Question: Chapter 5 question 1 Internal Controls One of the largest losses in history from unauthorized securities trading involved a securities trader for a French bank.

Chapter 5 question 1

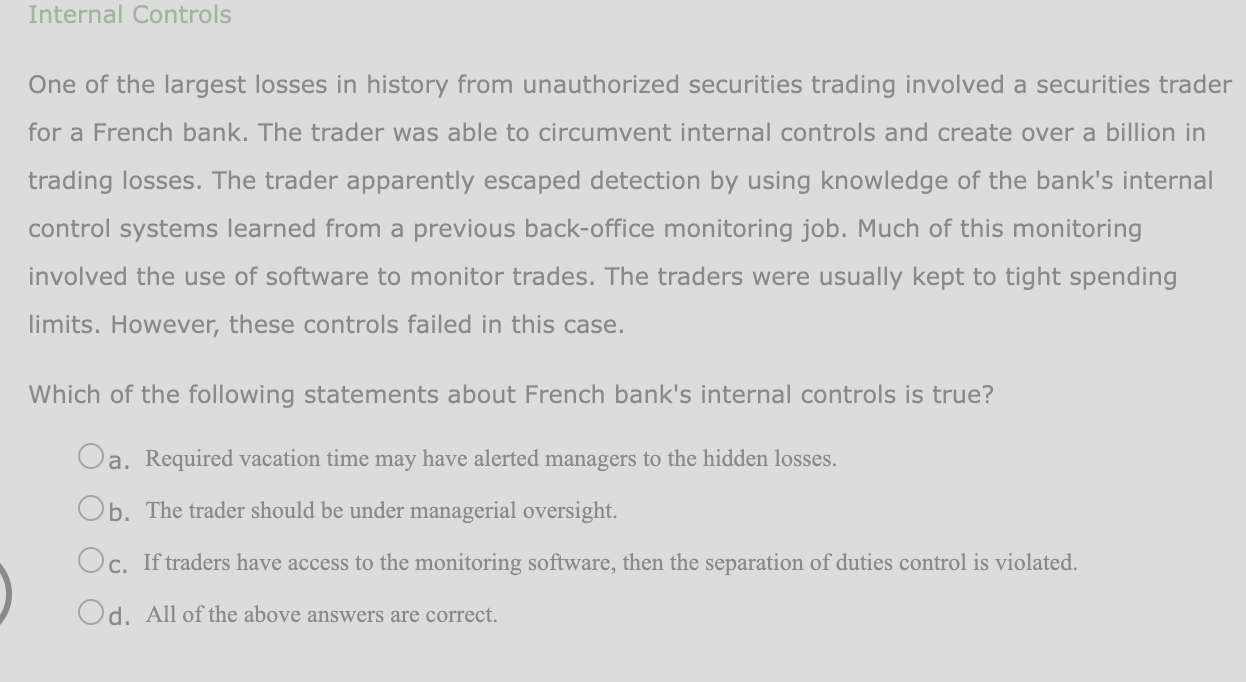

Internal Controls One of the largest losses in history from unauthorized securities trading involved a securities trader for a French bank. The trader was able to circumvent internal controls and create over a billion in trading losses. The trader apparently escaped detection by using knowledge of the bank's internal control systems learned from a previous back-office monitoring job. Much of this monitoring involved the use of software to monitor trades. The traders were usually kept to tight spending limits. However, these controls failed in this case. Which of the following statements about French bank's internal controls is true? Oa. Required vacation time may have alerted managers to the hidden losses. Ob. The trader should be under managerial oversight. Oc. If traders have access to the monitoring software, then the separation of duties control is violated. Od. All of the above answers are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts