Question: Chapter 5: [pp. 128-138, 148-149] - Do you know the factors that determine the interest rates, difference between nominal and real interest rates, what each

![Chapter 5: [pp. 128-138, 148-149] - Do you know the factors](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f94ba42b06f_85966f94ba3a48dd.jpg)

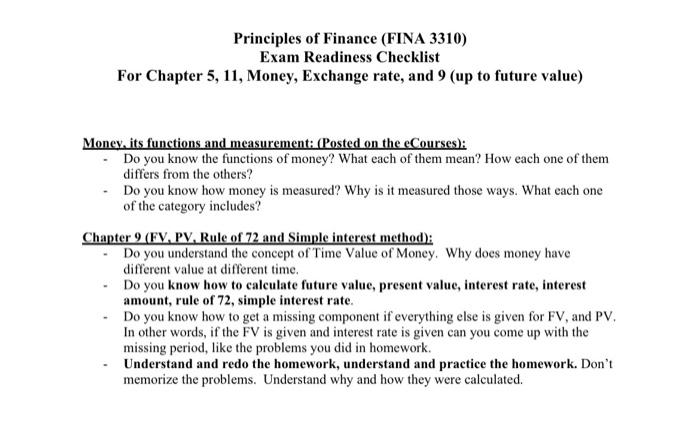

Chapter 5: [pp. 128-138, 148-149] - Do you know the factors that determine the interest rates, difference between nominal and real interest rates, what each of the premiums represents, when are they (premiums) applicable and when are they not applicable? - Do you know how to calculate each one of the premiums if everything else is given in the formula? - Do you know the difference between actual, required and expected return? - Do you know whether high interest or low interest good for business or stocks? - Redo the homework. Understand and practice them as well as the examples in the book. Chapter 11: [pp. 395-398,406-407, 412-414, 418-420, 666-668, 670-672] - Do you know the basic relationship between risk and return? - Do you you know how to calculate Holding period return and annualized return (both dollar value and percentage return)? - Do you know how to calculate portfolio risks and returns? - Understand and redo the homework, understand and practice the homework. Don't memorize the problems. Understand why and how they were calculated. - Do you know what is CAPM (the formula we used to calculate required return for stocks), how is it used, what do the components stand for and how to calculate missing variables? - Do you know the various type of risks, which ones are diversifiable and which ones aren't? - Do you know how to calculate portfolio risks and returns? - Redo the homework. Understand and practice them as well as the examples in the book. Exchange rate: (Handout posted on the eCourses) - Do you know what is exchange rate, why do we have them, why do exchange rates change and what factors impact them? - Do you know the difference between a spot rate and a forward rate, if high or low exchange rate good for a country? - Do you know how to calculate appreciation and depreciation of exchange rates, how to calculate an amount of currency given a spot or forward exchange rate and how to calculate a forward rate if spot rate and rates of interest or inflation are given for two countries? - Redo the homework. Understand and practice them as well as the examples in the book. Principles of Finance (FINA 3310) Exam Readiness Checklist For Chapter 5, 11, Money, Exchange rate, and 9 (up to future value) Money, its functions and measurement: (Posted on the eCourses): - Do you know the functions of money? What each of them mean? How each one of them differs from the others? - Do you know how money is measured? Why is it measured those ways. What each one of the category includes? Chapter 9 (FV, PV, Rule of 72 and Simple interest method): - Do you understand the concept of Time Value of Money. Why does money have different value at different time. - Do you know how to calculate future value, present value, interest rate, interest amount, rule of 72 , simple interest rate. - Do you know how to get a missing component if everything else is given for FV, and PV. In other words, if the FV is given and interest rate is given can you come up with the missing period, like the problems you did in homework. - Understand and redo the homework, understand and practice the homework. Don't memorize the problems. Understand why and how they were calculated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts