Question: chapter 5 homework. Problem 5-14 Present Values (LO2) what is the present value of the following cash-flow stream if the interest rate is 6%? (

chapter 5 homework.

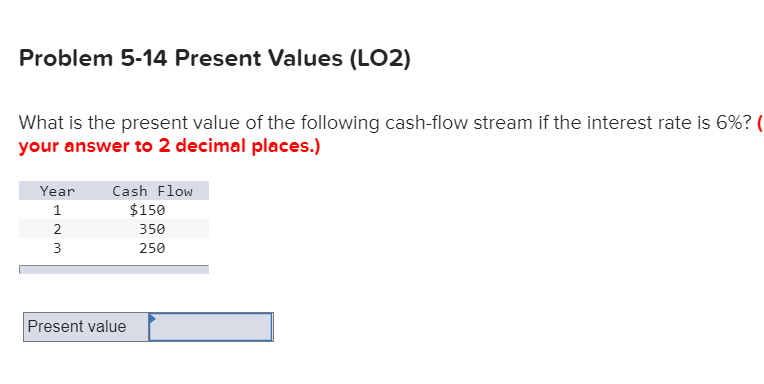

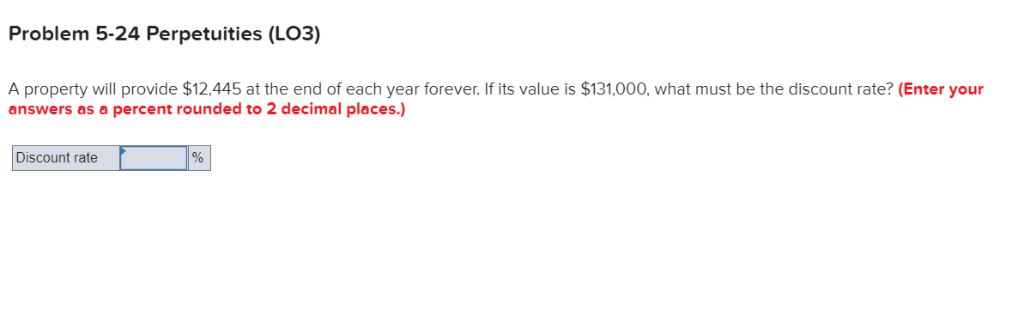

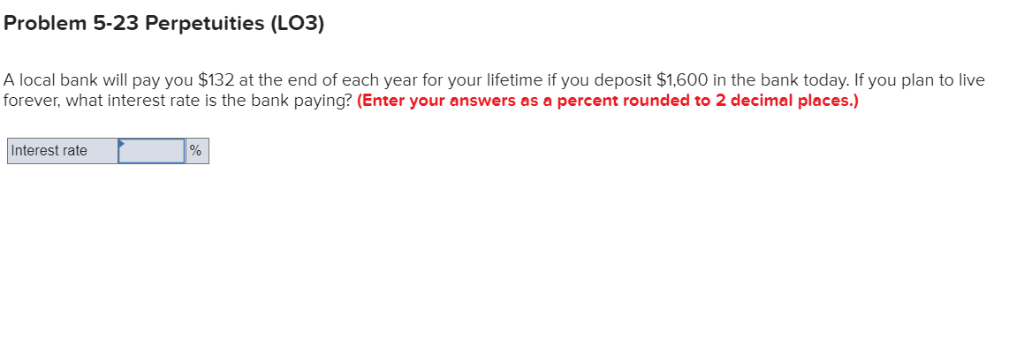

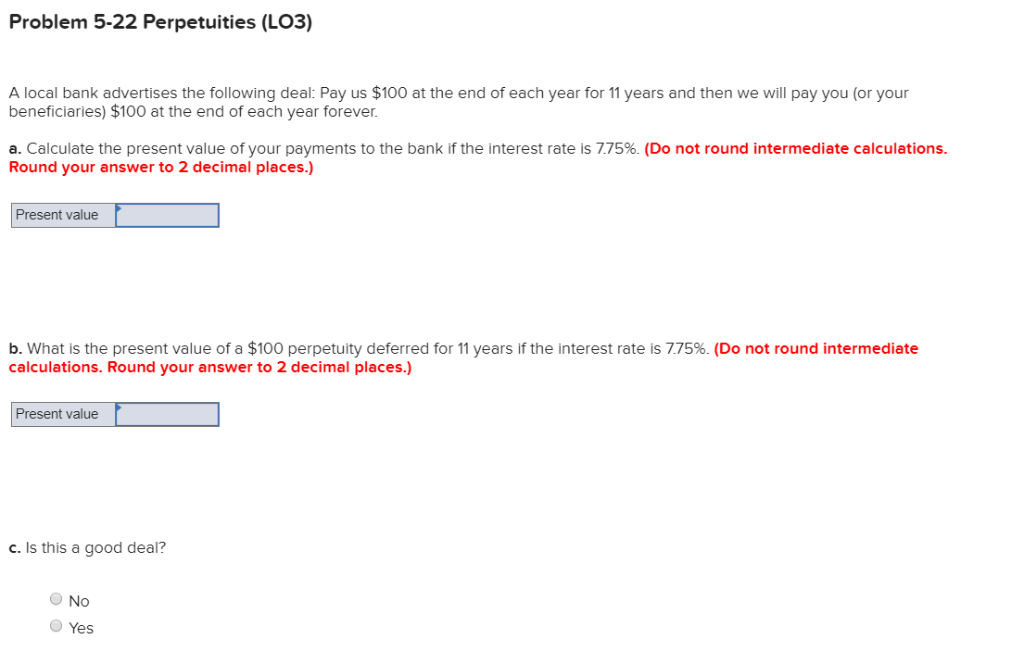

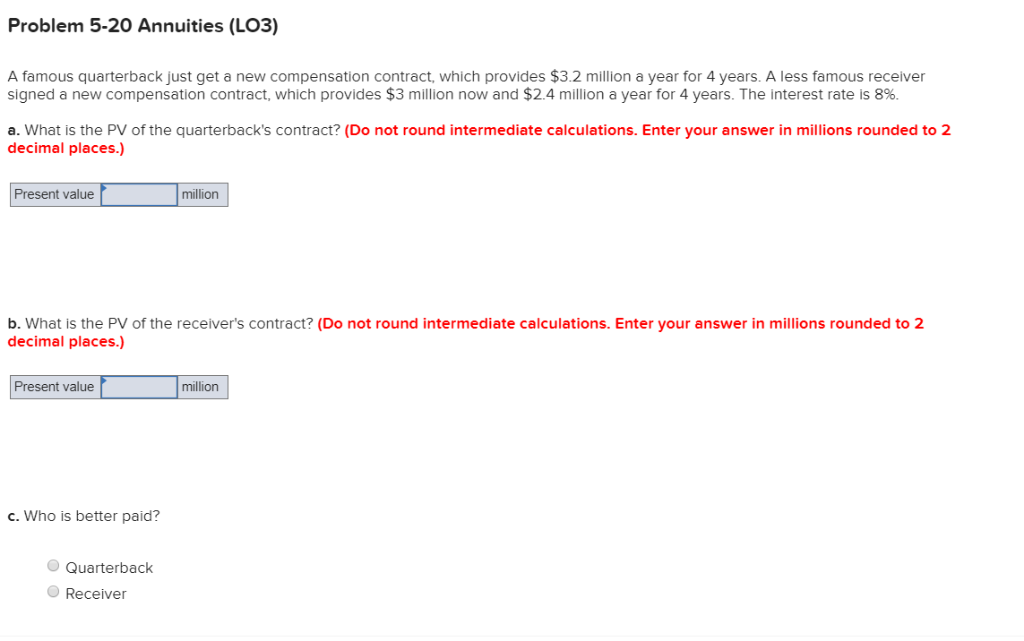

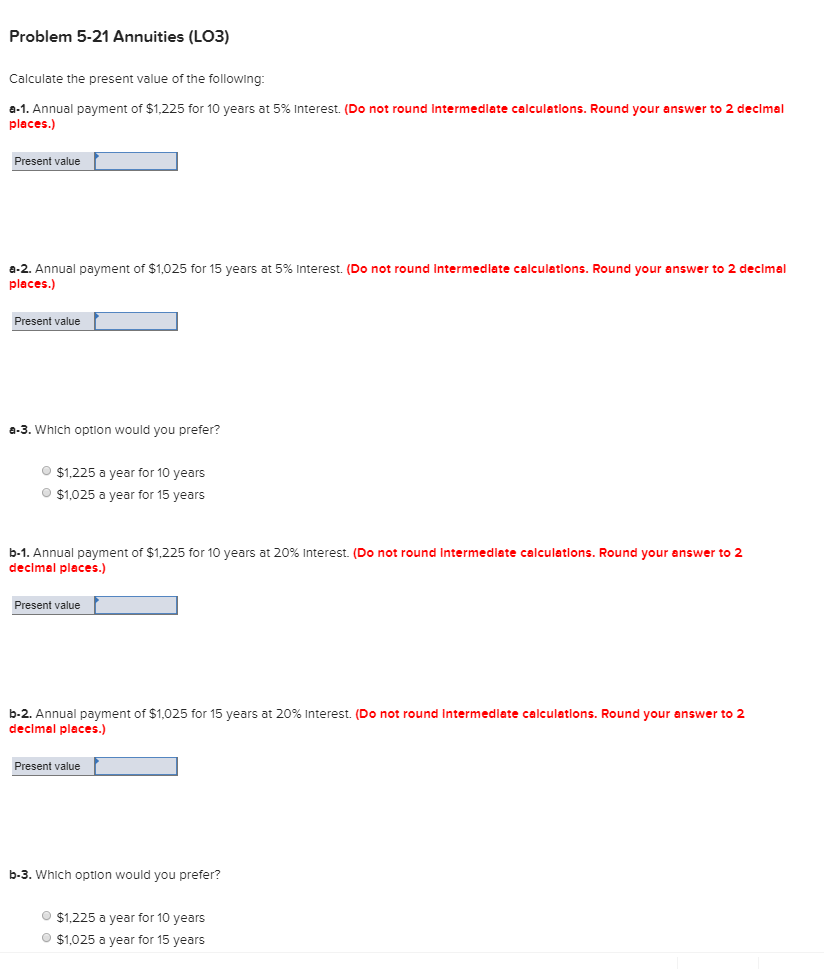

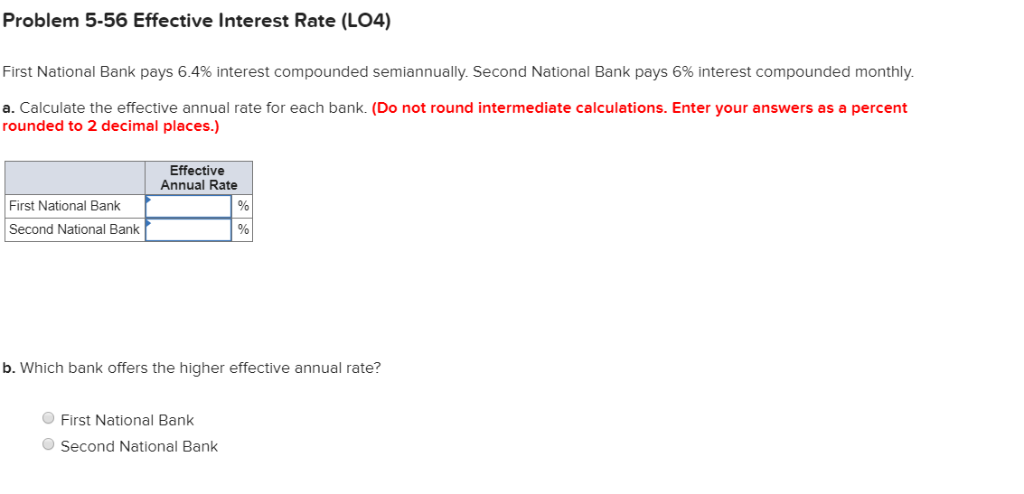

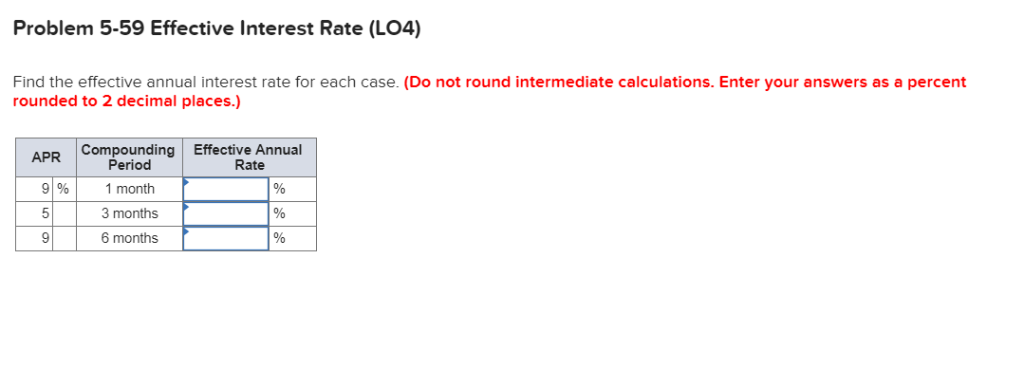

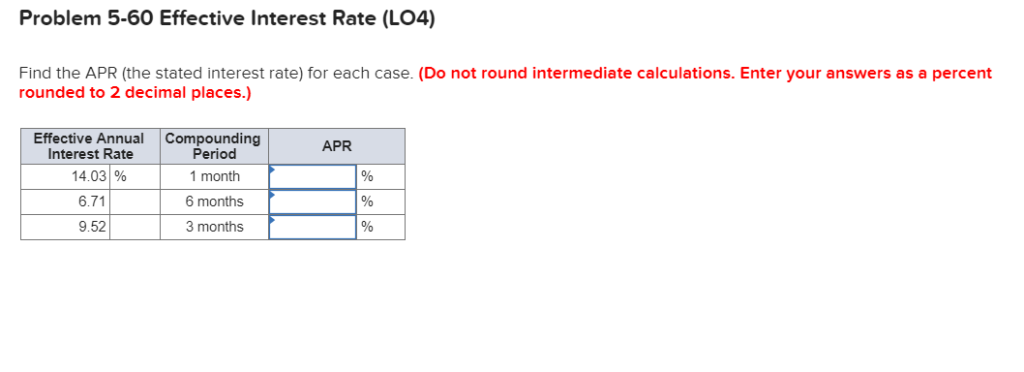

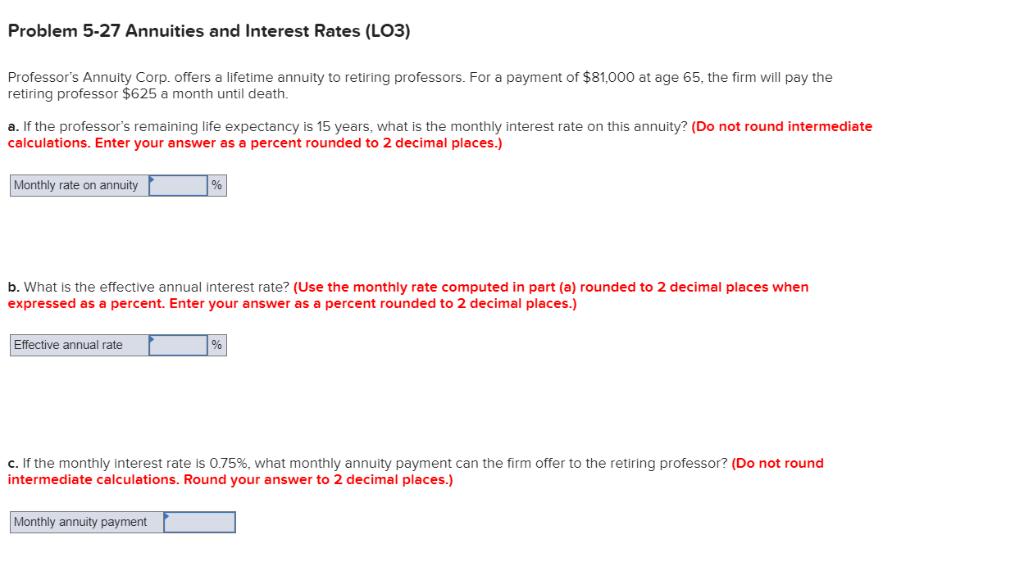

Problem 5-14 Present Values (LO2) what is the present value of the following cash-flow stream if the interest rate is 6%? ( your answer to 2 decimal places.) Cash Flow $150 350 250 Year 2 Present value Problem 5-23 Perpetuities (LO3) A local bank will pay you $132 at the end of each year for your lifetime if you deposit $1,600 in the bank today. If you plan to live forever, what interest rate is the bank paying? (Enter your answers as a percent rounded to 2 decimal places.) Interest rate Problem 5-22 Perpetuities (LO3) A local bank advertises the following deal: Pay us $100 at the end of each year for 11 years and then we will pay you (or your beneficiaries) $100 at the end of each year forever. a. Calculate the present value of your payments to the bank if the interest rate is 775%. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Present value b, what is the present value of a $100 perpetuity deferred for 11 years if the interest rate is 775%. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Present value c. Is this a good deal? No Yes Problem 5-21 Annuities (LO3) Calculate the present value of the following a-1. Annual payment of $1,225 for 10 years at 5% interest. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Present value a-2. Annual payment of $1,025 for 15 years at 5% interest. (Do not round interrmediate calculations. Round your answer to 2 decimal places.) Present value a-3. Which option would you prefer? $1.225 a year for 10 years $1,025 a year for 15 years b-1. Annual payment of $1,225 for 10 years at 20% interest. (Do not round intermediate calculations. Round your answer to 2 declmal places.) Present value b-2. Annual payment of $1,025 for 15 years at 20% interest. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Present value b-3. Which option would you prefer? $1,225 a year for 10 years $1,025 a year for 15 years Problem 5-56 Effective Interest Rate (LO4) First National Bank pays 6.4% interest compounded semiannually. Second National Bank pays 6% interest compounded monthly. a. Calculate the effective annual rate for each bank. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Effective Annual Rate First National Bank Second National Bank b. Which bank offers the higher effective annual rate? First National Bank Second National Bank Problem 5-59 Effective Interest Rate (LO4) Find the effective annual interest rate for each case. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Compounding Effective Annual Period 1 month 3 months 6 months Rate 9% | 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts