Question: Chapter 5 - Financial Risk and Required Return PROBLEM 7 Assum that HCA is evaluating the feasibility of building a new hospital in an area

Chapter Financial Risk and Required Return

PROBLEM

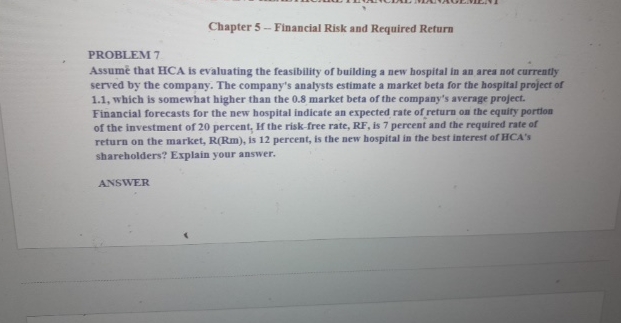

Assum that HCA is evaluating the feasibility of building a new hospital in an area not currently served by the company. The company's analysts estimate a market beta for the hospital project of which is somewhat higher than the market beta of the company's average project. Financial forecasts for the new hospital indicate an expected rate of return on the equiry portion of the investment of percent, If the riskfree rate, RF is percent and the required rate of return on the market, is percent, is the new hospital in the best interest of HCA's shareholders? Explain your answer.

ANSWER

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock