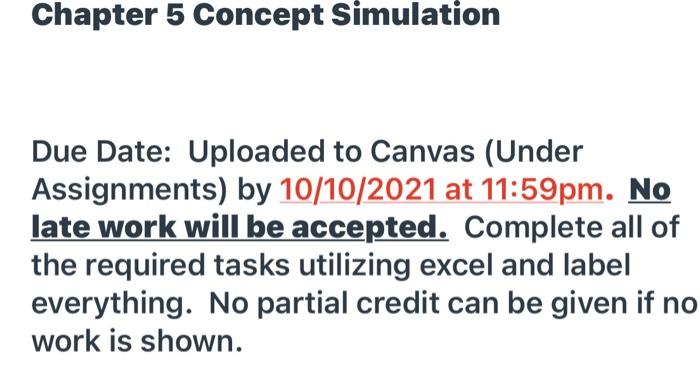

Question: Chapter 5 Concept Simulation Due Date: Uploaded to Canvas (Under Assignments) by 10/10/2021 at 11:59pm. No late work will be accepted. Complete all of the

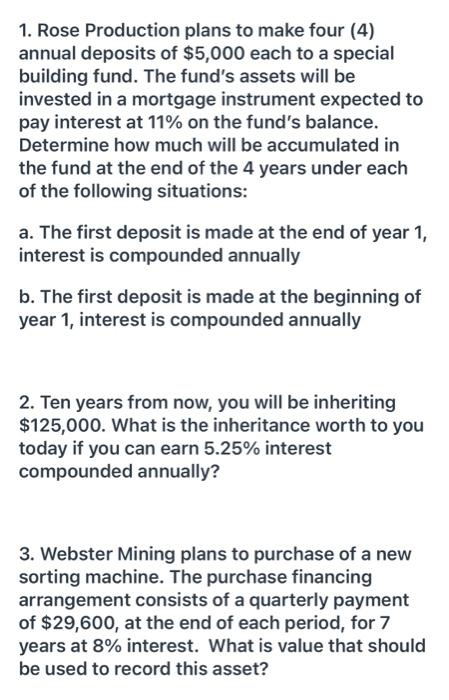

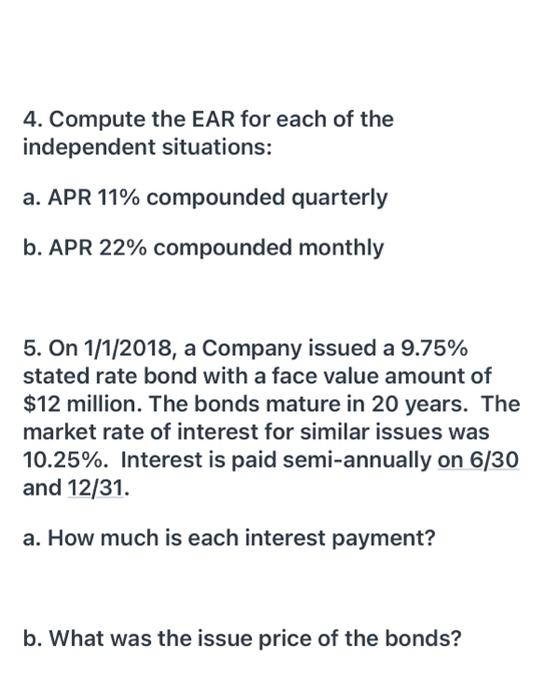

Chapter 5 Concept Simulation Due Date: Uploaded to Canvas (Under Assignments) by 10/10/2021 at 11:59pm. No late work will be accepted. Complete all of the required tasks utilizing excel and label everything. No partial credit can be given if no work is shown. 1. Rose Production plans to make four (4) annual deposits of $5,000 each to a special building fund. The fund's assets will be invested in a mortgage instrument expected to pay interest at 11% on the fund's balance. Determine how much will be accumulated in the fund at the end of the 4 years under each of the following situations: a. The first deposit is made at the end of year 1, interest is compounded annually b. The first deposit is made at the beginning of year 1, interest is compounded annually 2. Ten years from now, you will be inheriting $125,000. What is the inheritance worth to you today if you can earn 5.25% interest compounded annually? 3. Webster Mining plans to purchase of a new sorting machine. The purchase financing arrangement consists of a quarterly payment of $29,600, at the end of each period, for 7 years at 8% interest. What is value that should be used to record this asset? 4. Compute the EAR for each of the independent situations: a. APR 11% compounded quarterly b. APR 22% compounded monthly 5. On 1/1/2018, a Company issued a 9.75% stated rate bond with a face value amount of $12 million. The bonds mature in 20 years. The market rate of interest for similar issues was 10.25%. Interest is paid semi-annually on 6/30 and 12/31. a. How much is each interest payment? b. What was the issue price of the bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts