpreting Accou $ 231 Net sales Costs and expenses Cost of sales Research and development Selling, general, and administrative Operating income

CHAPTER 5 Communicating and interpreting Accou $ 231 Net sales Costs and expenses Cost of sales Research and development Selling, general, and administrative Operating income (loss) Interest and other income (expenses), net Income (loss) before provision (benefit) for income taxes Provision (benefit) for income taxes Net income (loss) Source: Creative Technology LTD The company's beginning and ending assets were $403 and $342, respectively. (52) $ (47) (5) Required: Listed here are hypothetical additional transactions. Assuming that they also occurred during the fiscal year, complete the following tabulation, indicating the sign of the effect of each additional transaction (+ for increase, - for decrease, and NE for no effect). Consider each item independently and ignore ACS. (Hint: Construct the journal entry for each transaction before evaluating its effect.) Recorded sales on account of $400 and related cost of goods sold of $300. incurred additional research and development expense of $100, which was paid in cash. Issued additional shares of common stock for $260 cash. d. Declared and paid dividends of $90. Transaction Return on Assets Gross Profit Operating Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts