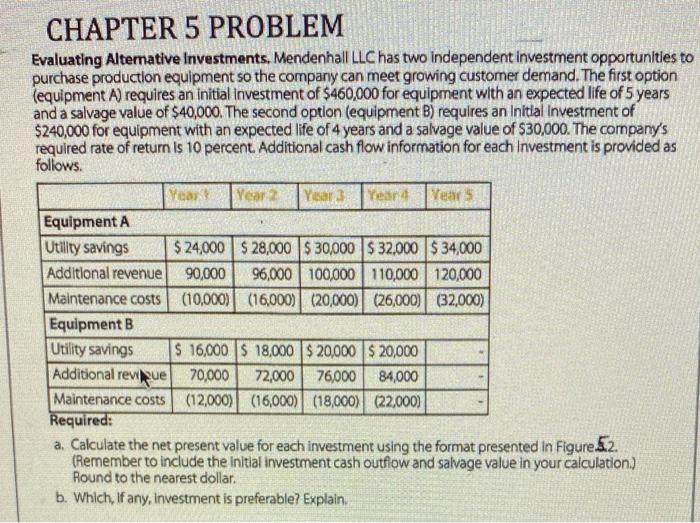

Question: CHAPTER 5 PROBLEM Evaluating Alternative Investments, Mendenhall LLC has two independent investment opportunities to purchase production equipment so the company can meet growing customer demand.

CHAPTER 5 PROBLEM Evaluating Alternative Investments, Mendenhall LLC has two independent investment opportunities to purchase production equipment so the company can meet growing customer demand. The first option (equipment A) requires an initial Investment of $460,000 for equipment with an expected life of 5 years and a salvage value of $40,000. The second option (equipment B) requires an Initial Investment of $240,000 for equipment with an expected life of 4 years and a salvage value of $30,000. The company's required rate of return is 10 percent. Additional cash flow information for each Investment is provided as follows. Year Year Yesar 3 Yeard Years Equipment A Utility savings $ 24,00028,000 $30,000 $32,000 $ 34,000 Additional revenue 90,000 96,000 100,000 110,000 120,000 Maintenance costs (10,000) (16,000) (20,000) (26,000) (32,000) Equipment B Utility savings $ 16,000 $ 18,000 $20,000 $20,000 Additional revisue 70,000 72,000 76,000 84,000 Maintenance costs (12,000) (16,000) (18,000) (22,000) Required: a. Calculate the net present value for each investment using the format presented in Figure 5.2. (Remember to include the initial investment cash outfiow and salvage value in your calculation) Round to the nearest dollar. b. Which, if any, Investment is preferable? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts