Question: Chapter 5 Homework Exercise E Peter Garcia Meza is considering buying a company if it will break even or earn net income on revenues of

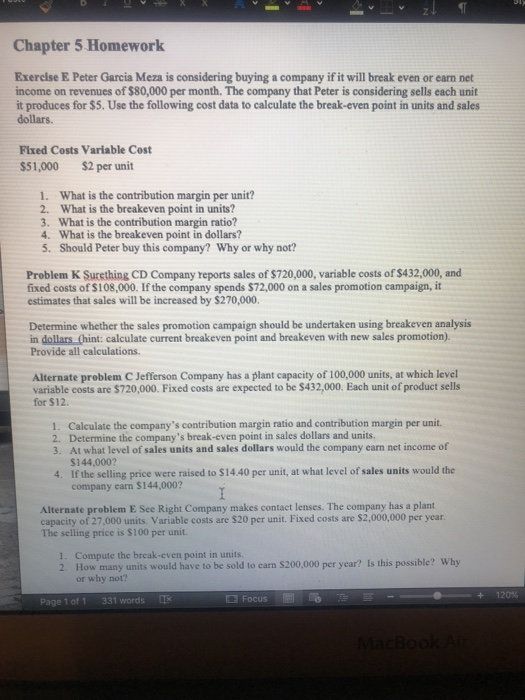

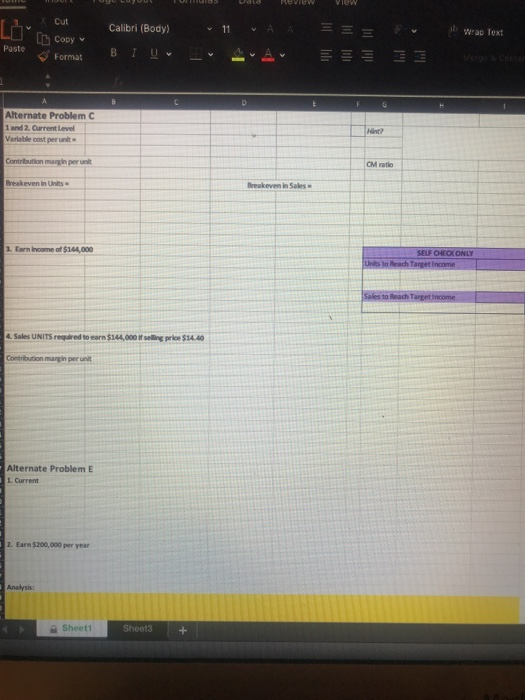

Chapter 5 Homework Exercise E Peter Garcia Meza is considering buying a company if it will break even or earn net income on revenues of $80,000 per month. The company that Peter is considering sells each unit it produces for $5. Use the following cost data to calculate the break-even point in units and sales dollars. Fixed Costs Variable Cost $51,000 $2 per unit What is the contribution margin per unit? 2. 1. What is the breakeven point in units? 3. What is the contribution margin ratio? 4. What is the breakeven point in dollars? 5. Should Peter buy this company? Why or why not? Problem K Surething CD Company reports sales of $720,000, variable costs of $432,000, and fixed costs of $108,000. If the company spends $72,000 on a sales promotion campaign, it estimates that sales will be increased by $270,000. Determine whether the sales promotion campaign should be undertaken using breakeven analysis Provide all calculations. in dollars (hint: calculate current breakeven point and breakeven with new sales promotion). Alternate problem C Jefferson Company has a plant capacity of i 00,000 units, at which level variable costs are $720,000. Fixed costs are expected to be $432,000. Each unit of product sells for $12. 1. Calculate the company's contribution margin ratio and contribution margin per unit. 2. Determine the company's break-even point in sales dollars and units. 3. At what level of sales units and sales dollars would the company earn net income of $144,000? 4. If the selling price were raised to S14.40 per unit, at what level of sales units would the company earn $144,000? Alternate problem E See Right Company makes contact lenses. The company has a plant capacity of 27,000 units. Variable costs are $20 per unit. Fixed costs are $2,000,000 per year. The selling price is $100 per unit. 1. Compute the break-even point in units. 2. How many units would have to be sold to earn $200,000 per year? Is this possible? Why or why not? Focus- + 120% Page 1 of 1 331 words Wrap Text Gene utCalibri (Body) Copy ste hapter 5 Homework ote: There are several ways to complete these problems. Use whatever way you feel most comfortable and SHOW YOUR WORK in a professional manner s th tabelsl) and use the CHECK YOURSELF to stay on track Instructor will provide you th the Solution Code to see how these could be calculated (again, other methods are ok as long as amounts agree) LWAYS REFER TO PROBLEM INSTRUCTIONS FOR REQUIREMENTS Exercise E Contribution Margin per Unit BE in units CM ratio BE in sales Should Peter buy the company? Why or why not? Problem K Current Breakeven in Sales Dollars SELF CHECK ONLY New Sales Total New Sales Total New Contribution Margin Ratio New Breakeven w Sales Promo: Analyis: Alternate Problem C Hint? a Sheett Sheet3+ MacBoo Cut b wrap Text CopyCalibri (Body) Paste BIU Alternate ProblemC 1 and 2 Current Level Varlable cost per unt Hint? Contribution margih per unt Breakeven in Units Breakeven in Sales 3. Earn Income of $144,000 CHECK Sales UNITS required to earn $144,000 it selling price $14.-40 Alternate Problem E L Current 2. Earn $200,000 per year Analysis a Sheet1 Sheet3+

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts