Question: Chapter 5 Practice Problems Problem 1 At the start of the current year, Apple Corporation (a calendar year taxpayer) has accumulated E & P of

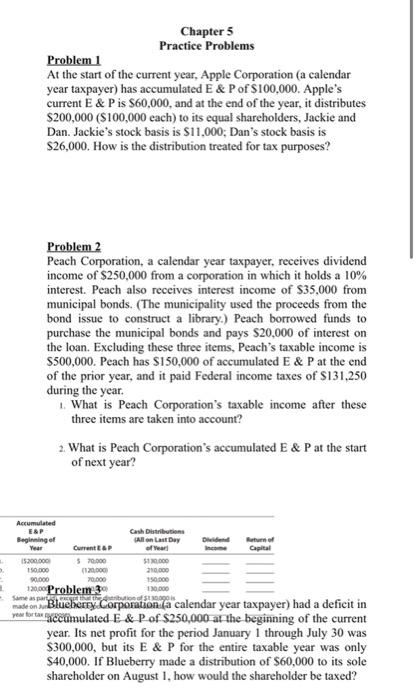

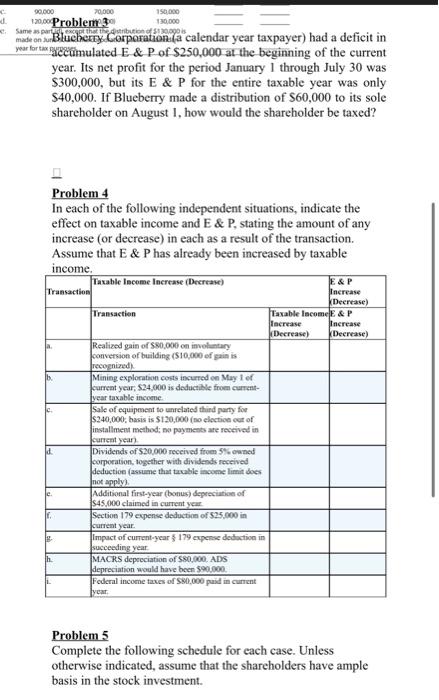

Chapter 5 Practice Problems Problem 1 At the start of the current year, Apple Corporation (a calendar year taxpayer) has accumulated E \& P of $100,000. Apple's current E&P is $60,000, and at the end of the year, it distributes $200,000 ( $100,000 each) to its equal shareholders, Jackie and Dan. Jackie's stock basis is $11,000; Dan's stock basis is $26,000. How is the distribution treated for tax purposes? Problem 2 Peach Corporation, a calendar year taxpayer, receives dividend income of $250,000 from a corporation in which it holds a 10% interest. Peach also receives interest income of $35,000 from municipal bonds. (The municipality used the proceeds from the bond issue to construct a library.) Peach borrowed funds to purchase the municipal bonds and pays $20,000 of interest on the loan. Excluding these three items, Peach's taxable income is $500,000. Peach has $150,000 of accumulated E \& P at the end of the prior year, and it paid Federal income taxes of $131,250 during the year. 1. What is Peach Corporation's taxable income after these three items are taken into account? 2. What is Peach Corporation's accumulated E \& P at the start of next year? menenpebrexcorporation: (a calendar year taxpayer) had a deficit in yew torar gecumulated E \& P of $250,000 at the beginning of the current year. Its net profit for the period January 1 through July 30 was $300,000, but its E \& P for the entire taxable year was only $40,000. If Blueberry made a distribution of $60,000 to its sole shareholder on August 1, how would the shareholder be taxed? made on jubluebeny corporatuoni(a calendar year taxpayer) had a deficit in year brtaxpycetumulated E \& P of $250,000 at the beginning of the current year. Its net profit for the period January 1 through July 30 was $300,000, but its E \& P for the entire taxable year was only $40,000. If Blueberry made a distribution of $60,000 to its sole shareholder on August 1, how would the shareholder be taxed? Problem 4 In each of the following independent situations, indicate the effect on taxable income and E \& P, stating the amount of any increase (or decrease) in each as a result of the transaction. Assume that E \& P has already been increased by taxable inerme Problem 5 Complete the following schedule for each case. Unless otherwise indicated, assume that the shareholders have ample basis in the stock investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts