Question: chapter 5 quiz Help Save & Exit Submit A company had beginning inventory of 12 units at a cost of $15 each on March 1

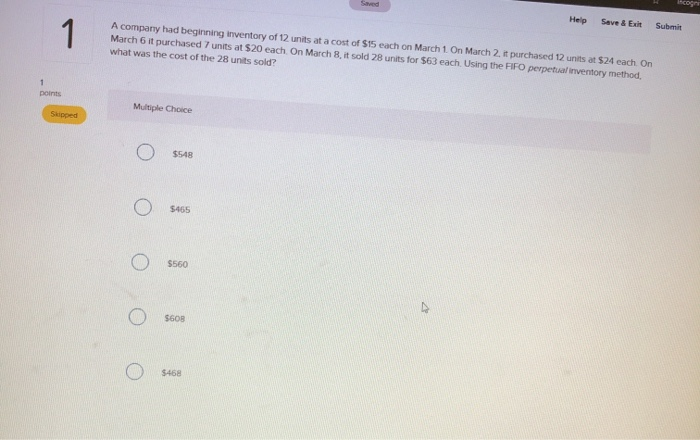

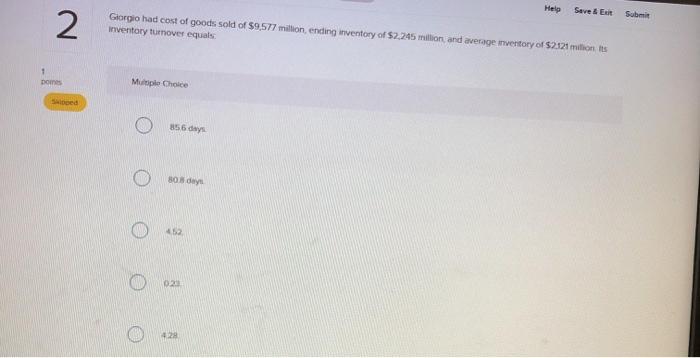

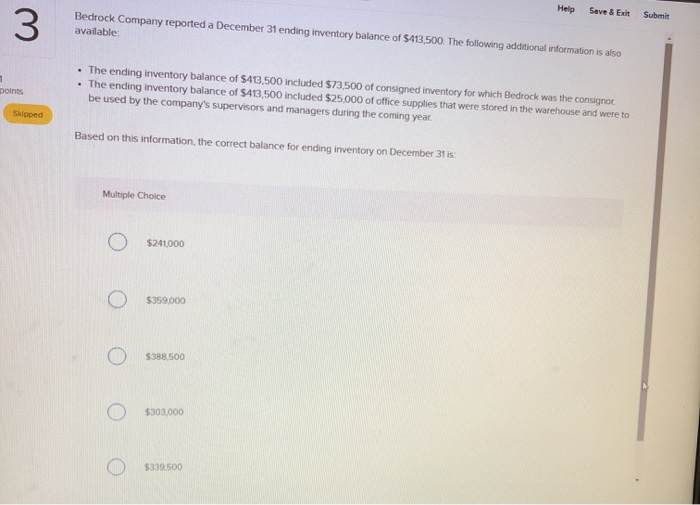

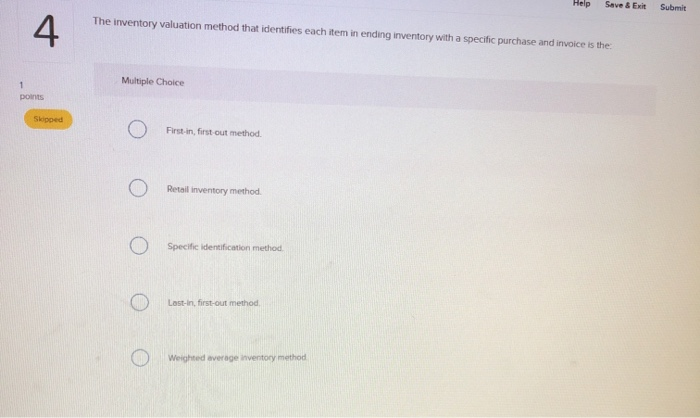

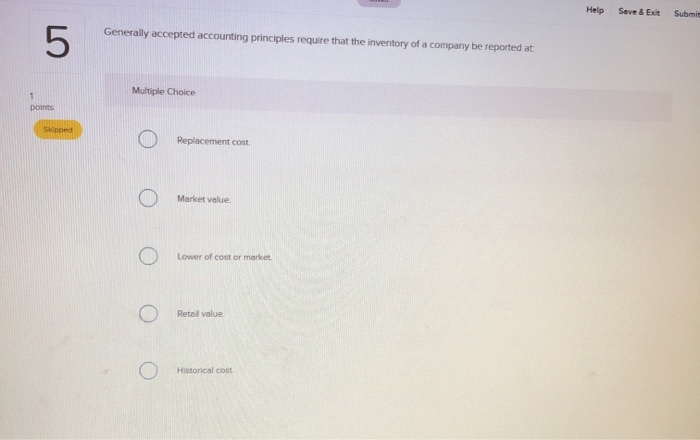

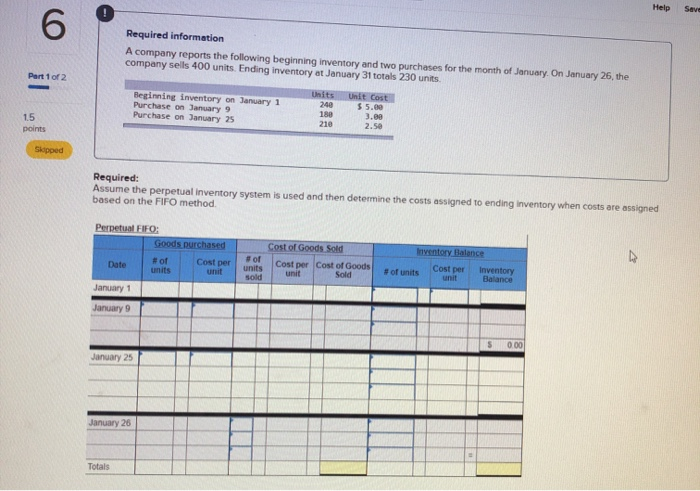

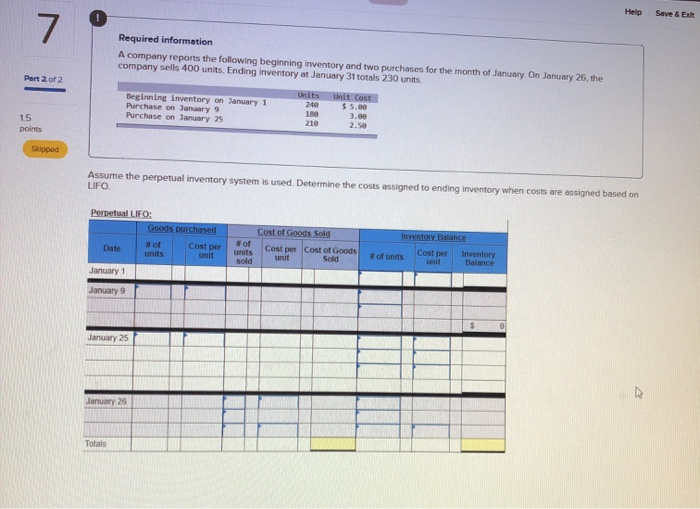

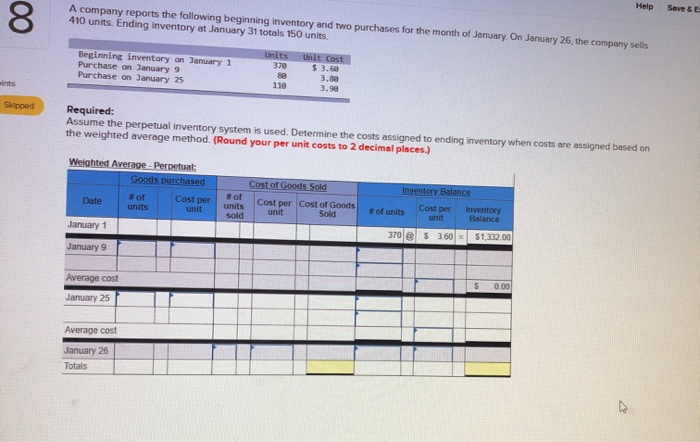

Help Save & Exit Submit A company had beginning inventory of 12 units at a cost of $15 each on March 1 On March 2. it purchased 12 units at $24 each On March 6 it purchased 7 units at $20 each On March 8, it sold 28 units for $63 each Using the FIFO perpetual inventory method. what was the cost of the 28 units sold? points Help Seve Em Submit Giorgio had cost of goods sold of $9,577 million, ending inventory of $2,245 million and average inventory of $2.121 million its inventory turnover equals points Multiple Choice Suipped 856 Bedrock Company reported a December 31 ending inventory balance of $413,500. The following additional information is also available The ending inventory balance of $413,500 included $73,500 of consigned inventory for which Bedrock was the consignor The ending inventory balance of $413,500 included $25,000 of office supplies that were stored in the warehouse and were to be used by the company's supervisors and managers during the coming year Skipped Based on this information, the correct balance for ending inventory on December 31 is: Multiple Choice 5241000 0 5359,000 C) 388 500 O 303,000 $339,500 0 Save & Exit Submit The inventory valuation method that identifies each item in ending inventory with a specific purchase and invoice is the points Slopped C) First in, first out method Retail inventory method Specific identification method O Last-in, first-out method Weighted average inventory method Help Save & Exit Submit Generally accepted accounting principles require that the inventory of a company be reported at O" or Multiple Choice O Replacement cost. 0 Market value O Lower of cost or market 0 0 Historical cost Help Save Required information A company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 400 units Ending inventory at January 31 totals 230 units. Part 1 of 2 Beginning inventory on January 1 Purchase on January 9 Purchase on January 25 Units 240 Unit Cost $ 5.00 3.60 2.50 15 1.805.00 points Skipped Required: Assume the perpetual Inventory system is used and then determine the costs assigned to ending Inventory when costs are assigned based on the FIFO method. Perpetual FIFO: Goods purchased # of Cost per units unit of Date Cost of Goods Sold Cost per Cost of Goods 1 unit Sold Cost per unit sold Inventory Balance January 1 January 9 January 25 January 26 Totals Help Save & Exh Required information A company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 400 units Ending inventory at January 31 totals 230 units Part 2 of 2 nits Beginning inventory on January 1 Purchase on January 9 Purchase on January 25 Unit Cost $5.00 3.80 21 points Skipped Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on UFO Perpetual LIFO: Goods purchased #of Date Cost per units Inventory Balance of Cost of Goods Sold Cost per cost of Goods unit Sold units Cost per Cost per unit inventory alance January 1 January 9 January 25 January 25 Help Save & A company reports the following beginning inventory and two purchases for the month of January On January 26, the company sells 410 units. Ending inventory at January 31 totals 150 units. Beginning inventory on January 1 Purchase on January 9 Purchase on January 25 Units 379 Unit Cost $ 3.60 3.30 3.99 Sidpood Required: Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round your per unit costs to 2 decimal places.) Weighted Average - Perpetual Goods purchased Date #of Costner units Inventory Balance of Cost of Goods Sold Cost per Cost of Goods unit Sold Unit Units Cost per C Cost per Cost per unit inventory Balance January 1 370 e 5 3.60 = 51,332.00 January 9 Average cost January 25 Average cost January 26 Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts