Question: chapter 6 answer as many as you can plz Common stock value-Constant growth McCracken Roofing, Inc, common stock paid a dividend of $1.47 per share

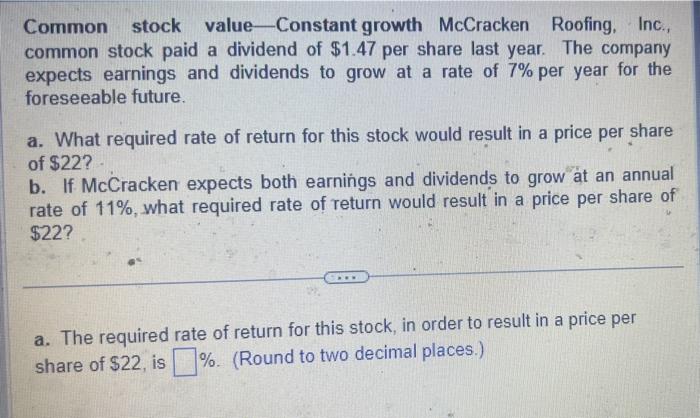

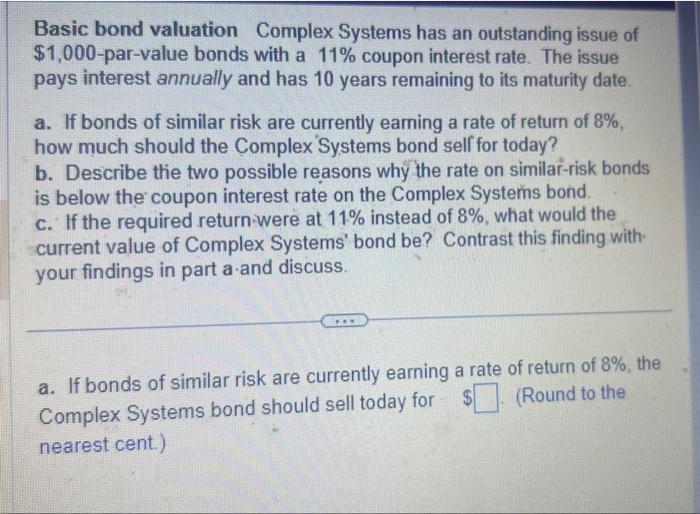

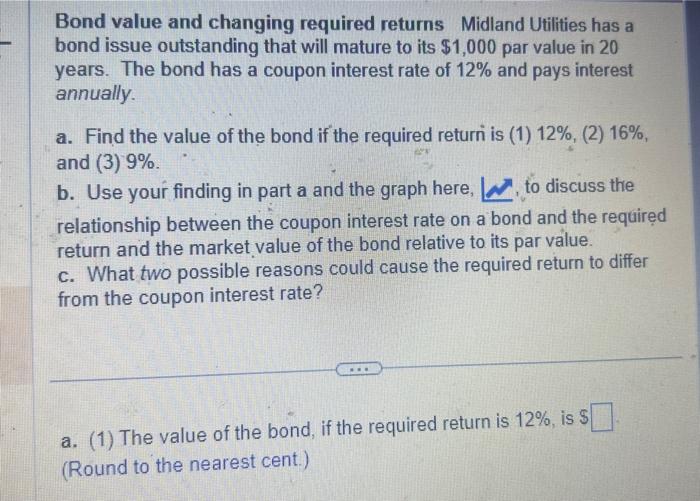

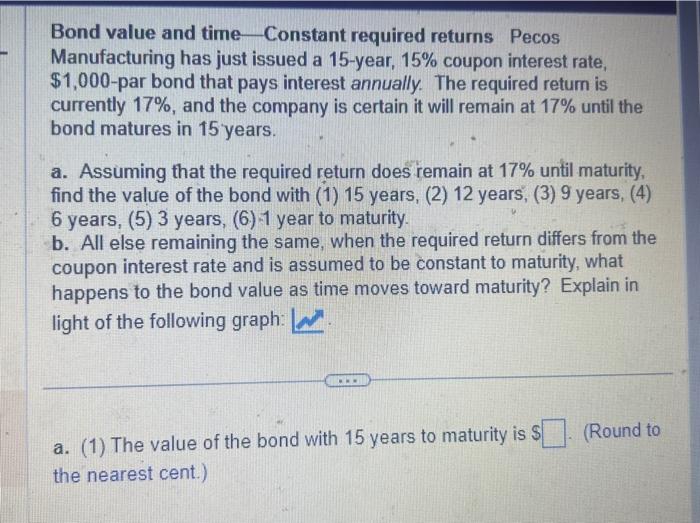

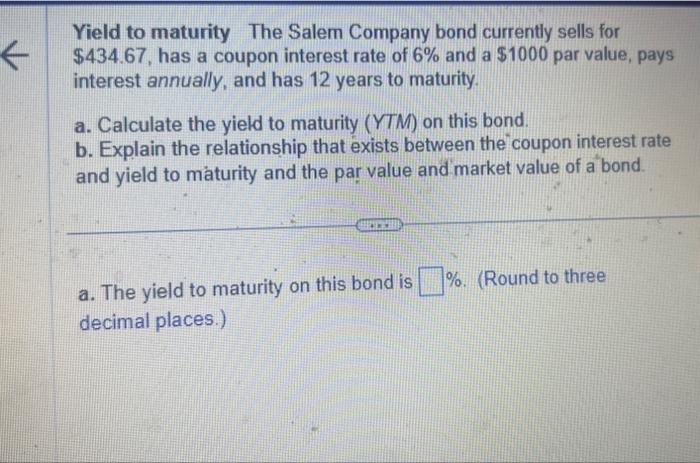

Common stock value-Constant growth McCracken Roofing, Inc, common stock paid a dividend of $1.47 per share last year. The company expects earnings and dividends to grow at a rate of 7% per year for the foreseeable future. a. What required rate of return for this stock would result in a price per share of $22? b. If McCracken expects both earnings and dividends to grow an an annual rate of 11%, what required rate of return would result in a price per share of $22? a. The required rate of return for this stock, in order to result in a price per share of $22, is %. (Round to two decimal places.) Basic bond valuation Complex Systems has an outstanding issue of $1,000-par-value bonds with a 11% coupon interest rate. The issue pays interest annually and has 10 years remaining to its maturity date. a. If bonds of similar risk are currently eaming a rate of return of 8%, how much should the Complex'Systems bond self for today? b. Describe the two possible reasons why the rate on similar-risk bonds is below the coupon interest rate on the Complex Systems bond. c. If the required return were at 11% instead of 8%, what would the current value of Complex Systems' bond be? Contrast this finding with. your findings in part a.and discuss. a. If bonds of similar risk are currently earning a rate of return of 8%, the Complex Systems bond should sell today for $ (Round to the nearest cent.) Bond value and changing required returns Midland Utilities has a bond issue outstanding that will mature to its $1,000 par value in 20 years. The bond has a coupon interest rate of 12% and pays interest annually. a. Find the value of the bond if the required return is (1) 12%, (2) 16%, and (3) 9%. b. Use your finding in part a and the graph here, , to discuss the relationship between the coupon interest rate on a bond and the required return and the market value of the bond relative to its par value. c. What two possible reasons could cause the required return to differ from the coupon interest rate? a. (1) The value of the bond, if the required return is 12%, is $ (Round to the nearest cent.) Bond value and time Constant required returns Pecos Manufacturing has just issued a 15-year, 15\% coupon interest rate, $1,000-par bond that pays interest annually. The required retum is currently 17%, and the company is certain it will remain at 17% until the bond matures in 15 years. a. Assuming that the required return does remain at 17% until maturity, find the value of the bond with (1) 15 years, (2) 12 years, (3) 9 years, (4) 6 years, (5) 3 years, (6) 1 year to maturity. b. All else remaining the same, when the required return differs from the coupon interest rate and is assumed to be constant to maturity, what happens to the bond value as time moves toward maturity? Explain in light of the following graph: a. (1) The value of the bond with 15 years to maturity is $ (Round to the nearest cent.) Yield to maturity The Salem Company bond currently sells for $434.67, has a coupon interest rate of 6% and a $1000 par value, pays interest annually, and has 12 years to maturity. a. Calculate the yield to maturity (YTM) on this bond. b. Explain the relationship that exists between the coupon interest rate and yield to maturity and the par value and market value of a bond. a. The yield to maturity on this bond is \%. (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts