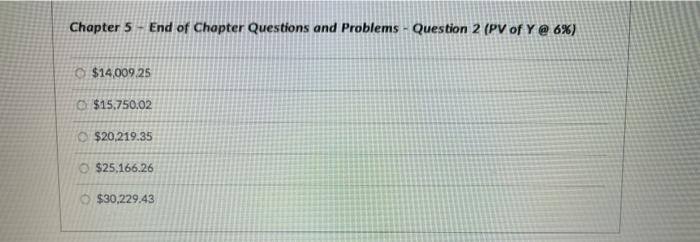

Question: Chapter 5 End of Chapter Questions and Problems - Question 2 (PV of Y @ 6%) $14,009.25 $15.750.02 $20,219.35 $25,166.26 $30,229.43 LOI 2. Present Value

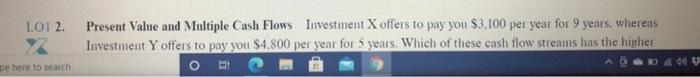

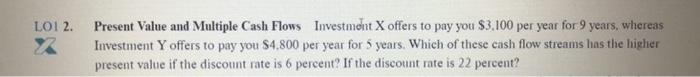

Chapter 5 End of Chapter Questions and Problems - Question 2 (PV of Y @ 6%) $14,009.25 $15.750.02 $20,219.35 $25,166.26 $30,229.43 LOI 2. Present Value and Multiple Cash Flows Investment X offers to pay you $3.100 per year for 9 years, whereas Investment Y offers to pay you $4.800 per year for 5 years. Which of these cash flow streams has the higher De here to search LO1 2. x Present Value and Multiple Cash Flows Investment X offers to pay you $3,100 per year for 9 years, whereas Investment Y offers to pay you $4.800 per year for 5 years. Which of these cash flow streams has the higher present value if the discount rate is 6 percent? If the discount rate is 22 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts