Question: Chapter 5 Forecasting Questions Answer the following questions using Consumer Price Index (CPI) Data. 1) Compute CPI forecasts using the nave forecasting method. 2) Compute

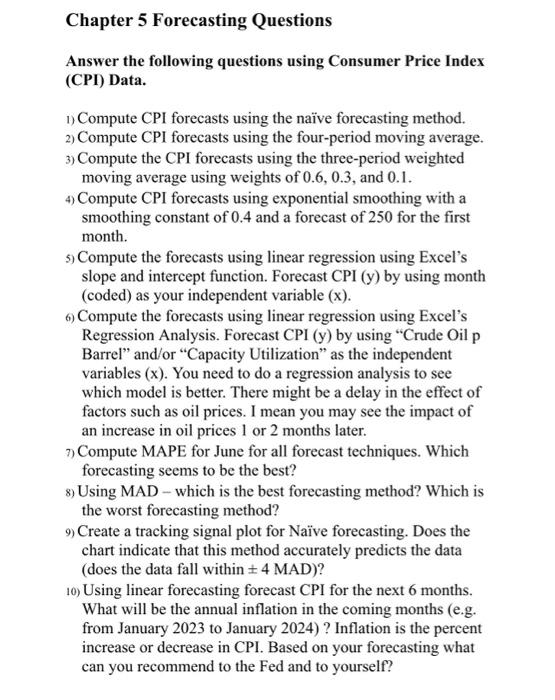

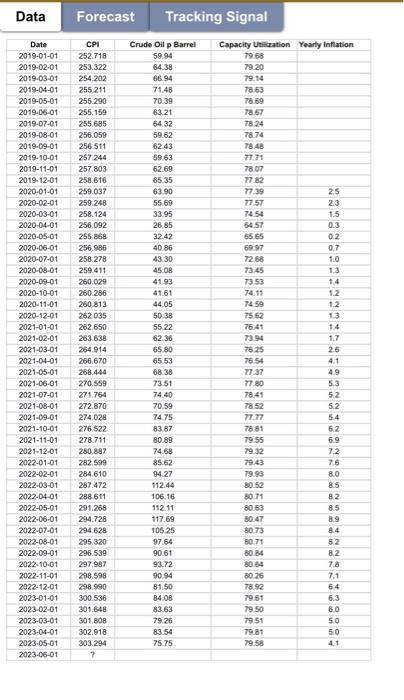

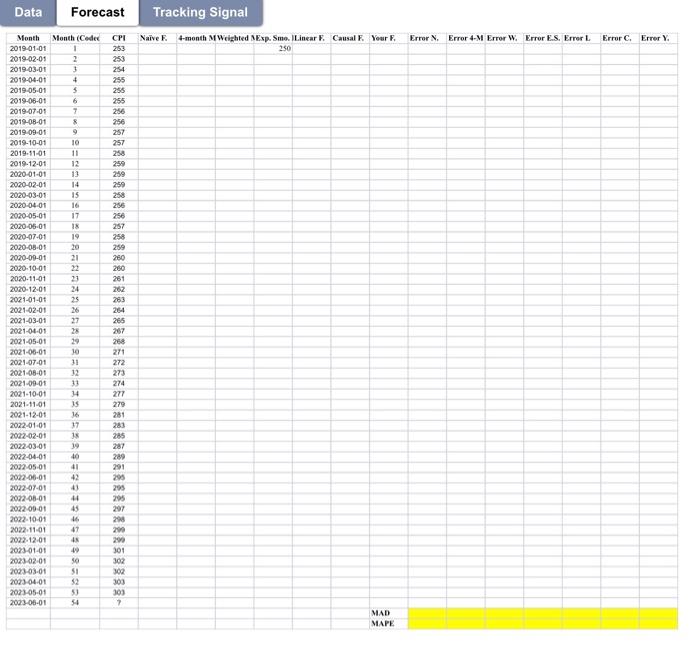

Chapter 5 Forecasting Questions Answer the following questions using Consumer Price Index (CPI) Data. 1) Compute CPI forecasts using the nave forecasting method. 2) Compute CPI forecasts using the four-period moving average. 3) Compute the CPI forecasts using the three-period weighted moving average using weights of 0.6,0.3, and 0.1 . 4 Compute CPI forecasts using exponential smoothing with a smoothing constant of 0.4 and a forecast of 250 for the first month. 5) Compute the forecasts using linear regression using Excel's slope and intercept function. Forecast CPI (y) by using month (coded) as your independent variable ( x ). 6) Compute the forecasts using linear regression using Excel's Regression Analysis. Forecast CPI (y) by using "Crude Oil p Barrel" and/or "Capacity Utilization" as the independent variables (x). You need to do a regression analysis to see which model is better. There might be a delay in the effect of factors such as oil prices. I mean you may see the impact of an increase in oil prices 1 or 2 months later. 7) Compute MAPE for June for all forecast techniques. Which forecasting seems to be the best? 8) Using MAD - which is the best forecasting method? Which is the worst forecasting method? 9) Create a tracking signal plot for Nave forecasting. Does the chart indicate that this method accurately predicts the data (does the data fall within 4MAD )? 10) Using linear forecasting forecast CPI for the next 6 months. What will be the annual inflation in the coming months (e.g. from January 2023 to January 2024) ? Inflation is the percent increase or decrease in CPI. Based on your forecasting what can you recommend to the Fed and to yourself? Data Forecast Tracking Signal Data Forecast Tracking Signal Chapter 5 Forecasting Questions Answer the following questions using Consumer Price Index (CPI) Data. 1) Compute CPI forecasts using the nave forecasting method. 2) Compute CPI forecasts using the four-period moving average. 3) Compute the CPI forecasts using the three-period weighted moving average using weights of 0.6,0.3, and 0.1 . 4 Compute CPI forecasts using exponential smoothing with a smoothing constant of 0.4 and a forecast of 250 for the first month. 5) Compute the forecasts using linear regression using Excel's slope and intercept function. Forecast CPI (y) by using month (coded) as your independent variable ( x ). 6) Compute the forecasts using linear regression using Excel's Regression Analysis. Forecast CPI (y) by using "Crude Oil p Barrel" and/or "Capacity Utilization" as the independent variables (x). You need to do a regression analysis to see which model is better. There might be a delay in the effect of factors such as oil prices. I mean you may see the impact of an increase in oil prices 1 or 2 months later. 7) Compute MAPE for June for all forecast techniques. Which forecasting seems to be the best? 8) Using MAD - which is the best forecasting method? Which is the worst forecasting method? 9) Create a tracking signal plot for Nave forecasting. Does the chart indicate that this method accurately predicts the data (does the data fall within 4MAD )? 10) Using linear forecasting forecast CPI for the next 6 months. What will be the annual inflation in the coming months (e.g. from January 2023 to January 2024) ? Inflation is the percent increase or decrease in CPI. Based on your forecasting what can you recommend to the Fed and to yourself? Data Forecast Tracking Signal Data Forecast Tracking Signal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts