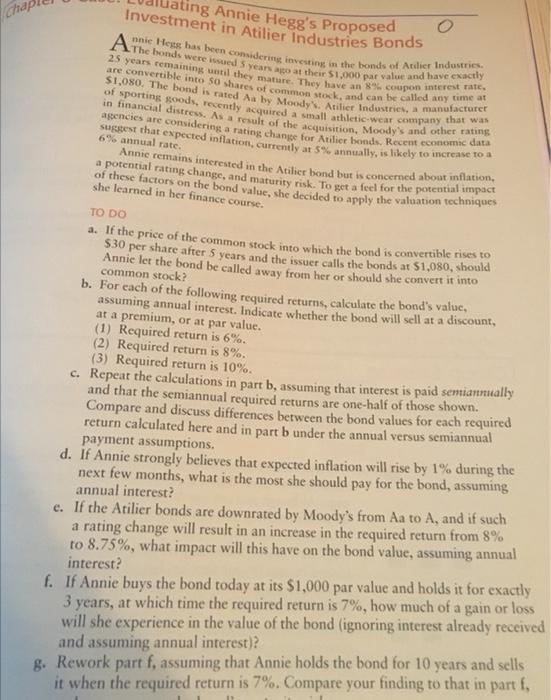

Question: chapter 6 case study: interest rates and bond valuation please answer parts a,b,c,d,e,f,g,h,i. Investmeng Annie Hegg's Proposed 0 A mic Hegs bas in Atilier Industries

Investmeng Annie Hegg's Proposed 0 A mic Hegs bas in Atilier Industries Bonds S1.080. The bond is athares of common shack, and can be called any time at in finatial distres, Aa a result of a a small athletic-wear company that was agencies are considering a rating of the acquisition, Moody's and other rating 6% annual rate. Annic remains interested in the Atilier bond but is concerned about inflation, of these factors on the bond and maturity risk. To get a feel for the porential impact she learned in ber finance course. TO DO a. If the price of the common stock into which the bond is convertible rises to $30 per share after 5 years and the issuer calls the bonds at 51,080 , should Annie let the bond be called away from her or should she convert it into b. For each of the following required returns, calculate the bond's valuc, assuming annual interest. Indicate whether the bond will sell at a discount, at a premium, or at par value. (1) Required return is 6%. (2) Required return is 8%. (3) Required return is 10%. c. Repeat the calculations in part b, assuming that interest is paid semiannually and that the semiannual required returns are one-half of those shown. Compare and discuss differences between the bond values for each required return calculated here and in part b under the annual versus semiannual payment assumptions. d. If Annie strongly believes that expected inflation will rise by 1% during the next few months, what is the most she should pay for the bond, assuming annual interest? e. If the Atilier bonds are downrated by Moody's from Aa to A, and if such a rating change will result in an increase in the required return from 8% to 8.75%, what impact will this have on the bond value, assuming annual interest? f. If Annie buys the bond today at its $1,000 par value and holds it for exactly 3 years, at which time the required return is 7%, how much of a gain or loss will she experience in the value of the bond (ignoring interest already received and assuming annual interest)? g. Rework part f, assuming that Annie holds the bond for 10 years and sells it when the required return is 7%. Compare your finding to that in part f, h. Assume that Annie buys the bond at its last price of 98.380 and holds it until maturity. What will her yield to maturity (YTM) be, assuming annual interest? i. After evaluating all of the issues raised above, what recommendation would you give Annie with regard to her proposed investment in the Atilier Industries bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts