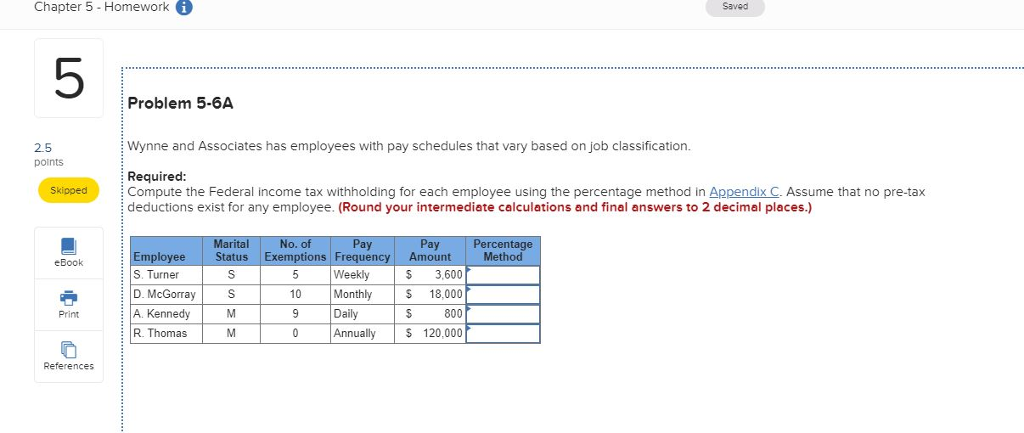

Question: Chapter 5 Homeworki 5 Problem 5-6A 2.5 Wynne and Associates has employees with pay schedules that vary based on job classification. Required: Compute the Federal

Chapter 5 Homeworki 5 Problem 5-6A 2.5 Wynne and Associates has employees with pay schedules that vary based on job classification. Required: Compute the Federal income tax withholding for each employee using the percentage method in Appendix C. Assume that no pre-tax deductions exist for any employee. (Round your intermediate calculations and final answers to 2 decimal places.) Skipped Ma Status Exemptions Frequen O. ay Amount ITm S. Turner D. McGorray A. Kennedy R. Thomas eBook Weekly 5 3,600 10 Monthly S 18,000 800 Annually 120,000 M Daily References

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock