Question: Chapter 5 Time Value of Money 181 INTEGRATED CAs E RST NATIONAL BANK ME VALUE OF MONEY ANALYSIS You have applied for a job with

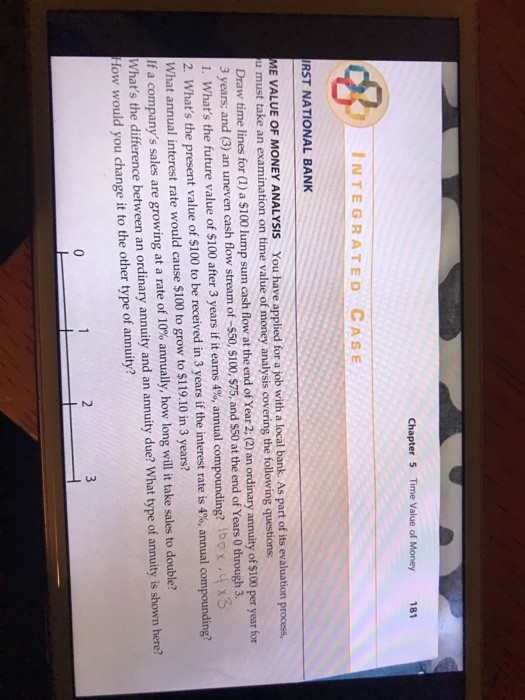

Chapter 5 Time Value of Money 181 INTEGRATED CAs E RST NATIONAL BANK ME VALUE OF MONEY ANALYSIS You have applied for a job with a local bank. As part of its evaluation process, ust take an examination on time value of money analysis covering the following questions: Draw time lines for (1) a $100 lump sum cash flow at the end of Year 2; (2) an ordinary annuity of $100 per year for 3 years; and (3) an uneven cash flow stream of-$50, s100, $75, and $50 at the end of Years 0 through 3 1. What's the future value of $100 after 3 years if it earns 4%, annual compounding? 0-L3 2 What's the present value of $100 to be rceived in 3 years if the interest rate is 4%, annual compounding? What annual interest rate would cause $100 to grow to $119.10 in 3 years? If a company's sales are growing at a rate of 10% annually, how long will it take sales to double? What's the difference between an ordinary annuity and an annuity due? What type of annuity is shown here? How would you change it to the other type of annuity? 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts